Today I’m happy to announce our new Banktivity is out of beta and available on macOS and iOS. Check out www.banktivity.com to download the new Mac version today! The iOS versions are live on the App Store too.

For those of you that haven’t been following the blog recently, I encourage you to read our post, A subscription that doesn’t suck. We’ve implemented a subscription in a way that we think you’ll find is pretty great:

- Pick the tier that makes sense for you. Take advantage of our connected services and support.

- If you don’t need connected services or support, you can pay for a year then cancel and keep all the non-connected functionality.

- You will continue to have access to bug fixes.

In this earlier post, I covered some of the great new features in Banktivity. But I thought for this post, it would be fun to cover some of the smaller features we added since they haven’t gotten as much attention. At the end of the post I have an update on getting prices for international stock exchanges, so be sure to read the whole thing 🙂

More good stuff in the new Banktivity

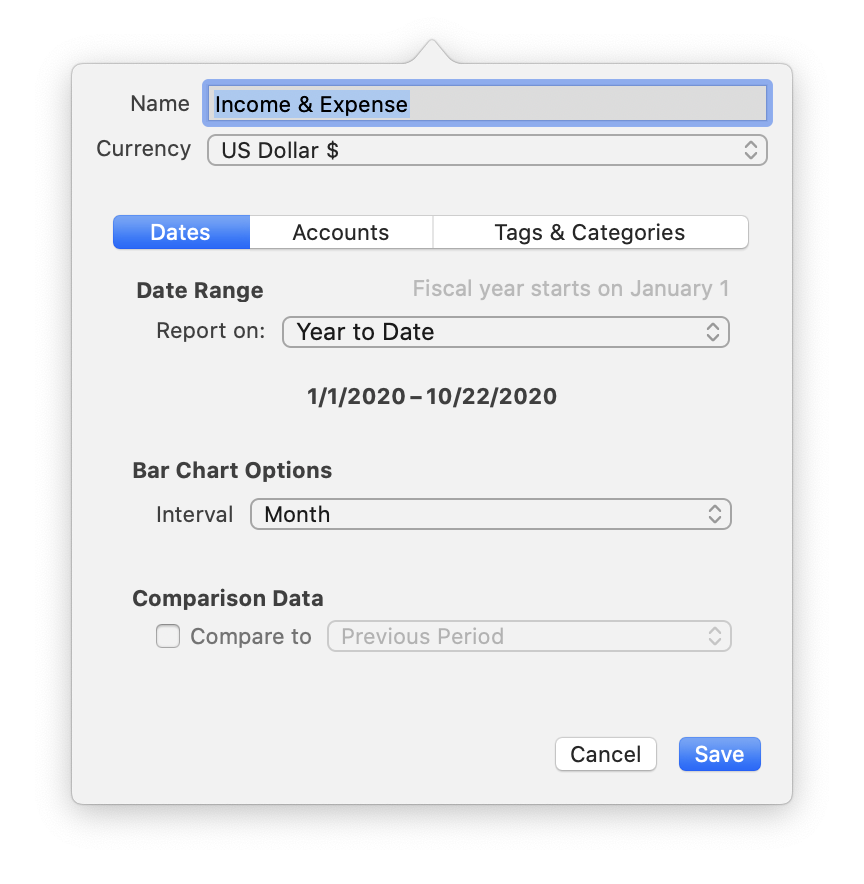

New date range reporting options

Now in reports (and budgets!) you can choose year to date, month to date and even quarter to date as a reporting option. Further, if you do this in a report, you can compare this to the same period a year ago.

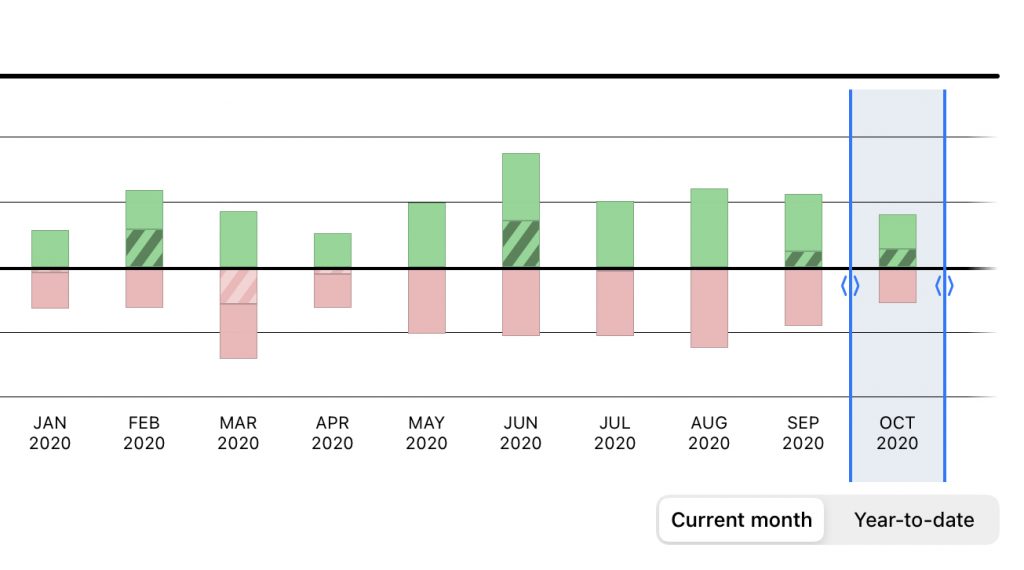

Easy date toggling on iOS

We implemented similar date range functionality in iOS with a new button to easily toggle between current month and year to date.

