When you embark on a large software project some of the first steps are planning and scope. Furthermore, when you’re working on a revamp of an existing product, you have an opportunity to look back and admit to your mistakes, and look for ways to correct them. In this post I discuss two big goals for Banktivity, both of which required a lot of planning and integration deep into the architecture of the app.

Goal 1: Improved Navigation

One of the goals in developing the next generation of Banktivity for Mac was to make exploring and navigating your finances easier and more intuitive. We wanted to do this because we’ve always felt that there was room for improvement in how customers navigate about our app. Furthermore, with our forthcoming ad-hoc reporting, quick and easy navigation becomes even more important.

In a forthcoming version of Banktivity we are introducing what can only be best described as Forward and Back navigation. No matter how you explore, cut, slice and dice your financial data, you can easily get back to what you were viewing with a two finger swipe or by using the new back button (there is a forward button too). Furthermore, this is fully integrated into the sidebar. For example, if you select a report, then an account in the sidebar and then select your budget, two clicks of the back button will get you back to your report. We aren’t claiming to have invented Forward and Back navigation, as it’s actually quite common, but we’re particularly excited about this feature because it has been a long time coming to financial software.

Goal 2: Play Nice with Varying Screen Sizes

Today’s Macs come in numerous sizes. On the large end you can have a MacPro powering dual displays and on the small end you have the tiny 11″ MacBook Air. Optimizing Banktivity for either of these extremes leaves a lot to be desired. If we optimize for the smallest screen, then those using a large iMac just have things stretched really big. If we optimize for a MacPro powering a huge display, then the app would literally be unusable on the smaller laptops. You are probably thinking now, “well sure, you should just optimize for the middle.” We considered this, but it results in rather poor experience for those that have the largest and smallest displays. So what is a developer to to do?

