My last blog post covered the history of Banktivity (formerly called iBank). This blog post will briefly touch on some things we are working on for the future.

Banktivity 5 has a lot of great features in it, like Bill Pay and Cloud Sync. But if you read my previous post, you know that software is never done. Our dedicated team is always working on fixing bugs, implementing features and keeping the underlying architecture modern and running smoothly as new operating systems are released.

Before I go into talking about a major overhaul to one of our existing features I want to say a bit about this blog. We started this blog to have a medium to let people know what we are working on. This gets tricky sometimes when we want to talk about a new feature, but don’t necessarily want our competitors to know. Sometimes we start working on a feature a year or more before it will even make it into a shipping product. If we announce we are working on something like that, we don’t want to mislead people in thinking that some feature is going to be released in the next month or so. Similarly, when we are working on a feature we don’t want to peg it to a release date because we don’t want to ship it until we think it is ready. I’m saying all of this to try and manage expectations. With all of that being said, for the following features that I’m going to talk about, let it be noted that we have no dates to announce at this time.

Reports

We’ve heard our customers loud and clear; most of you want improved reports. This means a lot of different things to different users. Often when we prod on the details of what customers want, it’s really across the board. Some people want to be able to compare year to year, others want to be able to tag a transaction to report on it later. Others want reports that are easier to generate. And some want reports that allow for greater customization. I can’t promise we’ve solved every situation, but let me tell you about the great things we have done.

Ad-Hoc Reports.

Ad-Hoc reporting works by allowing you to save any report you are looking at. In Banktivity 5 you can drill into reports to see more detailed data, but you can ONLY see it by drilling in, there is no easy way to get back to it without a bunch of clicks. With Ad-Hoc reporting, you can save any drill down report and it will appear in the sidebar/sourcelist. I’ll talk about some of the new data you can see when drilling down into reports in a another post. But the take home point here is that Ad-Hoc reports are convenient, light weight and powerful.

Grouping.

With it being so easy now to generate a report, we imagine that customers might want to manage many more. A flat list of reports can quickly get cumbersome, so yes, in the future, you’ll just be able to group them into “folders” and organize them however you want. And yes, you will be able to make groups within groups too. I know my flat list of reports for the IGG books is way too long. I can’t wait to start using the new report grouping feature!

Tags.

This might be the single biggest improvement I’m going to talk about in this blog post – the new reports, where appropriate, allow customers to refine results based on Tags. Droves of customers have been requesting this for a long time and I’m really excited that we have it built-in to the accounting engine now. I want to be clear, this isn’t some feature we sloppily tacked on at the last minute, we baked this into the core and foundation of our product. You can add any number of tags to transactions or splits, and report on them. This exposes a powerful new dimension to reports and will let customers slice and dice and understand their financial data in a whole new way. For customers who haven’t been able to leave Quicken because of their support for classes, you will finally be able to say goodbye.

Comparison Amounts.