Improved category autocomplete

I don’t want to spend too much on this one, but I know for those that have wanted this, it will be well received!

If you have a category structure like this, “Auto:Fuel” in the past you couldn’t type “Fuel” and get any results. Now you can 🙂

Update security prices from Direct Access holdings

This is a nice little feature that happens behind the scenes in Mac and iOS. Now, when we get transactions and data for investment accounts that are connected with Direct Access or OFX, we check to see if there is information about the prices of your investments. If that price data is there, we pull it out and insert it into the document. This should help keep people’s investment values more up to date for those securities that we can’t get prices. But don’t worry we are smart and only use the price data from your holdings if we can get it through a better source, and of course, we will not over-write any prices you enter.

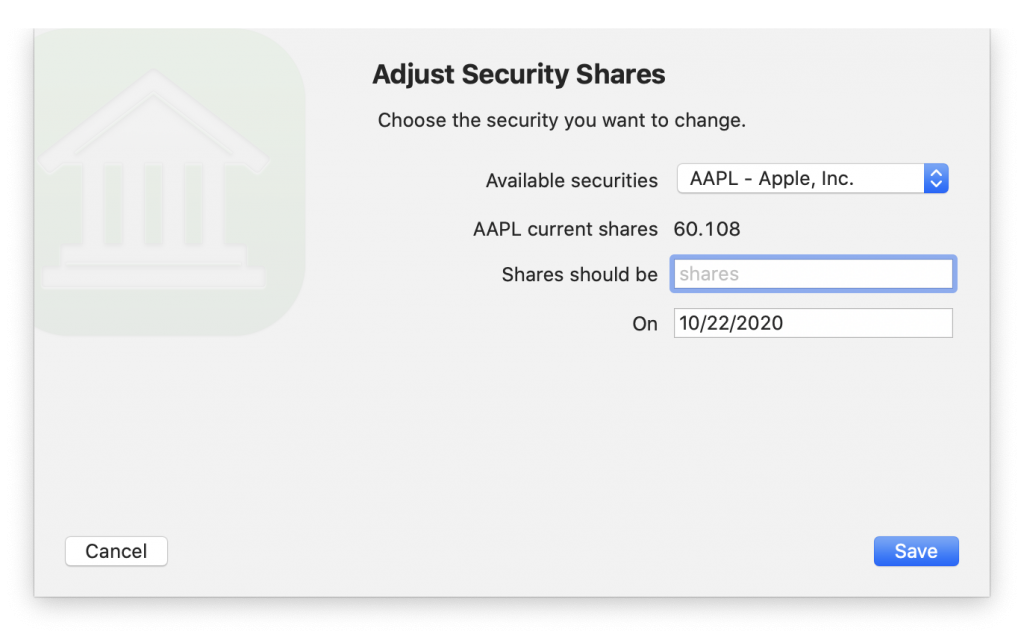

Adjust shares assistant

This is a new Mac-only feature that helps you track your investments more accurately. This new assistant lets you tell the app how many shares of a security you should have and then Banktivity will insert the adjustments as necessary.

Display different account balances in the sidebar

We’ve added a new preference (Mac-only) to change which value you want displayed next to each account in the sidebar. Up until now, we always showed the “total balance.” Now there are two additional options: cleared balance and today’s balance.

Touch ID to unlock documents

This is one of those features that has been in iOS for a long time. (In iOS you can unlock your document with Touch ID or Face ID depending on what your device supports.) Now on Mac you can unlock your Banktivity documents with Touch ID (assuming your Mac supports it) or even Apple Watch.

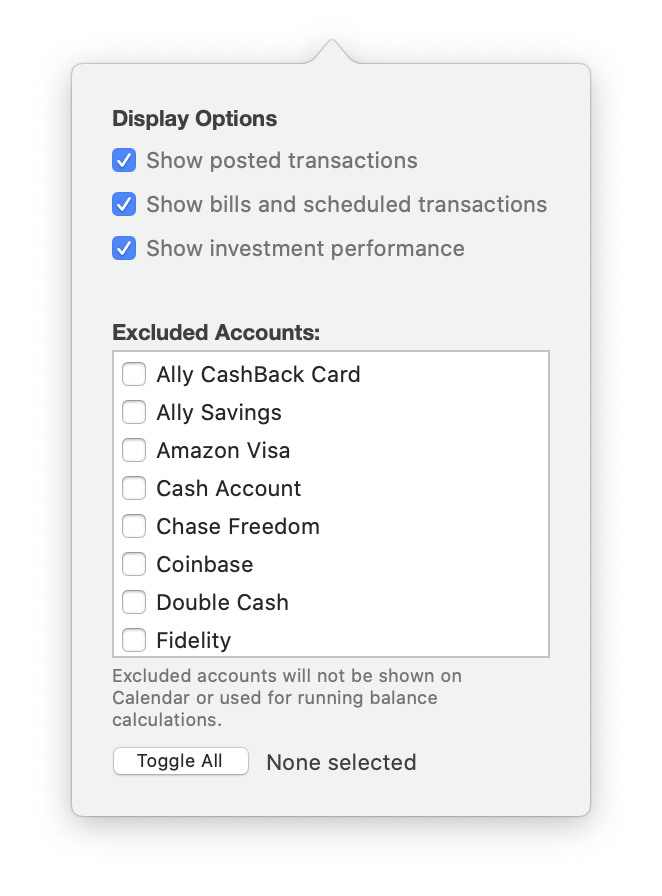

New Calendar Options

Calendar gets a new configure popover where you can change what types of information and transactions appear on the calendar. We used to always show all three types of info: posted transactions, scheduled transactions and investment performance. But now you can pick and choose depending on what makes sense for you.