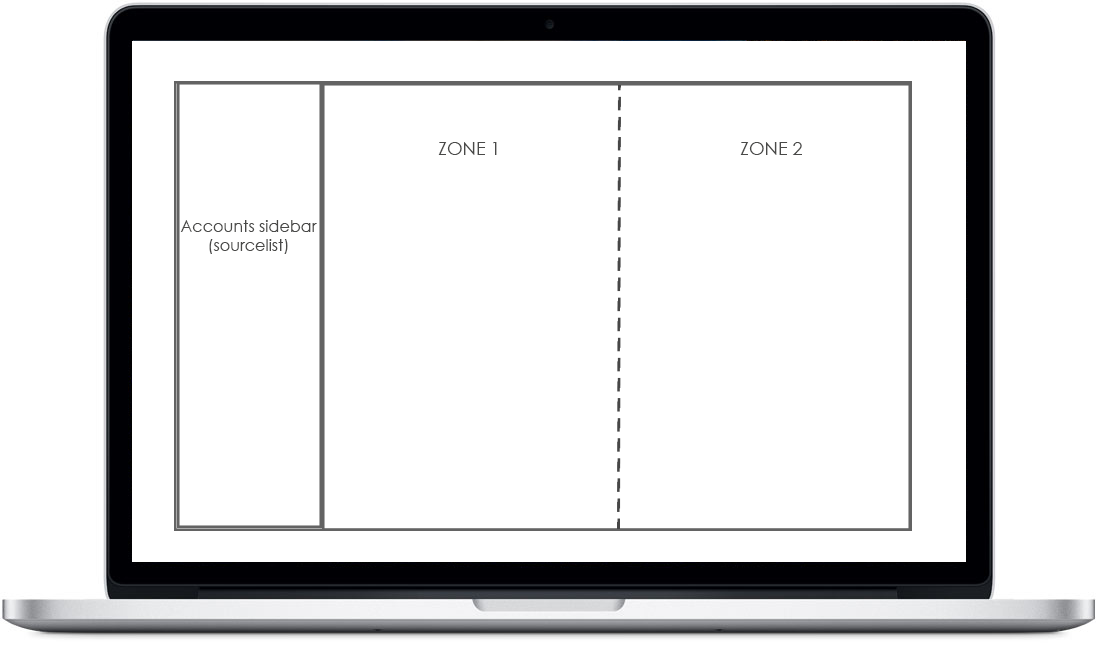

Introducing Zones

In a forthcoming version of Banktivity we are introducing the concept of “zones.” Zones are simply the spaces available for content (e.g. transactions, reports, budgets, etc.) on the ride side of the sidebar (aka the source list). You can think of Banktivity 5 as having one zone. However, for a future version you will be able to have two zones side by side. This allows customers with really large screens to have two completely separate views of data next to each other. What’s better yet, is that if you have a small screen you can still use two zones when you collapse the sidebar area.

You can drag and drop items from the sidebar into a zone. Then once a zone is occupied, it maintains its own navigation stack so you can go forward or backward independently of the other zone. You can even drag some views that are in a zone back into the sidebar. For example, if you were looking at a spending report in Zone 2 and you drilled down into a specific category, say Groceries, you could then drag the Groceries category detail report back into the sidebar. This report would then be saved and would live in the sidebar until you opted to delete it.

Our new dynamic navigation and drag and drop capabilities are really best illustrated with a movie:

As you can see in the video, you can drag and drop items to and from the sidebar into different zones. Each zones maintains its own forward/backward navigation stack so you can explore within the zones independently. I’m really excited about our new navigation. The whole app feels much more modern and allows for some great customization.

I know someone will ask when this new version is coming out. And the answer is, we don’t have a date to put give out to the public yet. Please also keep in mind that you are seeing a non-final UI – there will be changes!

Thanks for reading and I look forward to hearing your feedback.

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

I was hoping for something like this with the introduction of Tabs in Sierra ! Brilliant ! Now how about a little color on icons and numbers, much prefer to see red and green than look for – signs.

Hi Mario, are you referring to numbers in the transaction list, sidebar, or someplace else?

Yes I would prefer to see debits in red and credits in green on the register. Also I miss the color of ibank 4 icons on the sidebar

I agree. Great suggestions!

BTW, just saw the video and it looks awesome… can’t wait

Great idea. Will come in handy when looking at a check register and a credit acct at the same time.

Yes, these features will be incredibly helpful and make Banktivity much more functional!

The zones sound great. Have you considered the situation where the user has multiple screens. Can the zones be displayed in different screens?

Also – I may be missing something – but what video is Mario (above) referring to?

For multiple screens you can open up additional windows that will behave the exact same as the “parent” window. They even have a sidebar.

There is a video near the bottom of the blog post you can watch.

The Zones feature looks great. I initially thought it would really be a variation of opening an account or report in a separate window. But it is clear this is much more powerful.

Well done, Ian and team! Looking for forward to this new version. If you need a beta tester, just let me know!! 🙂

Ian:

The changes you’ve described all sound terrific and will do much to enhance the value of Banktivity, not to mention its usability. Could you give us some idea as to when they’ll be released? I also concur with Mario Recuero’s suggestion that the use of color be increased, especially in the register and on the sidebar.

Bernie

As mentioned in the blog post, “I know someone will ask when this new version is coming out. And the answer is, we don’t have a date to put give out to the public yet.” Sorry!

Would be nice to know if I can buy Banktivity 5 and get a free upgrade. I’m holding off buying it because of the possibility of this new software. I’m not interested in buying it twice in a couple of months.

I’m also interested in Beta testing opportunities for the Mac and/or iPhone.

How did you get your category reports to show useful things like grocery spending and utilities, rather than Tax, Tax, Medicare, FICA, Tax? Did you mock the data that way (only net paycheck) or do the new reports do that for you?

In my sample data deductions from the paycheck aren’t accounted for, so it just shows net salary.

Thanks for sharing the great progress! I am looking forward to new version.

Will the new paradigm make readily apparent which zone has keyboard focus if one were to use the keyboard? Currently, it is difficult to tell where the keyboard focus is.

Will you be updating us on usability? I made a previous comment on the need for making data entry easier and faster with greater editing control via keyboard, fewer keystrokes and less mousing.