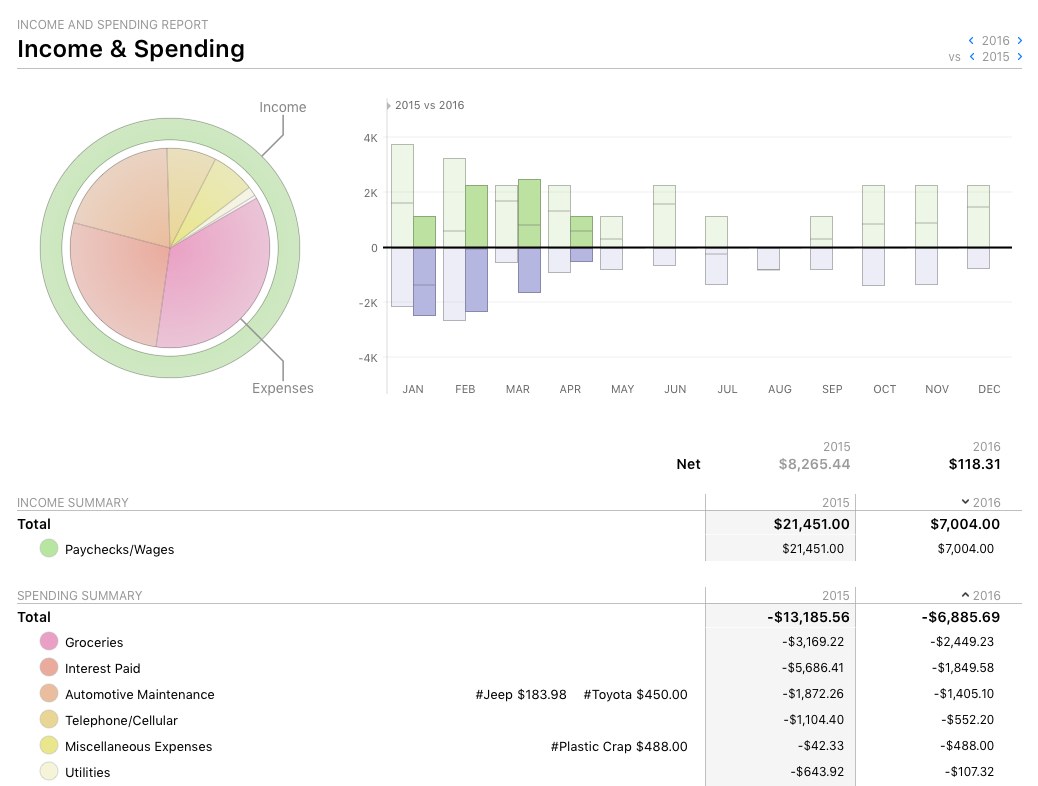

For almost every report, there will be a new option to show comparison data. This means you can easily compare spending for say, 2016 to 2015, or July 2015 to July 2014 and so on. We did put some sanity restrictions on this feature though. For example, you can’t compare all of 2016 to part of 2015; the date range length must be the same for the comparison period. However, you can shift the comparison range back in time as far back as you want to go – you could compare Q1 2016 to Q1 2006 if you wanted. It can also handle comparing months of different lengths, so you can compare March 2016 to February 2016. Displaying the comparison data is an option for any report that supports it. So it’s there if you want it, but doesn’t get in your way if you don’t want it.

In the screenshot above you can see the 2015 and 2016 data sets side-by-side. You can also see the tags separated out on this report: Plastic Crap, Jeep and Toyota. The report is interactive as well. You can click on any category row to get more info just about that category, or you can click on a tag, to just get relevant info about spending and income for that tag. (I used Plastic Crap in the example because I’m in the process of a big move and sometimes it seems, wherever we look, there is more plastic crap to deal with. :-))

In the screenshot above you can see the 2015 and 2016 data sets side-by-side. You can also see the tags separated out on this report: Plastic Crap, Jeep and Toyota. The report is interactive as well. You can click on any category row to get more info just about that category, or you can click on a tag, to just get relevant info about spending and income for that tag. (I used Plastic Crap in the example because I’m in the process of a big move and sometimes it seems, wherever we look, there is more plastic crap to deal with. :-))

Nice Little Things.

We’ve added a lot of other niceties into reports. Here are a few:

– Not sure if want to see your sub-categories in the list or rolled up into the main category? No problem, we’ve implemented a little disclosure triangle to expand and collapse sub-categories right inline. If you hold down option key while expanding or collapsing, all categories are expanded/collapsed.

– Maybe you don’t want your results sorted alphabetically, no problem, you can now just click a header to sort data how you want it.

– Want to see data from a past interval quickly? Ok, just click the < or > arrows to change the range of data you are looking at. This works for comparison data too.

– Drill down into some more detail and want to go back, you can now two-finger swipe.

– Maybe you need a different report title? No problem, the title of the report now reflects what you name the report.

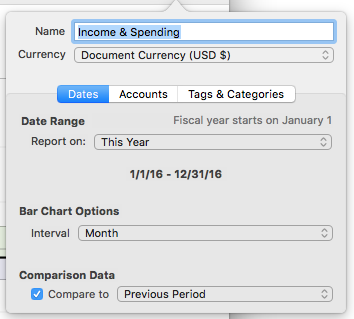

A redesigned report editor that exposes some of the new reporting capabilities like comparison data and tags.