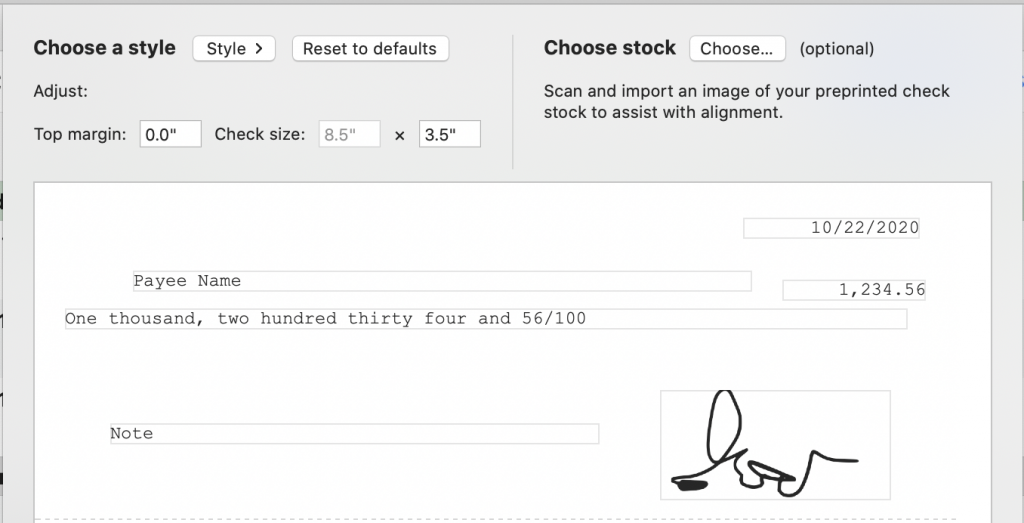

Add signatures to checks

Our check printing feature is available in the gold tier. We’ve spruced it up for this version of Banktivity by reworking the interface and by adding the ability to print your signature on your checks.

And more…

There are still yet more little improvements packed into the app. Here is a list of what else improved: statement summaries have more information, you can click the reconcile checkmarks to jump to a transaction in a statement, added a contextual menu item to remove tags from a transaction, added a contextual menu item to delete transactions, minor improvements to date navigation on reports, reworked the File menu, added Page Up and Page Down support, improved envelope budgeting setup assistant, default built-in browser now identifies itself as Safari and last but not least, new document setup assistant, improved auto-complete for check numbers. I don’t want you to think that is all that changed. We also fixed numerous bugs and reworked various parts of the app to reduce technological debt.

More new goodies on iOS too

On iOS you’ll notice almost the entire UI has been revamped. You’ll also notice that the UIs between iPad and iPhone are almost identical. Of course, we also support split screen in iPad, dark mode in both iPad and iPhone and there are new setup assistants. Similar to Mac, we also reduced our technological debt on iOS to make adding features easier in the future.

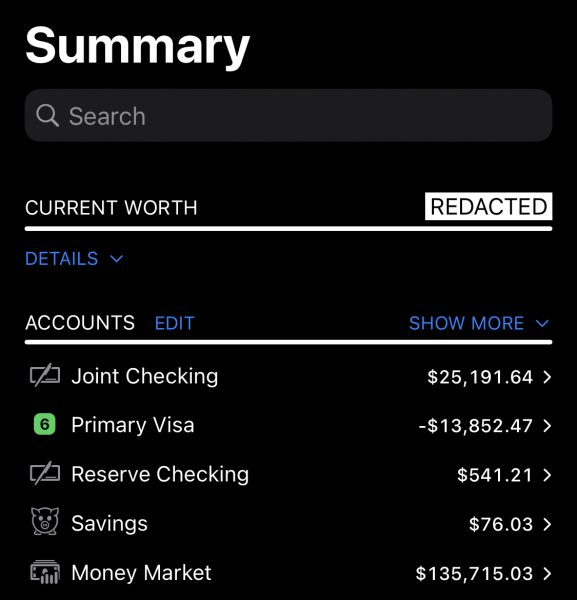

Redact your net worth on iPhone

On iPhone you can also now hide your net worth on the summary screen – this was a popular feature request. This is done with a simple swipe to the right gesture.

Better iPadOS integration

We re-did almost every screen on the iPad so that we can better support the trackpad on the magic keyboard. We still have some more work to do with full keyboard support, but Banktivity is a very good citizen on iPad and iPhone.

Update on coverage of international stock exchanges

We know that some of our non-US customers want to be able to download stock prices. Now, with the move to subscription, it makes even more sense for us to continue to improve and expand our online services.