Thanks for your hard work! (I am an experience beta tester and will be happy to help.)

Ian, this looks like this may solve the issue folks have had for a long time on flexible reporting. So the only issue that persists now is the much-requested one of fixing the data entry “clunkiness” in split transactions.

+ for that thought Donna.

Stay tuned.

I just finished a session to catch up with the past couple months of after being on several trips and am so frustrated with the tedious process I started to look into the new Quicken. I came across this blog trying to see how well the iBank to Quicken import will work…

Although these advances look great and I can see the benefits, it remains that for the past 5 years there has been no focus on making data entry easier (nor fixing many basic bugs others and I have reported). If it were up to me, I’d drop all development on new features and iOS versions until the transaction data entry (splits for sure but other nuisances like inflexibility on how categories are assigned (such as ALWAYS asking if the category should be memorized when with no option to avoid the pop-up), weird handling of capital letters, etc).

I’d like to hear a little more than “stay tuned” to keep me from jumping ship because I’ve been hoping for so long that things will improve with data entry. I’m going to try Quicken with their guarantee and return if I can see some improvement within the 60 day window.

And single line registers…

I’m looking forward to the new version. I’m also promoting your product to others that are still using antiquated finance programs. Will the new version be a free upgrade for existing users? I’m hoping not to promote Banktivity only to have my friends immediately turn around and pay for Banktivity 2.0. Thank you for your continued dedication to this product.

Agree! Needs to be a free upgrade for exisiting users of latest version of the latest version.

One other navigation help would be to enable hot links on the overview reports. I came fro Moneydance and in their overviews you could click on things and go to the relevant transaction, security, etc.

For example, you show the upcoming transactions. Clicking on one should take you to the relevant transaction in the register. Click on your securities and it shows you the security. Click on the expenses and it shows you a report of the transactions that make that expense up. Click a budget bar and you see the expenses for that budget.

It’s one area Banktivity falls quite short.

Yes, new Overview section will be more interactive.

Hi Ian — thanks for the update. This looks fantastic, and addresses one of the main issues I have as well. In addition to the points above, I was wondering if the transaction register columns will be adjustable? That would help especially when having multiple windows open on the screen. Additionally, (and admittedly low priority) color options for the graphs and charts would be fantastic (I have some trouble making out differences with lighter/pastel shades ) Thanks for your hard work.

Awesome work guys, can’t wait to get my hands on it.

When will this be?

Wow! Can’t wait! I have converted my husband for his business accounts.

And am wondering how secure the iPhone app is. I was an early convert from Quicken…

I have most Banktivity (I LOVED the old iBank name….!) files on a stand alone desktop for security purposes. I would love to have a daily transaction posting on iPhone for travel etc., credit card purchases…..but have been afraid to trust the iPhone app. Does it work with IOS 10?

Our app does work on iOS 10. Regarding security, please take a look at this article here: https://www.iggsoftware.com/support/articles/ibank-5/is-cloud-sync-secure/

Hi. This is not very helpful. I am trying to fill-in the support form but it will not send because there is no ‘captcha test’, whatever that is. I want to report a fault with Bankativity 5, but I am unable to do so. Can someone help me? Thanks. Angus

Angus,

support for Banktacvitiy is based upon US east coast hours; no help forth coming on this blog. Contact them on their ‘online chat’ at East Coast office hours.

PT

Thanks Ian! When running a basic income / expense report in zone 1, will I be able to hold down the option key when I select a particular category, automatically showing me the drill down in zone 2?

Yep, that is exactly how it works.

Find-and-Replace

PLEASE PLEASE PLEASE?

8<:-)

Totally Agree for FIND/REPLACE, the amount of hours I have spent tidying up txns one by one !!

Also I would like to see the ability to search inside reports generated by Banktivity.

Agreed!

I second “Find all”, “Find-and-Replace”, et al.

Also, Can you Include a Calendar in Banktivity and make entering the date tied to it and there have it much easier to chose and enter a date in a new transaction!!