I could go on about other features we are working on, and to be honest, I’m really tempted to. It’s an exciting time to be running IGG Software as years and years of backend work are finally coming together for our entire product line. Alas, I want to save some good fodder for future blog posts.

One last note, please keep in mind that the work I described above is a work in progress, as such, it can and will likely change.

Let me know what you think. Does it look like we are heading in the right direction with reports, or does it look like we missed the feature you wanted?

Happy Banking,

Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

Simple request: please allow a user to start with *both* the home and business pre-defined categories… or if the user started with home, let them later add the business categories (and vice-versa). Lots of us have home businesses! 🙂

one feature in a finance software that never truly developed into a useable desktop program that was created by a developer Graham Haley for Mac. This program only lacked the ability to bill pay and connect with banks and credit cards which was major but doable. The the feature that set this software apart from everything else out there including some of the more popular personal finance software like i.e., Quicken was the ability to change a single scheduled transaction in the future up to 2 years; for example you had all your future transactions appear in your Bank of America account for the months you set which could be years down the road. So you see that one month you could afford $1000 for a payment versus the scheduled transaction of $500. I could actually change that one single transaction for that month which may be 4 months out to $1000, not effecting the remaining scheduled transactions of $500. And all accounts could be viewed with separate forecast view options. This was so valuable I could play with the numbers and see what worked. And it also had a forecast option for each account by month, years, Account Tracker is still available for the iphone and ipad but the desktop version is only a viewer. He has been working on this for years but never fully developed it to what I consider a functional integrated product like Bankivity You might ask well why would i need this. Right now most financial software requires you to actually end and resubmit a new transaction when scheduling transactions. This eliminates that and allows the existing scheduled transaction to be changed without re-entering single transaction with that amount then re-entering the original transaction for subsequent months with the original $500 ; the change only effects that specific payment, leaving the remaining scheduled transactions the same. This works great especially if you can’t pay the extra amount you had planned. You just go back and change it back to the original amount and the scheduled transactions stays the same. I used it allot when just planning future balances. You can review the program for yourself its Account Tracker pretty basic but allot of potential.

My main grievance is the lack of bulk edits for Payees, Notes, etc sometimes you want to clean up transactions downloaded.

Vote +1

Vote +1

+1

please allow a user to start with *both* the home and business pre-defined categories… or if the user started with home, let them later add the business categories (and vice-versa). Lots of us have home businesses!

Sometimes new categories are created by accident due to a minor syntax difference, you may end up with 2 versions of the same name, one with a capital the other without etc. Should be able to drag and drop one account into the other without having to edit each transaction in the ledger

This functionality has existed for years… in the ‘Categories’ section.

You can select multiple categories and merge them (right click), or drag & drop categories onto each other to merge. Easy.

Now… if we could do that with Payees that would be nice. 😉

I’d love a bulk payee function as well!

I have burnt a lot of hours tidying up my file to produce neat reports by payee !! This bulk function would be a very desirable feature.

Like Mario describes, I have many cases where multiple payee names represent the SAME payee. Unlike him though, I have so many, I can’t afford the hours and hours it would take to fix them.

A negative side effect of my payee jumble is that report entries often need to be adjusted. Adding more features without adding bulk edit for payees will only increase the need to do so.

If I could choose ONLY ONE improvement, it would be bulk edit of payees!! I believe it should be TOP priority. Please do not release more features without making this one of them!!

“I have burnt a lot of hours tidying up my file to produce neat reports by payee” – DITTO. Many many hours tidying up.

Hi Ian,

Wondering if IGG has evaluated the impact of Documents Folder in iCloud under Sierra OS ? Banktivity does its own synch so I was wondering how this could impact or will the file be moved out of Documents. Hoping both features can work in unison (i.e. synch and iCloud backup)

A pet hate of mine is Scheduled Transactions and the logic change since V5. Under V4 it was possible to make changes to the due date without complications and to have auto posting.