Today I’m happy to announce that we have found a legitimate backend provider to start offering downloading of end of day security prices for Australia! Unfortunately, to get live or even 20 minute delayed quotes, legally, isn’t feasible for us.

We still need to finish the implementation and of course, we need to test it. Once that is done, we will roll this out to our Silver and Gold tier customers.

I’m excited for you all to get your hands on these new versions of Banktivity. You’ll notice that we keep calling it “the new Banktivity” and that is because this really marks a major milestone for us. The move to subscription is a big change, but I truly feel we can deliver better software and services with our new model going forward and I am excited to embark on this journey with you.

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

Great news about AU stock source, I am more than happy with an end of day update. I will update to Big Sur as soon as it is available and subscribe to silver.

Hi Ian, congrats on the new Banktivity. Looks impressive with lots of great new functionality.

As a long time user and subscriber to Direct Access I have to say your new subscription model ALMOST doesn’t suck. Or maybe I am misinterpreting the functionality of the new version in which case you are correct and it totally doesn’t suck.

I am a retired Canadian user who has one USD bank account and one USD credit card (both with the same Canadian FI) with maybe 8-10 transactions a year in each. If I am interpreting your subscription pricing correctly, in order to have accounts in two currencies I would have to have a Gold subscription and pay an additional USD $50 (CAD $67) each year. I do not need and would not use any of the Silver or Gold subscription features (although I can certainly see the value for many subscribers).

In lieu of paying $50 per year I would be happy to manually input F/X rates periodically but it is unclear from your website whether new Banktivity will even allow me to have accounts in both CAD and USD unless I have a Gold Subscription. Hopefully I am misinterpreting and that is not the case.

I know you can’t possibly anticipate every user case but I speculate there may be other users like me who have a seldom used credit card and/or bank account in another currency and that are wondering about this as well.

Hi Dave, thanks for writing. You would need to gold to unlock the multi-currency support. However, after you’ve paid for a year, you could downgrade if you didn’t mind entering exchange rates manually.

Along with Dave and Antoine, I’m a European user also disappointed that the multi-currency support will not continue except for the highest subscription rate. I don’t use direct access services as I prefer to manually enter transactions. I only switched to Banktivity this year after being a dedicated Quicken user for 25 years – because of their discontinuing support for multiple currencies. If I stay with v7.5, will automatic currency prices stop, and when?

That’s good news… but as a non-US customer, with the move to subscription and Direct Access not being available in Europe (France in my case), there’s not enough value here for me to upgrade to those new versions. I see the work done by the teams, but I’ll stay on v7 unless the services becomes of value for EU as well.

Ian – really useful update. You mention that you’ve added a ‘Month to Date’ option in reports and budgets but I can only see a Year to Date option in my budget on B8 Mac (29) …. how do I get the month to date option in budgets?

I noticed that in some of my reports (e.g., Income/Expense) I have a quarter-to-date or month-to-date option, but not in budgets. I too am running v. 8.0 (29)

I tried Banktivity 7. For the most part I liked the app, but there were several things that were disappointing. Mainly, I could not use Tags with Scheduled Transactions. Tags play a very large part in my transaction structure/organization. Posting a Scheduled Transaction and having to remember to go back and add all the Tags, was not a great experience. Not have the ability to add Tags to Scheduled Transaction is a non-starter. Also, I had issues with transactions and statements disappearing. Well, they did not really disappearing, they just did not appear after I entered the transaction/statement, until I left the account and returned. Have either of these been address with the new Banktivity?

Hi Jessie, thanks for the comments. Adding tags to scheduled transactions is a pretty popular feature request. It didn’t make it into v8 obviously, but it is something I hope we can get on our roadmap. I wouldn’t expect you to have a case of disappearing/reappearing transactions in any view. If you are seeing this, please let us know so we can find the bug!

Any update on when direct downloads will work in UK/EU? This isn’t mentioned in today’s blog so I assume it is still a work in progress. Until that makes an appearance I’m afraid none of the other new features in B8 will be enticing me to part with any money on a subscription. I don’t write checks/cheques, have no investments, my goals are straightforward enough to manage outside of Banktivity, have no intention of using the iPad or iPhone apps, have an iMac so TouchID not an option, Apple Silicon some way off and Big Sur not yet out of beta. Hugely disappointed with this version as it offers nothing for me

Our roadmap has the most update info bringing DA support back to the UK/EU: https://www.iggsoftware.com/blog/2020/08/services-roadmap/

If the new features aren’t compelling enough for you, I understand. The good news is, we aren’t making v7 self-destruct or anything like that so you can keep using it ?

As another French-based user posted, there is not enough value here for me to subscribe. I would have to pay the highest tier to get the exchange rates – but would not be getting Direct Access and only end of day stock prices. I will remain on B7 for the moment, but if you finally support Open Banking and implement live stock prices then the B8 upgrade would be good value for me.

I’ve just “upgraded” to your subscription based software, and installed the latest app on my iPhone

One of the features I have enjoyed in the iPhone app is the ability to quickly add a transaction “on the go” – bit no longer it seems! When I open the new App, once I hit the first screen, I then have to go through 3 further clicks / action before I presented with the screen that I used to go straight to upon opening the old app!

Why?

This makes entering transactions “on the go” SO much slower and less attractive.

If not addressed (within the next 30 days), I’ll be cancelling my Gold subscription

Tapping the + button at the bottom right on the Summary screen DOES go immediately to a transaction register IF you have set a ‘Default Account’ in Settings.