There has always been a calendar in Banktivity – use your keyboard up/down arrows when in the date section and a small calendar will appear.

Yes, Agreed.

Dear IGG,

I think the new stuff you are doing sound awesome! I also see you working hard on improving and adding features! With all of that being said, I do think you all need to set a target date for a release and publish that. You are a little overdue for a communication and also a release.

I by no means wanna throw Quicken in your face, but I can say….. That are doing a nice job and the 2017 for Quicken does lack a lot of stuff. However, you can see their commitment and dedication to the Mac platform. They have found their energy and momentum. They are now committed to improving and expanding.

With all of that being said, IGG is a little behind and it’s understandable being you all have done a complete rewrite on code to match current Mac platforms. You all have a great product and you lead in the mobile app! We do need to get access for financial institutions jilt Quicken has with no monthly fee and you all should make that effective immediately. You can start that tomorrow if you wanted, just turn it on for everyone! Hints doing away with the Direct Access. That should be and always be included in purchase price on upgrades. Like Quicken, charge for software and update more often to make your money…..

I wanna make sure I’m clear….. Great job to you all and my feedback is just one offer of information to consider. I love you all and wanna support you as long as you stay current and innovate on REGULAR basis and communicate more often on plans and features.

Thanks!

Jason

I am betting that a very high percentage of us Banktivity Users share the same feeling.

Ron

Any improvement is of course appreciated, however fixing unintuitive entry procedures should be done at the same time.

Unless patented by Quicken, why can’t I enter something into a field, hit return and get a new entry field with the same date I was working in?

This post would get too long if I listed them all. I found work arounds for most annoyances, but I can’t imagine that your people are not frustrated at times, since you claim to use it for your entire company accounting.

For now to answer: “What is a developer supposed to do?” about screen sizes, just figure out how to enable pinch zooming.

Most Mac users have a track pad and I can enlarge whatever is on the screen (this post in Safari for example), by pinch zooming and then adjust my window size to what I want to see, Banktivity should have that feature.

The type and info on a 23 inch monitor are so small that I have to switch the entire resolution as a work around to get it to be bigger.

Just would like to see simple things improved first. Appreciate all the work but why cant we have merge /edit payees. Payees change and I don’t want to have to waste time amending transactions. also Downloading sometimes sneaks a payee name change so after a few months the same payee may have several versions. Also there HAS to be a simple way to enter split transactions clunky is an understatement. Data entry could be streamline as well. Also I would like to see a link to apple pay via the app so that if you use apple pay for a transaction it immediately gets entered automatically to the software. Appreciate the good ongoing work but please more updates…

Totally agree with Pete Lucas, Payee management is a nightmare which needs to be addressed centrally within the app , custom transaction types is also a feature which I miss from the ‘dark side’ !!

Mario, they are not really the ‘dark side’ anymore. I have been trying them out and I think I’m truly gonna switch staring January 1st. There is a lot to like with them now. I’m even testing the next patch right now and I can say their commitment to being #1 is absolutely there. Unless IGG gets something out to market now, they are not gonna be #1 anymore. The other guys are very responsive and new features and improvements just keep coming and coming. As mentioned, we can’t even get updates…

These blogs posts are meant as a way to let people know what we are working. We don’t want to announce any dates until we are 100% certain about them, until we are, we can’t say when we will release a new version. I hope this helps.

Ian,

your nervousness about committing to improvements is alarming. Set a date that you are confident you will meet, then gently exceed it.

Your lack of dates or commitment has led to incredibly drawn out feature updates and months and years of hanging bugs. This conveys a very poor image of “we will do it on our own good time”. Intuit did that and it didn’t work out for them and now they are hounding at your heels,

PG

I understand your frustration. I remember when Intuit was working on Quicken Essentials and they missed their own deadline several times, by many, many months. We love the software we create and we think it’s important to take the time that it takes. Believe me, when we have something to announce for a date, we will announce it!