Under V5 we lost auto posting (grrrr) and I find it a chore to change scheduled dates (e.g. share dividends occur every six months but not exactly as predicted by Banktivity logic). To change the date on scheduled transactions requires you to add a new schedule and delete the old schedule, this works erratically (I suspect a bug) and often you need to rebuild the scheduled transaction from scratch.

I don’t see any advantages to V5 logic over what worked perfectly in V4. I hope this is on the radar to automate postings and rescheduling as needed (a simple date change edit will do !!)

Thanks for the update, Ian. I’m really glad to hear you guys are working on improving the reports function. I do hope you got the request to fix the Net Worth report so it makes a distinction between LIQUID vs. HARD assets… for example, since the earliest days of iBank, the Net Worth report shows both Checking accounts and Cars & Houses as “Cash Assets”. This is a fundamental flaw and renders this essential report somewhat useless.

I’m looking forward to switching from Quicken as soon as you have added tags/classes. Any way to be notified when this is available?

It would be nice to be able to search for a given payee across all Accounts. Quicken has this feature and it really simplifies things. Some times you pay a company out of varying accounts, but it’s impossible to remember which one..So you get to hunt and peck through each Account, and hope you find it

Have you considered a catch all tens ‘Smart Account’ definition that would give you the functionality you see. I use this all the time to find payee’s across all my accounts

Would it be possible to add forecasting in the ipad version ?

Thank you

Hi

It would be nice if the balance was shown in color…… Example, if you are in the “negative balance”, the amount would be in the color red and when it goes in the “Positive Balance” it could change to the color Black ……….. perhaps “Income” may be shown in the color green

It would dramatically change the visuals from the current lackluster color scheme..

Ron

spot on !, add color icons too

You can easily pick and add your own icons . Use Google/images/icons, find your icon, open your Category, drag and drop 🙂 🙂

THANK YOU SO MUCH! I just spent all this time trying to add .TIFF files to the Resource file in Package Contents, but–nice security Bankivity–the app won’t open if you tinker with the contents. This is a GAME CHANGER!!! Bankivity, you should make this feature better known.

Ian

Is there anyway we can add graphics to our messages ? I do miss a “Forum” to communicate 🙁

You can’t attach screenshots or anything like that, sorry!

Would be nice just to be able to make a simple line plot for net worth with flexible start and end date. Current net worth report that just fills in constant values from current date to end of the year (into further) is very annoying. Also find bar chart vs simple x-y plot using all available data. Quicken reporting is much better

I’m all about tidiness. Can you please add a line separating bank accounts from credit account etc. You do it on your mobile app why not the desktop version.

Yes. This too.

One more request… as you work on improving the report function, PLEASE address the need to produce a true CASH FLOW report. Anyone trying to use Banktivity to create and manage a sophisticated budget really needs a Cash Flow report to reconcile the differences between the flow of expenses and asset transfers between asset accounts.

Been really quiet here…. No updates since 4-21…….. I hope that the wait won’t be too long….

Archiving Data – I really think that it is about time that Bankivity incorporates a better method to archive data. I have been using iBank since its inception and my data file is now 64 Mb. I also have 10 bank accounts, 15 credit cards and about 50 different investment accounts (each Investment certificate is a separate investment accounts so I can track them all by due dates).

The method you suggest to archive data is very difficult to manage. Other banking programs offer archiving.

This list of updated and new features has me very excited. Thank you for all your hard work and listening to user feedback!

Is there any chance that we’ll get some cash-flow reporting and forecasting in the improved reporting?

I know that this is a request that gets into other issues. I’ve had to constantly dump the data out of iBank and into Excel for more than ten years to be able to forecast cash flow and report on Budget vs Actual vs Forecast. Of course, the problem we face in iBank/Banktivity is the missing ability for variable-month budgeting. The goal is to be able to create a month-by-month baseline budget at the start of a year for the coming year. Then, as the year progresses, the ability to report actual vs budget for any single month and also year-to-date. And then be able to report budget vs forecast, where the forecast report uses actuals for the past and the budget for the future. And there should also be an evergreen budget which is an adjusted budget. This lets you make modifications to expense categories that will bring your yearly total back to the original annual budget by changing the monthly budget amounts for the rest of the year.