If no default account is set, it will ask you into which account you wish to enter the transaction. If you’re already viewing a SPECIFIC account, tapping the + button will enter the transaction into that account.

Seems pretty quick to me.

Yes, BUT ………. it takes 3 clicks just to get the summary screen on opening the App!

How? Mine opens up to the Summary screen of last file opened. I don’t have to tap anything.

I’m with Paul – mine opens straight to the summary screen.

Do you not think that the UK subscription prices are verging on the absurd given that there is no direct access available? Surely they should have been set a bit more realistically given that this flagship feature is missing?

This blog post talks about working on getting DA working for the UK: https://www.iggsoftware.com/blog/2020/08/services-roadmap/

Please note you can subscribe, then not renew after a year, and the app keeps working and you get free updates.

But cloud sync breaks if you don’t keep paying. So I’d essentially be paying £60 so I could enter transactions on my phone. I still think that the subscription should be lower until such times as you fix direct banking. You’re going to lose customers as a result of this stance. There are other options with working uk direct banking which are cheaper than the silver level I would need to purchase as I have loan accounts. Surely even you can admit that it’s a bit of a no brainier. The uk pricing really makes no sense.

Well, that’s probably fair given that IGG would have to pay for server storage, bandwidth, maintenance, etc. to allow Cloud Sync to occur. I don’t think a subscription for this is unreasonable at all – and you can always just get the lowest subscription tier for that.

The alternative is for you to use your iCloud Drive (or DropBox) to sync your file between two Macs – I have no idea if that will work on the iPhone or iPad – provided the file isn’t opened on two devices at the same time.

I agree with Andrew above. Knowing from the start that the services offered are (by far) not the same between CA/US customers and the rest of the world, a lower-tier for only the sync functionality would have been more than welcome… and I would have been a happy paying customer in such a case.

Saying “you can subscribe for a year and then stop” isn’t fair: with today’s model, if you do that you can still use the sync functionality (that will be my case, as I purchased v7 a year ago). It won’t be the case anymore with the subscription-model: stop paying, and then iOS + macOS apps won’t talk to each another anymore.

Yes, I can understand syncing has a cost, but not as high as the Bronze tier you ask.

I think it’s unreasonable to charge the same price as US customers when they’re a million miles away from feature parity.

I think these are fair points made by Andrew and Antoine. Not only is the UK price very high but we don’t have feature parity with US customers. I wouldn’t mind paying a subscription, as I accept that there are ongoing costs that IGG have to cover, but times are tough for us all and the current offering is excessive; we don’t even have Direct Access anymore. Many of the new features of v8 are also US-centric. Please consider a lower tier or lower prices for UK and EU customers, some of us loyal and long-standing who have bought every new version but feel left out of this latest one.

Ian, for many years you’ve offered TidBITS members a modest discount on Banktivity’s price.

Is this still in place for v8? If so, how do I claim the discount, please?

Hello, hello???

Hi Al, we currently aren’t running any promotions. However, this is certainly something we might consider again in the future.

Thanks Ian, the discount for Banktivity 7 is still showing on the TidBits member’s site. Maybe you should ask Adam to delete, to prevent confusion.

Hi, I am on Silver subscription (trial) for about two weeks now and never had price updates on my stock portfolio (only Swiss stocks). I have been entering stock prices manually since February. It seems that IEXcloud in their international package don’t include the Swiss stock exchange (.sw). Without any improvement in this matter I am considering not to Subscribe, I don’t use Direct Access. Thanks Peter

I’m glad to hear you’re making international security price downloads a priority. With the loss of current price data for New Zealand securities earlier this year, Banktivity has lost much of the appeal and usefulness for me. I’m hoping New Zealand price data is high on your priority list. I’d certainly be happy with close of prior business day data, as you’re developing for Oz. Fingers crossed on my end.

I’ll see what we can do…I need to do some more research.

Hi, long time user since the iBank days, also in New Zealand. I’d also love to see NZX security price downloads, and yah, prior day closing prices would be totally fine. Thanks to you and your team for a great product Ian.

I noticed when I logged in this afternoon that Banktivity seems to have downloaded some what look to be current NZ security prices. Fingers crossed this has been addressed (can’t find any mention on the site) – if so, many thanks.

I like Banktivity, but the loss of download capability in the UK (a long time ago now) means that I won’t be upgrading until it is restored. The value just isn’t there right now for us in the UK. Please keep updating us on progress towards this: once it’s there, I’ll happily subscribe to Banktivity 8. Good luck with the launch.

Thanks for the comments Steve! Your situation makes sense.

Ian,

Could you consider adding a contextual menu item to duplicate transactions. I think it would get much bigger use than DELETE.

Banktivity not respecting CAD system preferences using comma as separator.

I don’t known why, but sync on my iPhone take around 1 hour, each time…..

Can you check that! It’s look it’s start to sync all the data each time

I know I’m an outlier as an iPad user of Banktivity, so I expect features will follow from the Mac version eventually, and that’s fine. What is not fine is the beta software that is the new Banktivity for the iPad. Every day I find something new that is missing, fails, or is a terrible regression. A good example would be creating and editing scheduled transactions is no longer possible from scheduled transactions! How was this released without that basic functionality? Managing categories is another failure point. It’s one long list displayed by subcategory. That means if you have “other” subcategories for categories like “entertainment” or “healthcare” all you see is the word “other” over and over. You have to select each one to find out what it is.

