Now that Banktivity 6 has been in the wild for a little while, I wanted to write about a few lesser known features in the app. Most folks know about the big ticket items like Workspaces, Tags, Quick Reports, Find and Portfolio. But we’ve added a ton of other new features and polish throughout the app, and they deserve some attention. So over the coming months I’ll be doing a few blog posts calling out some of these less-spotlighted features and, of course, we will write about other development/company news as appropriate. I know many are clamoring for an update on our iOS apps – sorry, you won’t find that in this blog post. But trust me, when we have something to say about them, we will write about it here!

So, without further ado, here are three lesser-known features in Banktivity 6 –or as I like to call them, hidden gems.

Hidden Gem #1 – The Sapphire

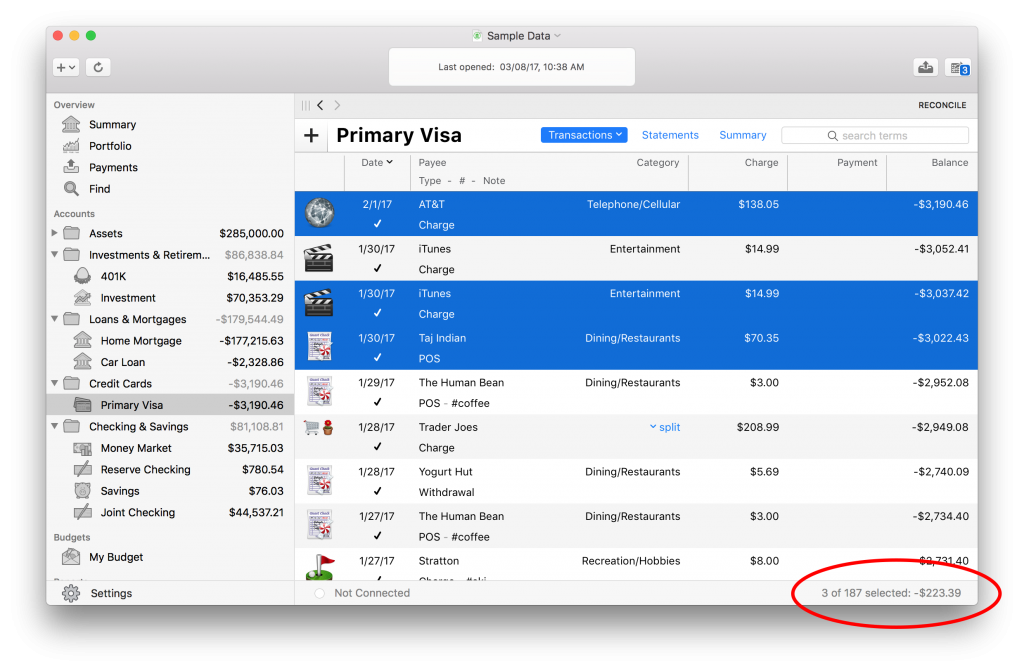

Sometimes, customers want a way to quickly sum up a couple of transactions. Now you can do that: at the bottom of the window is a little description showing the sum of all of the selected transactions (see the red ellipse in the screenshot below). Not much else to say about this. It’s simple, it’s fast, it’s useful.

Hidden Gem #2 – The Ruby

Are you a fan of nested categories? We do a much better job now of showing nested categories in reports. One thing that we needed to figure out, however, was what to do if someone wanted to expand all categories. Now, if you see nested categories and a little disclosure button, just click it with the Option key down and ALL categories will be expanded or collapsed. It’s not a huge thing, but a nice little touch. By the way, the Finder behaves the same way with folders.