I posted these ideas a long time ago back in the iBank forum when we were waiting for iBank 3, I think.

I’m looking for this functionality too. One example in the envelope budgeting webinar shows putting $500 into an envelope for a December vacation. Just because cash is available right now doesn’t mean you have an extra $1000 to spend in December. To know if you do you need to see how that $1000 impacts your cash flow throughout the year and even into the following January.

I have been using iBank and now Banktivity for many years. I decided to shut down my PC world entirely and so walked away from Quicken. So far I’ve been relatively happy with that decision. Clearly, you’ve been paying attention to the reporting challenges we users have with Banktivity and I look forward to your updates.

One report that I don’t see mentioned is a basic investment report that everyone needs at one time or the other. This is the REALIZED GAINS/LOSSES report. Yes, you can go to the Investment Overview report, go down one level and pick off the gains and losses manually, but when you try to do that for a security that has been owned for 5 years and you’ve been buying more along the way, thus needing cost averaging calculated, the manual job is just too onerous. That is why we use data base systems, to do that work for us.

Anyway, please put this report on your ToDo list as soon as you can. I’ve spend several hours on Chat with your support people and right now there is no such report available.

Thank you, in advance.

Banktivity is great. Reports should cover a mirror image of what one can do in Quicken. Make it a truly global product. Example, in India tax guys do not get a report from brokers about capital gains. Taxpayers have to insert data themselves in their submitted return. In Quicken, I can get a capital gain report from Investing>capital gains immediately after entering a sale transaction. Most taxpayers have an ongoing excel spreadsheet to record the data which would then be totalled and entered into the return. Indexation is involved for some gains which is done manually in excel.

These are great initiatives and addresses some of the concerns I had converting from Quicken (a few years ago now). Addressing the flexibility, particuarly grouping, tags and reporting (along with the woeful iPad sync!!) are the key things that will make this the number one app. I was looking at changing to Xero (the interface with Sharesight is excellent), but the complexity, along with the changes you are making brought me back. For now. How far away are these changes? the lack of flexibility and the number of workarounds required to address the shortfall in grouping and reporting make this pretty urgent from my perspective.

A direct interface with Sharesight would also be a BIG bonus.

Many thanks

Feature request: I have used Banktivity for several years since I gave up on Quicken. However, its investment reporting is still inferior to Quicken. No investment transactions report, no way to generate a graph of you experience with a stock you own or did own with actions marked – all standard in Quicken. And it takes forever to start up if you have scheduled transactions and they do not insert them selves automatically like In Quicken, you have to highlight the transaction and the Post it. Banktivity works but it is very frustrating for an investor. Build some decent investment analysis reports and fix scheduled transactions. Nothing in this blog that helps investors.

I am wondering if there is an update on when the new features discussed in this post are going to be released? I am a long-time Quicken Essentials users and with the latest release of Mac OS Sierra (and my now-foolish decision to upgrade last night), I am unable to load my Quicken Essentials program! That problem is compounded by the fact that as a Canadian, I am unable to upgrade to a new version of Quicken for Mac. I am, effectively, done using Quicken and need to find a replacement ASAP. I considered iBank back in 2013 when I first bought my MacBook, but decided against it when I learned it didn’t have a “tags” feature. That is a must for me, since I want to differential between income and spending amounts by family member without creating separate categories for them (i.e. like “Food – Dad”, “Food – Mom” and “Food – Kids”. With Quicken, I can have “Food” and use Tags to further segment them into Mom, Dad and Kids.

Hopefully this feature comes in soon!

Ian, thank you so much for writing these blogs. After reading this blog on the reporting functions you are working on, I could not be more excited. Thank you! I am super stoked and will continue to watch for the updates. Keep up the great work! After jumping ship from Quicken several years ago to iBank 4, I haven’t looked back. And reading actual blogs from you letting us know what your team is working on is very refreshing. Did I say I was excited?! 🙂

Please make bulk edit of payee (just like the bulk edit of categories) a top priority ASAP.

its such a simple feature, that helps making best use of reports. I Personally feel this is the feature that isn’t present in Banktivity vs Quicken.