That’s just two examples from a rough beta released as a commercial product. There are many, many more. I have a subscription that ends in January. I probably won’t be renewing, not because I don’t want to but because I doubt the commitment to an iPad version based on what the company considers a product ready for commercial release.

I couldn’t agree more. I have been saying this for years. The world is going mobile and after all these years with iPads on the market, I use my Mac barely once a month with iPad being my primary device. IGG Software still doesn’t seem committed to the iPad version. Version 8 has improved in several areas, but things that were working fine in V7 got removed or changed for no logical reason. The application frequently crashes or has some unexpected results. I am still in the trial phase, but if I don’t see a higher commitment to the mobile future or better present, I will likely drop out before the trial ends.

Hi Steffen, I know you are one of our toughest critics. Our subscription model allows us to move forward with our iOS apps more than ever before. If we weren’t committed to it, we would have dropped it entirely for the new subscription model.

Thanks, Ian!! I am a software developer myself, so I know how tough development can be. I do see how much improvement the new version is, but you have taken away or deactivated very good features from the old version and added useless features to the new version, for example the “tab to start” title screen, the fact that the document doesn’t open automatically, the way how upcoming transactions aren’t matching with existing transactions anymore and many more. But most importantly I had hoped that the iPad becomes less dependent from the Mac. I contacted support three times and every time I had to go to my Mac to resolve things that couldn’t be resolved on the iPad. I know things aren’t always smooth with new versions, so I hope that you will have some transparency what you have on the roadmap and hopefully you will put some of the good features of the old version back.

You can edit scheduled transactions. Go to Manage > Templates and your scheduled transactions are at the bottom of the list currently. We will get the category issue fixed soon!

As a long time iBank user, I was happy to “upgrade” to Banktivity 8 across my Mac and IOS devices. Having accounts in multiple currencies and investments across a few countries, I have ended up on the Gold subscription.

However, being in Singapore, I have never been a Direct Access user (my bank supposedly supports, but the built in timeouts on their web access prevent the completion of downloading the required account info to set up !) and also never been supported with download of stock prices. I am okay for now to pay the subscription price (seeing it as a version upgrade) but would definitely like to see improvements on the stock side before I renew – I mainly have mutual funds and long wondered why the Bloomberg code or ISIN code can’t be used for download. The good news is that the long term bug where manually entered stock prices were not synced to the iPad version now seems to have been addressed.

One more thing…. have been using since the initial beta, but on the release version there appears to be a bug when data is entered into the register -it does not clear the previous contents (the autofill from a previous transaction to the same place) and hence the new data gets written in front and creates an invalid input, which then needs to be cleared and reentered….. It worked fine on the beta. This is on Big Sur current beta, so may be an Apple issue.

I don’t know if my earlier comment was lost or what. I posted it over a week ago. I am in Australia and locking foreign currencies behind the gold tier is punitive. I work for a US company who happened to give me some private stock, and now you want me to pay $30 a year extra for that feature which I practically never use? I don’t need checks or exchange rate downloading.

I guess I will try to use the Silver tier and pretend the stock is in AUD, if that doesn’t work I’ll be looking for another app. Which is a huge shame, I’ve been a customer for 10 years.

Thank you for being a long time customer! I don’t know the details of the stock you received, so I think it is up to you if you want to track it as AUD so you can fall squarely into the Silver tier, or alternatively, track it as a USD stock in a USD account. You could also buy gold once, get the multi-currency support, but then a year later just renew at Silver. If you took this route, multi-currency functionality would keep working (except downloading of exchange rates).

Oh interesting. Your post did mention that not renewing retains all features, but it did not make it clear that renewing at a lower tier retains all offline features of the higher tier.

I will consider this option, thank you.

Hi there. Just adding to this, I really don’t think this extra cost for foreign exchange rate downloads (gold tier) is good value. I’m glad I have seen here that there is an option to go gold and then revert to silver, but even paying gold for one year to do this doesn’t seem like great value. I’m hoping you’ll consider some of the feedback on this particular topic and relook at tiers vs. benefits as you embed this new subscription model.

1. So if we download and install Mac version 8 it will upgrade our data file. Then, at the end of the trial if we don’t like it, how do we go back to version 7 without reentering all transactions we entered during the trial phase?

2. Do I understand that check printing is only with the most expensive version? So the ability to print checks as we now have in version 7 will be removed unless we go to that version. It seems to me that something as important and basic as check printing would be included in all versions. What am I missing?

Bart, I am interested in the reply to this too. I have also downloaded the trial as I particularly need the sync between my phone and Mac. Although I am not particularly happy about paying for this functionality only, as I’m in the UK and most of the other stuff is aimed at the US market, the update to the iPhone app is very good. Whether it’s good enough to warrant a bronze subscription remains to be seen for my trial.

Hi, thanks for the comments.

1. v8 files aren’t backward compatible with v7 files. If you want to try out v8, but aren’t ready to commit, I recommend running v7 and v8 side by side.

2. That is correct, check printing is a gold tier. The reason is because it is a feature that requires a lot from us to improve and maintain, but hardly anyone uses it (relatively speaking). So it is a premium feature.