Hidden Gem #3 – The Diamond

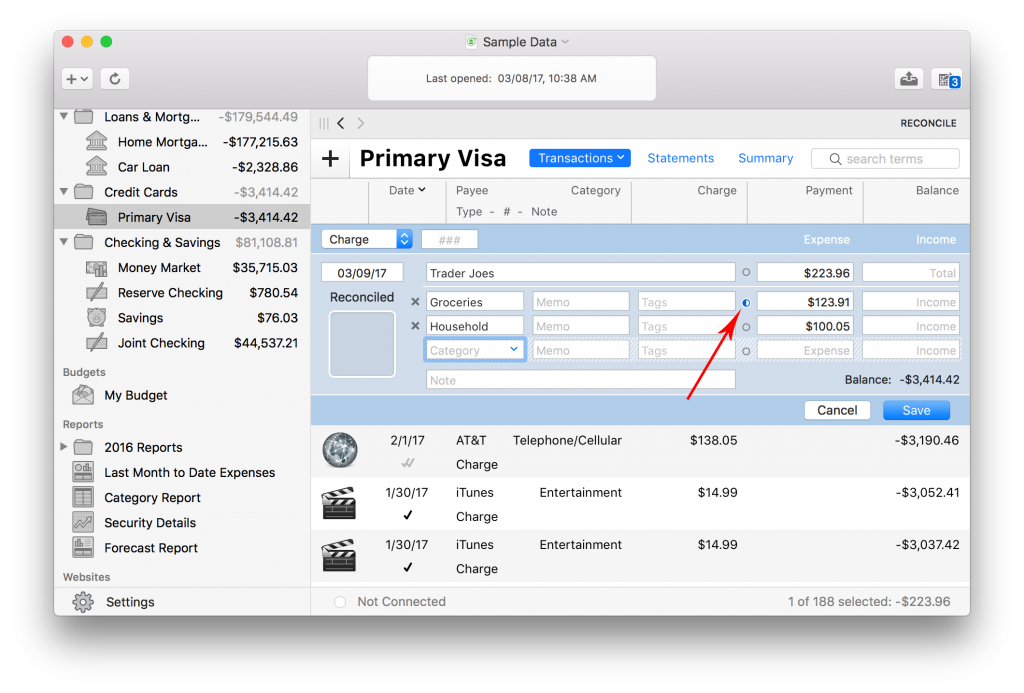

Alright, there isn’t anything hidden about this, as it is probably one part of the app you interact with most: our inline transaction editor. For Banktivity 6, it has been completely re-engineered. We tried to keep the parts of Banktivity 5 that worked well, and improved the areas we thought needed help. One of first things you will notice is that you can tab to any part of the editor, add or delete splits, and do just about anything with key strokes. Yay!

We also greatly improved how split balancing works. There are two basic use cases that we wanted to get right and we think we really nailed it. The use cases are as follows.

Split entry case 1: A transaction exists in your account that is not split, and you want to split it. When you are adding splits to this transaction, you never want the total to change, or else it will affect your account balance.

Split entry case 2: You sit down to enter a new transaction, and you just want to enter in all of the split items and let the total be the amount debited from (or deposited to) the account.

Right off the bat, we handle both of these cases without you having to do anything – we just do the right thing – but we also exposed a new control so you can be more precise in controlling exactly how split entry will work. How do you know what behavior you are going to get? Look at the little “split balancer” next to the amount (red arrow). That indicates which line item will “absorb” any extra amount to make sure the transaction remains valid. In the screenshot below I’m editing an existing transaction and I’m about to enter an additional split item. The Groceries item will absorb the value I enter so that the total will always sum to $223.96 – the total amount of the transaction.