Thank you.

Great program, I ditched Windows completely once I got this!

As a Canadian user however there are problems with the Investment Reports. I have investments in CAD and USD. The program has a good Investment Holdings report, but does not convert USD amounts into CAD amounts to generate this report. Totals in USD are simply added to totals in CAD, throwing off my investment reporting.

Love program

I had two securities that merged. Since there is no “Merge” option, I “Moved Shares” out (old security) and then “Moved Shares” in (new security). Unfortunately this did not allow capture of the original cost of the old shares, so the new security has a zero cost basis in the “Portfolio” view. Is there a better “fix” for merger of securities, other than actually selling the old and purchasing the new, based on the original cost (which then throws off the cash balance)? Thanks!!

I have the same issue. In the past various securities (for example, University of California funds) did not have symbols so the share prices could not be downloaded. I had to hand enter them. Now they do and can be downloaded. The first time one came in it created a different fund with the symbol. I can move shares as well but the cost basis is messed up as noted above, and you can’t delete the old fund because there are transactions in them, and the history of the share prices is lost. It is really important to be able to merge securities, with a warning, if you like, to ask the user if they truly are the same security and that share prices will merge.

In regards to the screenshot of the report above – to make this report complete, it would be great to have a third column with a difference between those two period (in $ value switchable to % difference). And in respect to the spending categories, ability to create groups and subtotals (for example by drag and drop category on each other) would create also added value to the overal report. Thanks a lot

I am a user from Europe. I have income and expenses in both USD and EUR.

Currently, when I look at reports from the past, they will convert it to the USD or EUR with todays rate? There should be option to see expenses made with either todays rate or the rate of that time.

So, for example, if i spent a 1000 euros 2 years ago, that would be 1300 USD. Today it is 1100 or so. There should be a button to switch between the 2!

For my purposes the biggest feature in reporting that I would like to see is to create reports based on a search criteria that includes notes and comments. Post travel reports, in particular, work best for me if I can look at all transactions with a note about that travel. It doesn’t always help to use just my Travel categories since some travel expenditures often overlap dates and categories for different trips.

I think you’ll really enjoy our new tag feature as well. But even if we didn’t have tags, you can create a report based on a transaction’s note.

Ian,

I must be blind, but am not seeing how to do the report on the note section. Can you elaborate?

When will the update with tags be released?

Really! I was looking for this recently and was unable to figure out how to do it

I should have been more clear. Some of our forthcoming reports allow you to report on the transaction note.

Would like to see flexibility on budget dates. My husbands check goes in the bank on the 28th of the month but is for the following month. If I change the date on the downloaded transaction to the first so the income will be included in my budget, then my balance is messed up and doesn’t match the bank. I need to be able to do a budge from the 28th of the month to the 28th of the next month. Anybody have any suggestions?

Yes! Please do this.

This blog entry was written in April 2016 and speaks to the inclusion of classes/tags capabilities, which IS in fact the only reason I can’t use your product. When will this be available in a production product? As you noted, people have been asking for this for many many years and versions. I fear Q for Mac may catch up with you before this is real!

Please please ensure colours assigned to a category work in your next update? When colors are chosen and saved at present, no change is shown. I really miss this feature – easily recognising alike transactions.

I have been Quicken 2005 since 2004 when first available. It is today not supported.

Will you support Banktivity into the future? If so, for how long if you know.

I am weakening toward Banktivity because you do have support now, but I dread

download/uploading.

We’ve been developing financial software for over 12 years. We don’t plan on going anywhere. Downloading and updating isn’t too bad. If you go to our support, they can help you: http://www.iggsoftware.com/support

Replying to earlier comments about Yahoo’s price data. I have read that Yahoo has discontinued access to historical prices via its API. Link here: https://forums.yahoo.net/t5/Yahoo-Finance-help/Is-Yahoo-Finance-API-broken/m-p/250503#U250503

Not sure what the alternatives are. I trust Ian and his team are investigating.