Hi Ian,

I didn’t think you could run both together? Won’t that affect the sync process with the iPhone apps?

If you wanted to be extra prudent you could duplicate your Mac file. Rename one to “My Finances v8” (or similar). Then open that document and disable cloud sync. Then set up sync again with that file on the Mac and then setup sync with iOS with the new v8 cloud file.

I’ve tried to comment here, constructively, twice over the past week or more and like Andrew Herron, who made a similar observation, none of mine have been published. They were not rude or disrespectful, but I’m curious to know why you publish some comments but not mine.

I’ll have to look back through the comments and try to find them.

Can you please provide a plan for Scandinavian stock Quotes. Upgrading from B7 to B8 make no sense for a user in Sweden since the change from Yahoo Finance.

Been using Banktivity since the iBank time back in 2004 but without this plan I will be forced to look for alternatives.

We do have support for end of day prices coming to numerous exchanges before the end of the year and it looks like Sweden, Denmark and Norway are on that list!

I can understand why you might only be able to offer EOD prices for small Scandinavian exchanges but I hope you are not going to try to fob us European users with only EOD prices for the big stock exchanges (LSE, Euronext, Frankfurt)! These big exchanges all have APIs for live prices, plus plenty of third party providers offer live prices. If B8 is only going to give me EOD prices of LSE and Euronext I may as well just stick with B7…

I am a USA Banktivity user (moved from AccountEdge who did not have a 64 bit iOS Catalina compatible program.) I have been mostly happy with Banktivity except for the somewhat regular disappearing reconciled transactions. Also the Direct Connect consistently does not download all transaction and only the current period, not transactions since the last download.

We currently use the stock accounts and foreign currency account functionalities, currently included with Bank7. To keep this same functionality with the new Banktivity, we are required to purchase Gold level. In essence, there is no loyalty to your current users – we are forced into the higher tier if we are using Bank7 full functionality. It is too bad you didn’t grandfather in your current customers and sell the new version to new users. This thrusts us into accounting software review mode again. Truly disappointing. Needless to say, there are other options in the price range and feature set offering. Please tell us why we should stay with Banktivity.

Thanks for the comments Cindy. I want to address the disappearing reconciled transactions. If you reset the cloud sync server with a copy from your Mac, that should rectify it going forward. If you need additional help with this please come by our live chat this week (M-F 9-5 eastern).

We’ve been developing Banktivity for over 15 years and have worked hard on making the best modern finance apps. Our subscription model allows us to continue doing that by making sure we have continued revenue to cover the costs of our “connected services” – stock quote downloads, currency exchange rate downloads, Direct Access and so on. If these services are important to you, I’d encourage you to subscribe. We’d love to have you as customer for many years to come. If you have questions about the new Banktivity, like its new features, the new subscription model or how to upgrade, please take a look at this page.

Ian G comment 7 Nov 2020, 6.09pm:

Error at last line, in link “at this page”- forgot the colon (:)

Fixed, thanks!

Greetings, will the new version support macOS 11 Big Sur on the new Apple M1 chip or will that take time to incorporate? Sorry if I missed this somewhere else. Thanks!

SHould have looked at FAQ. I see the Big Sur support but does M1 make a difference? I’m guessing not.

Yes, the new version will run native on the new M1 Macs and it is ready for Big Sur.

Please can you add a “cashflow” view into Annual Budget? You already have the building blocks to do this – you would just need to invert the graphic and add in budgeted income. The graph would then go up when I earn and go down when I spend. This would be more useful to me than the “expenditure” view as I don’t live pay check to pay check – I work freelance and so have variable income. What I need is a view that will show me at a glance if I am going to get low on cash at some point in the future.

I don’t known why, but sync on my iPhone take around 1 hour, each time…..

Hi, this certainly doesn’t sound right. You’ll want to go to our tech support to troubleshoot this. Blog comments definitely aren’t the best place for technical issues. Support page is here, http://www.iggsoftware.com/support Our live chat is open M-F 9-5 Eastern.

Can we install the Banktivity 8 in 2 different iPhone with only one subscription? Today I have the Banktivity 7 on my MacBook and I and my wife have the iPhone version synchronised in one Banktivity Document.

Yes, you can do this by sharing your Banktivity ID between you and your wife.

Ian – I am quite liking the new Banktivity, it’s very promising and looks good running on Big Sur. The new features are nice (especially the category inputs you mentioned, I’ve been crowing about that for some years). Some comments (it would be great if you had a section on the website for feature requests):

– The new feature for goals shows promise, but ALL of the data has to be input manually. It would be great if it used existing account balances to contribute (for example retirement really should select 401(k) and IRA’s automatically and input the balance

– Goals again. When you have multiple goals in one account (saving for Vacation and Car) it would be nice to use tags with splits to say how much of $1000 transfer to savings is for each goal

– Payees. There’s no nice way to manage payees. If I decide I want to merge Target NJ, Target NY and Target CO as ‘Target’ I can’t do this from the payees screen. I have to merge it at the transaction level after searching for them, and those payees remain as do the rules, so the issue can reoccur. A payee manager with the ability to merge payees with all the transactions would be awesome (another popular Financial app does do this really nicely…)

Keep it up!

I second all of Mark’s 3 suggestions – things I miss from my time as a Quicken user.

May I know if end-of-day stock price for Singapore market will be available anytime soon in the new version?