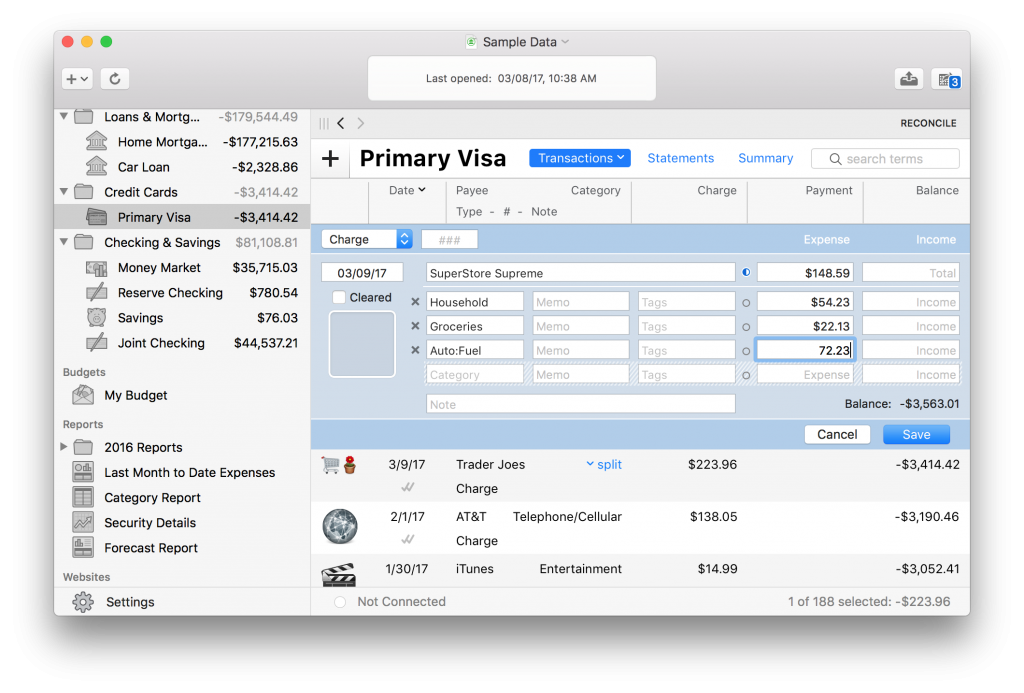

Here is an example of entering a new transaction where you want the total of the transaction to be the sum of all of the splits. Notice that the top most area, the total, has the split balancer widget. For this case, I can just enter split after split after split, and they will just keep tallying up.

The other great thing about the split balance widget is that you can move it to where you want it in case you have a situation that necessitates finer control.

If you needed another three little things to get excited about, there you go – three hidden gems. There are lots of other little nuggets of goodness in Banktivity 6. I’ll be outlining a more in the future, so check back soon, or even better, follow us on Twitter and Facebook.

Until next time.

-Ian

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

I’m enjoying the new functionality in Banktivity 6 and am getting use to the new UI. But is it just me, or is anyone else experiencing a lot of spinning cursors?

Generally speaking, program performance is fine – it fires up quickly and doing lengthy things like downloading transactions are no slower that previous versions. But once in awhile, for no obvious reason, I’ll get a spinning cursor that’ll last for 10 seconds or so, then all is well again. Another observation is I’ll often get a spinning cursor when switching to another running application and then switching back to Banktivity (even when it’s completely idle).

The program works fine otherwise, but all the spinning cursor delays are sure annoying. I haven’t created a support ticket yet, I thought I’d first see if anyone has run into this problem.

Thanks.

I’ve also run into this. I use an app to track my Macbooks RAM usage, and found that if I leave Banktivity open, it will stretch out to 6-7 gb, which is almost half my MBP’s RAM.

Closing Banktivity when I am done has done the trick for me (rather than leaving it open/idle).

Ditto, have you tweaked the parameter to save changes ? I have it running at 10 mins and it is much better but I am over that spinning ball ! It is an upcoming feature but Ian posted a hack thru the Terminal program that achieves the delay with the current GA version.

From an earlier IGG post :-

1. Quit Banktivity 6

2. Launch Terminal and type (or copy and paste) this:

defaults write com.iggsoftware.banktivity6 IGGAutosavingDelay “600″

3. Hit return

4. Launch Banktivity 6. The autosave timer should now be set to every 10 minutes.

Thank you Mario, I must have missed the earlier IGG post about that. I just set mine to 60 minutes and believe that has improved my problem. It takes my Banktivity about 15 seconds to save and while it’s doing that, you get a spinning cursor and have to just wait. Since the manual says it autosaves every minute, 15 seconds out of every minute amounts to a lot of waiting. Time will tell if this really has solved the problem.