Competition is good Jason, unfortunately Quicken is not available outside of US and Canada. I am glad they picked up their game and providing a real alternative in the Mac space (I used Q for years in the Windows platform,). Finance software is so critical, i don’t want a product rushed out that breaks years of financial data but like many I am growing impatient.

Will you be making an update soon to take into account the new touch bar on the MacBook pro?

Really looking forward to the newest updates. When will they be released?

I’ve seen one comment before about fixing a known issue that relates to scheduled transactions. I don’t remember just when it broke (maybe between 4 and 5 or on an interim release of 5) but, when I go in to change a date on a scheduled transaction when it’s saved it jumps a month (or a whole year). I know the “work around” is to hole the and keys but that gets clutzy and doesn’t always work properly. So, with all the new features, how about working on some bug fixes too?

(And, I do love Banktivity and am so glad I got rid of Quicken for iBank 3 a few years ago.)

Oh Carl…. I have wasted so much time with the bug you described ! As you point out the ‘workaround ‘ is not 100% fix. Scheduled Payments was perfect in IBank 4, and I don’t see any benefit to the engine change in Ibank 5 that brought in this issue. Remember automatic posting of recurring bills ?? WHY OH WHY was that removed !

I’m not one to use blog comments for feature requests but I have to ask. Has there ever been any discussion about adding the ability to attach documents to an account and not just a transaction. People have accounts that have items to attach directly to the account.. i.e.. loan agreements, statements, etc…..

I just got into Banktivity. I’s great but I have a suggestion regarding the managing of Bonds. I use to work with MS Money and when you buy, sell or redeem a bond you can do it in only one step (Date, Investment, Activity (Redeem or Buy), Transfer to, quantity, accurate interest and commission). All in one. I hope to see this coming soon in Banktivity. Right know you have to go through 2 or 3 steps to buy o redeem a bond.

Hey, the update looks nice! Hopefully it will be released soon.

Will this update free of charge? I just bought it..

Thanks

Stef

Please add the average cost accounting for mutual funds. This is practically industry standard and necessary to accurately match custodian cost basis.

this is a must!

When are we going to see an update to this app???

We need a Xmas Present !!!!!! Happy Holidays to all “Banktivity Users”. 🙂 🙂 🙂

I’m so glad you mentioned that the video showed a non-final user interface. I MUCH prefer the existing (ver. 5) look of the account/check register regarding the columns and placement of data fields. (Specifically, I don’t like how the Type, Number, and Note fields are all on a single line in the video, rather than in columns as they are now.)

Rob I tend to agree with you. But I think there is a better solution – preferences. Specifically, the data base does a great job of collecting the data – what I would love to see user control of how that data is displaced in the registers and in reports. Over the years I have seen many people requesting the single line register, while others prefer the current format. Why not support both by allowing the user to format the register.

I would you like to see my investment position net o taxes . is there any chance when I register a asset purchase I could put the tax of this investment?

No. Little to no chance. Sadly IGG do things their way, on their own timeline. And to be practical, IGG is totally US focused and the US tax code is so convoluted there is no reasonable way for IGG to be able to calculate tax on an investment and thus show “net of taxes”. I know some countries have much simpler tax codes, but in the US is is terribly complex and tax is quite beyond the realm of iBank/Banktavity.

Anyway to use CSV import into an investment account ? CSV import doesn’t appear to have “shares in” option. Odd omission.

I second this. CSV import/export is important. Moneywell handles it great, but Banktivity doesn’t and I think it’s missing

I’d love to see the ability to batch edit, change account types, and to show % ownership (I own a rental property with family so it would be nice to be able to say 30% ownership for that asset and bank account and mortgage).

But most importantly is importing from my bank. I can’t believe that Banktivity doesn’t match up imports from my bank to the accounts. My bank allows me to import all my accounts at once, but then I need to manually tell Banktivity which accounts are what. That’s crazy! Every other banking software I’ve tried does it automatically using the routing numbers.