Hi, I can’t promise this, but it does look likely we will be able to support EOD Singapore stocks.

That’s great, EOD Singapore stock is all that I need. Looking forward to start my subscription when that’s ready! Thanks.

Hi Folks! Any offer on Banktivity for this Black Friday?

Pretty curious: it seems I haven’t been able to read a single line about the sheer fact that one’s financial data will be hosted on remote servers, rather than his private computer/tablet/smartphone. This means a lot of financial information journeying on the Web, which is notoriously the safest place in the World (and the seven seas and the nine hells)…

We haven’t changed anything about how data files are stored. They are all stored locally on your device. If you use our optional Cloud Sync service, then your data does exist on our servers fully encrypted with only a password you know to decrypt them.

Hi. I will not use the new goal features. As I am in Spain, I cannot use the direct access and neither can the download of quotes. Under these conditions, it makes no sense to subscribe.

I would like to know if there is any forecast for:

– Download quotes in Spain

– Improved comparative reports: precise choice of dates (does not allow you to choose the dates precisely) and calculation of the difference of the two quantities that appear in the report, and even with percentage.

If those things were possible, I would be happy to subscribe, but right now I don’t see any point in paying a high amount to have less than what I had when I bought Banktivity 7.

Thank you very much and sorry for my English

I’ve always use OFX, not Direct Access to download my transactions. Is that option still available in Banktivity 8?

Hi! I am facing issue tracking stocks in Brazil. The end of day prices (and historical!) for Brazil exchange (xxxxx–SA (Sao Paolo, Brazil) is not working in The New Banktivity 8. As I click on the securities I see prices reflected in the chart but the price is from 11/23/2020 but I have updated the price on 11/27/2020.

Thanks.

Carneiro.

Hi Ian,

I have just downloaded the latest version and notice that a bug that I reported several months ago is still there. The bug is in the mortgage payment schedule where next year is shown as this year (2020) and the years are 1 year out for 3 years and then it catches up so the years are shown as follows 2020, 2021, 2022, 2024, 2025,2026,2026,2027, 2029 etc. I would like to think this will be put right soon

I’ll email you directly and try to better understand this issue. On a quick glance, I don’t think I’m getting it to repeat.

So excited to see that the new Banktivity supports imports for iOS/iPadOS! This is amazing!! Thank you, thank you, thank you!!

Hi Ian,

I just installed the new Banktivity 8 and I’ve encountered few issues:-

1. I tried to create a retirement plan but failed. Nothing like the screenshot on your website. I filled in my personal info as requested, and clicked “next”. The box disappeared and nothing happens. I tried numerous times but no luck.

2. I created a new file on Banktivity 8 on my Mac and synced to the cloud. When I tried to “restore”the new file from the cloud to my iPad and iPhone, I wasn’t able to do as the file was greyed out. (both iPad and iPhone has the latest apps)

I have raised my issues to the support team days ago however they haven’t responded to my issues. I am very disappointed with the level of customer service provided as I am now going to pay U$99 per year and yet I can’t get any supports from customer service.

Can you please provide some guidance as to when the ASX will be available – noting your remarks at the end of the attached blog? cheers

Hi Vaughan, Banktivity 8 can now get end of day prices from ASX. You’ll want to use the .AX or -AU suffix. We are still working on some caching issues that make some quotes update sooner than others, but they should all eventually get a price.

Ian – Brilliant – Cheers. Thanks for your continued development of this application and your patience in responding to me. I was using the .ASX suffix. DOH!

Hi Ian – Just a short comment regarding end of day prices from the ASX. My experience indicates that the quotes are VERY slow in downloading and happen hours after market close and that of my 8 holdings only 2 download every night. (Yep I am using the .AX suffix LOL). So currently I am still manually inputting data that I am paying to happen automatically. I am wondering what other users of the ASX are finding? Cheers.

Hi Ian – I can now confirm that the Price Update can take up to 24 hours but it will occur. Cheers Vaughan

I am a long-time iBank user, with a checking program that has suddenly stopped responding on my Mac. I recently upgraded to Big Sur. Any connection here? I’m nervous about changing anything, and losing my checking history, but is downloading the newest Banktivity all I need to do? How can I ensure that all my past and current checking info will be there, if I do? Thanks for your help.

Hi Regina,

I recommend talking with our tech support to address the issue, http://www.iggsoftware.com/support

That is a much better channel than me trying to provide tech support in our blog comments.

Thanks!

I can’t abandon macOS Mojave because my music notation software won’t run on anything higher. I assume that means I need to stay with Banktivity 7 until such time as my vendor finishes a 64-bit version of its application (I have even more years of work music arrangements than I do of financial data).

Yeah, unfortunately, v8 won’t run on Mojave. I hope your music vendor makes their update soon!

I am a long time (European) Bank/Banktivity user. As this software is made especially for US people, I had to adjust many things to European likely.

There is something that still bother me very much and I can’t find out how to manage.

When I buy a stock I regularly record the transaction in the brokerage account (price x shares minus fees) . Then when I sell it, lets say in profit I record the sale again with price x shares minus fees. BTW I use “transfer” to separate brokerages (accounts) and money market account as I use different stock markets). There is no way (at least I can’t find it) how to have this profit (or loss) calculate in a income&expenses report.

How can I make it happen? someone can help me. Thank you