To JR in an earlier post, I have experienced Banktivity’s memory usage steadily increasing too. In a test, Banktivity consumed 84MB of memory right after launch. After letting it run for 8 hours, with mild use, it’s memory usage was up to 635MB. I image after a few days you could see it get up to the GB range. By the way, I could find nothing to get it to release that memory, including saving.

Since the folks at IGG have now given us a forum over on reddit, I’ll now take this discussion over there.

Just a kudo to John with regard to his assistance today to a very frustrated new user. Very direct, informative and helpful and I retracted my request for refund. Thank you John.

Thanks for these and I’m looking forward to more. Hope someone will address Bank Accounts. If I put include them, they and their balances seem to show up in and actually affect the Budget, when, in fact, they are just depositories for the money, not part of the budget.

Thank you for creating a reddit space for banktivity users to share experiences and ideas of how to best use it!!!

Left Quicken for iBank ages ago. So, as a long-time user of Banktivity, I am frustrated by the lack of features excluded/omitted from the new version, which I downloaded for free trial. By way of example,

1. The US tax report breaks out categories by payee, but does not include a total for each payee. So, at the end of the year how are you supposed to verify the 1040-INT statements received from each bank when Banktivity’s report just lists the payments but doesn’t sum them by payee? This basic feature also was lacking in Version 5, forcing you to run tax reports for each individual account.

2. If you want to update a security’s price manually (which is necessary for precious metals, treasuries, etc) and own a fair number of securities, Version 6 makes the process far too complicated. Version 6 completely lacks the ability to sort securities (available in V5 using name/symbol/type/risk criteria); the only option is to display all securities or only those currently owned. After you finally locate the security to be updated manually, you have to click on it, enter a date, click add price and then enter the pricing information; a process much more cumbersome than in Version 5, which allowed entering the date and price in a single step.

Having a few different bank accounts and a diverse portfolio makes one seriously reconsider whether it is prudent to move to Version 6 from Version 5.

Even I experienced this difficulty in updating the securities prices. Then I stumbled upon this feature in main function PORTFOLIO. This will list all your securities and holdings. You can update the latest security price in this screen instead of the laborious way you are following today. Try this.

Why is my version on my iPhone 3.5.5 instead of 3.5.6?

I love Banktivity 6. But one thing is a bit annoying. When you start entering a new transaction the first thing you set is the type of payment (withdraw, charge, pos, …). When you come to the payee and have chosen one, the payment type may switch to the most recent type used with this particular payee. In my opinion the payment type should remain as set at the beginning of entering otherwise you must go back to it in order to chose the correct one again.

In Banktivity 5 you could drill down in a Budget category to see any Memo .

It appears (including Via Support) that you can’t see Memos.

When creating. Budget, you really need to see that detail.

Example – Home repairs – you want to be able to see what expenses are driving Home repairs.

I hope this is resolved in some way.

I am using Bankivity 6 as trial deciding whether to buy or not. The only thing that is making me pause is the reporting and the redundant information that means a statement print out is excessive pages. ie under the Payee why do I have to print the ticks and the word withdrawal, or deposit when the amount is in a column Withdrawl or Deposit. Also, why can I not have a final balance printed with the Transaction report giving me a real statement look?

To say I’m not a fan of the new split processing is an understatement. The previous version worked great for me – very easy. The new version is always screwing up the splits regardless of how I specify the “split balancer.” What used to take a few seconds to enter my paycheck with splits across accounts now takes minutes as I fight to get the splits correct. Not happy at all about the changes.

A way around this is to make the split balancer line the last empty line, without any category.

It will then just show you the ‘leftover’ amount until you’ve balanced all the splits, at which point it will simply disappear. This, IIRC, is how it behaved in V5

Nope. I had an uncategorized line but it was first. Moved it to the last line and the same behavior. As soon as I enter a new amount it changes all my splits, not just the split balancer line. Odd behavior that looks like a defect to me.