Wow, it’s interesting reading all these comments. I’ve been waiting for tags forever, and it looks like, even though you’ve spent 2016 writing about new features, there haven’t been any this year and a number of commenters are discussing bugs and problems that also haven’t been fixed this year. I was hoping to switch to Banktivity as of January, but I won’t be. And I have to say I am concerned about the slow pace of fixes, updates, upgrades.

It seems a fair concern, Carl. Not only has there only been blog posts about ‘new features,’ recently—most of which do seem exciting—even these brief updates are far too spread out to really put much stock in.

I’ve been a loyal ibank/Banktivity user for years and years. It was charming when it first came out, and I’ve long learned to live with the quirks as it was the only game in town on mac. That said, as application development is moving so slow, it’s just falling desperately behind in budgets and reporting, and I’ve begun shopping for alternatives for a fresh start in 2017.

C’mon IGG. Please announce a schedule, or beta availability, or frankly anything more than these limited, controlled videos to allow us to believe this is still truly a live / active project!

Everyday we are working hard on our new features. We don’t want to announce anything before it’s ready. Thanks for your patience!

Blog more. Really! It’s not hard to do and it really helps inspire confidence from your user base. You don’t have to detail things that you’re keeping close to the chest for competitive reasons. Choosing a personal finance software to use is much more of a commitment than just the $60. I really could care less about he $60. It’s great to see a developer that’s active on social and their blog. It’s a cue that work is actively being put into the product and I’m not investing my time in something that’s not evolving. Feature updates are great every few months! I love reading them but more activity and a release timeline would definitely be appreciated. It’s fine for game developers to tell me “It’s done when it’s done.” You’re not a game developer though. You write software that tracks and organizes peoples money. It would be nice if you said “We expect a big release in Q1 2017” or something along those lines. There’s certain functionality I’d like to have right now that other options provide. Waiting a bit longer isn’t a big deal but how do any of us know if you’re planning a release this month or at the end of summer? Maybe steal an idea from the guys over at Serif (who make Affinity Photo) and setup an active forum so users can share advice, you can communicate information about updates and timelines, and you can solicit feedback? A vibrant user community and a healthy dialog between them and the developer should be a big priority for any software company.

+1

Ian, since I came across the book “Show Your Work!” by Austin Kleon, I’ve wanted to share it with you. I produce a lot of work that I don’t want to show before it is a finished product but that leaves a lot of void time. This book helps me realize that along the way, I could share the kinds of challenges I am taking on and reveal my thinking about how to solve them. They don’t have to be specific of the content but rather the function.

Simon Sinek says, “People don’t buy *what* you do; they buy *why* you do it.”

Maybe more frequent posts about the types of challenges you encounter on behalf of users and the general strategies or priorities you consider in solving them will show users that there is always something building toward new releases, even when they aren’t released yet.

I hope this helps. I just like sharing things that might help others.

Very well written Steven S….

Having been using Igg software for quite some time and really love it. But I would.love to be able to see reports in the IOS mobile versions! Any chance this will be made available in the upcoming version?

Thanks!

Hi Ian,

Make my life easier, please. Implement a counter for scheduled transactions, something like “2 out of 4” next to each scheduled transaction, so I know how many transactions still remain right off the bat. That would be beautiful!

zzzzzzzzzzzzzzzz

Customizable icons are great. If you can, please include more category icons and make them a little easier to change.

I’m an old codger of 89, and I need a replacement for Quicken 2005 (14.0.5-R6 I think it is). Banktivity just seems far, far different from old Quicken 2005, which is so familiar and simple. It has served me since 2004 when it first came out.

The fancy colors and do-dads confuse me. I still log in my “paper” checks because I want a “paper trail”, and I have a myriad of accounts, many of which I must prepare 3-month, 6-month , 9-month printout for. My wife has a live-in caregiver and I must have excellent records. I’m sure I’m saying too much, but if you have any comment please post it or send it to me at my email address.

Lee

Oh yeah, I forgot to say I have a MacBook OS10.6.8 2.4Ghz 2GB Intel Core 2 Duo, what ever that means. And I’m still using Safari V.5.1.10, But I’ve got Firefox 48.0.2 too.

Lee