I think I know what you are referring to.

When you do your data entry do NOT hit enter after each input line and it will self balance. I post rental income that varies from month to month and it works much better than B5 .

Hello. I am agreeing with Joos. It is annoying that I start out saying I am entering a deposit and then the tabs go to withdrawal. Why not go to deposit when i said it was a deposit? This was a problem in v5 as well. Thank you for the other improvements.

I am trying to locate a simple way to be able to view the “memo” field in the register view. Any help? Anyone?

Yes, I would also like this! Makes it so much easier to see what you have spent your money on. Also, we should not have to double click to enter fields – should just be able to tab to them (category, memo, etc.). Thanks for listening!

I’m so ecstatic about Banktivity 6.0! Over the years I’ve used several different types of financial programs. For one reason or another, they just didn’t work out. This program coupled with a dynamic download capability has cut my financial-entry workload by 90% (and that’s not over-stating it!!!)! It is simply, absolutely the best!

One request: you already capture the tax code and attach it to the category. It would be very helpful to have a report by the IRS nomenclature assign to the tax code. And I bet a lot of other users would benefit from such a report capability.

Otherwise, it’s one fine program…..I love it. Did I mention: “I LOVE IT”?

How should I delete Banktivity 5 after installing 6

I can understand sticking to one OS because it is hard to be effective when supporting multiple platforms. My question is about the iphone and ipad apps. Why not include Android phones for alerts and etc. This information is generally basic but extremely helpful especially when the job takes you away from the office.

I’m not a iphone user. I cannot justify the price, so I stay with Android for communications.

Will I have access to my raw data, and where is it stored? I hope on local machine. I use Business Objects to develop custom reports for planning and research.

I’m new to IGG Software, but I have a background in developing governmental financial systems. I’m starting to write a script that will send a warning to a designated owner when a bank balance reaches some defined balance, thus preventing over draft. Since mine will kick of manually, it would be a nice feature if IGG would configure a trigger when a bank account reaches some defined balance an email is sent to a phone number or maybe just a notification to an ipad. Secondly, on scheduled payments: provide notification to a user’s phone number or Ipad when the payment is executed. In today’s world we have so many services that we authorize automated payments. This procedure would help keep track of payments and prevent over-draft situations.

Thanks,

Carl

Hi IGG,

I’m trying out Banktivity for the first time. Nice work! I’ve been using my own excel hacks until now.

There is one feature I would dearly love, although it would be a bit of work. If you could go into my Wells Fargo account, pull down all the check images, and figure out the payee automatically, oh boy, would I be happy. My wife loves to write checks (old school) and I spend quite a bit of time doing this manually.

I’ve considered doing this via a python Moneydance extension … but then … life is short.

Thanks,

Wallace

I havent updated to 6 yet, but quick question before I do. If I enter a new transaction into ver 5, say the payee is ABC, and I enter 10 splits to breakdown the transaction, the next time I enter ABC as a payee, ver 5 by default will enter the total and all the splits from the last time I entered ABC as a payee. Then I have to manually go in and uncheck them all and enter new totals. Does ver 6 do this as well? Its kind of annoying and a waste of time if Banktivity assumes all the details from the last transaction with ABC are the same as this transaction. Thanks! Other than that its pretty good software…

Any idea why Scheduled transactions cannot be included in reports. An option that existed in iBank and has now disappeared from Banktivity. Or am I missing something?

I’d like to see a very feature in monthly income and expense report and that is to include transfers in your calculations. That then will truly show your “true” net position. All transfers should be recorded not as income or expense but as a transfer and thus reported as such.

Can anyone tell me how to batch assign categories? I am going through last years Credit Card statement and trying to change all the unassigned transactions. It’s taking forever especially as I have to double click on each transaction to open it up. Is there a way to select all unassigned, then see them in payee order so I can then batch select a certain payee and set a category for them rather than doing each one? Thanks.

Select all the ones you want to change to the same category and then go to the Transaction menu.