The New Banktivity went live a little more than a month ago and we’ve already released five updates on Mac and iOS. (Including over 40 different enhancements and bug fixes combined.)

Banktivity is fully compatible with Big Sur, runs native on M1 Macs, and is blazing fast on them. If are you lucky enough to get your hands on a new Apple Silicon Mac, let us know what you think!

Last week we also started supporting downloading of stock quotes (end of day and historical prices) from the Australia, Brazil and Swiss stock exchanges. We are focused on adding more stock exchanges before the end of year.

What’s in Development

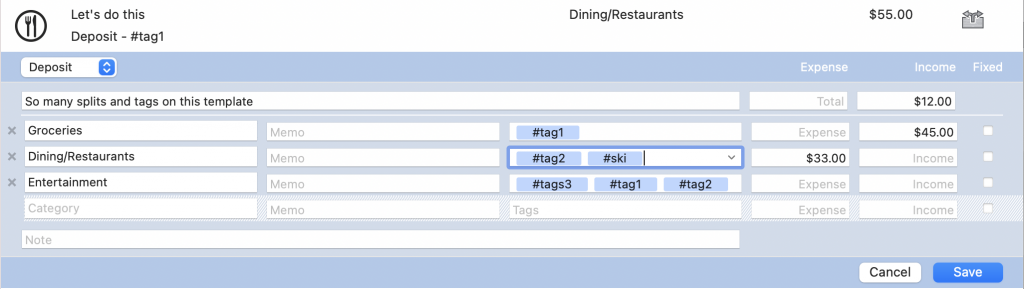

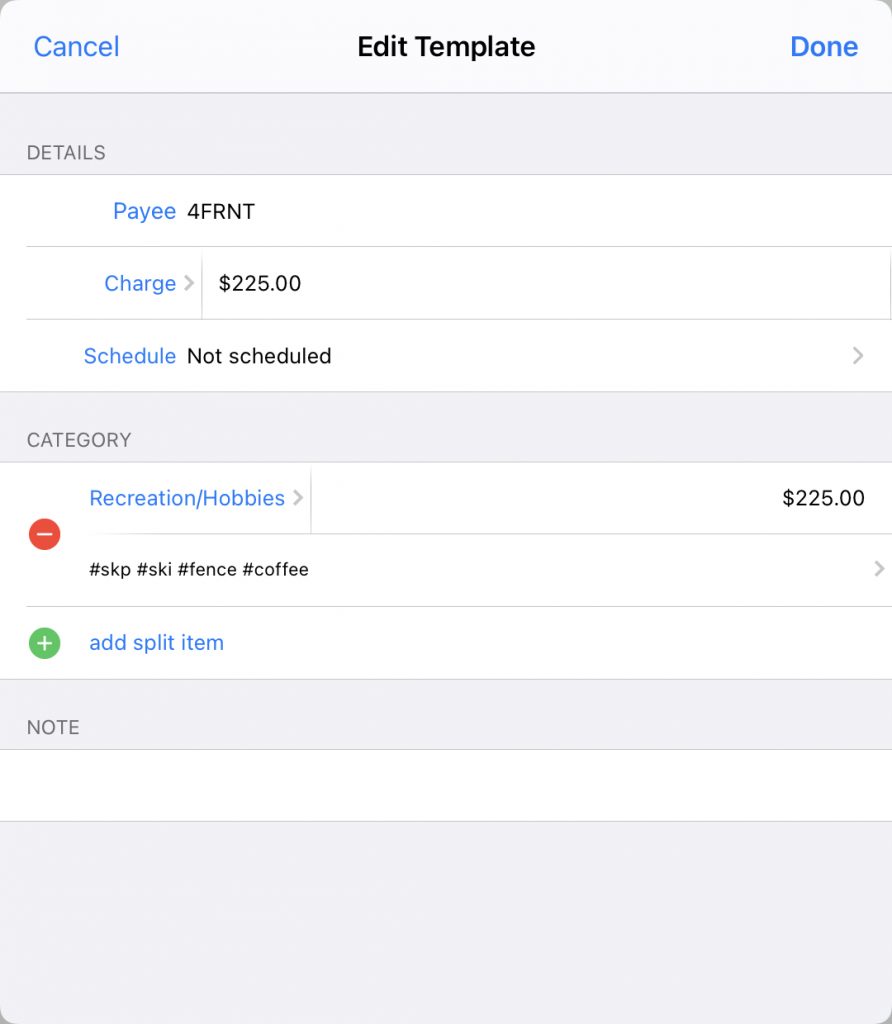

On the Mac we are working on implementing one of the most requested features: tag support for scheduled transactions and templates! We will be bringing this functionality to both Mac and iOS. Support for this new feature will be rolled out in Banktivity 8.1.

Here’s a screenshot showing how tags now appear in the template transaction editor:

We are also doing a little house keeping with the Mac printing codebase. In Banktivity 8.1 you’ll notice significantly faster printing and that several bugs have been fixed.

In iOS the scheduled transactions and template management screens are getting a bit of a makeover. Specifically, we want to make it easier to find and create scheduled transactions and manage all of your existing templates. iOS will also see the return of the “match” feature when posting scheduled transactions. We really wanted to bring this to the Mac, but we want to follow our mantra, more frequent incremental releases. (For those wondering, the Mac codebase for skipping and posting scheduled transactions is significantly different than what we are doing on iOS. In some ways it’s better and in some ways it’s worse, regardless, implementing this feature on Mac will take additional work.)

Our iOS apps will also get “tap to edit.” The swipe to edit transactions will remain an option, but you’ll also just be able to simply tap a transaction to bring up a transaction summary and then drop into edit mode if you want.

Conclusions

We are really happy with and proud of the new Banktivity and the continuous improvements we’re making. Banktivity will continue to evolve and you’ll have instant access as it does.

While I can’t promise an exact release date for Banktivity 8.1 yet, our goal is to get it out before the end of the year. To be fully transparent, this is a goal, but with software development shipping dates can get delayed.

I’m really looking forward to getting 8.1 in your hands. Thanks for your continued support!

- Continuing Investments in Direct Access - February 26, 2024

- Banktivity 9: The Little Changes - September 8, 2023

- Retiring services for older versions of Banktivity - August 11, 2023

Just upgraded my Mac (Catalina) to version 8 from 7 and still in free trial but note that the option to provide feedback is missing on the main menu. I had two points to mention. I cannot find a PDF user guide for version 8 – I do understand that with more frequent updates keeping such a document up to date is challenging. However, Mac Help always keeps the help screen on top of the Banktivity window and cannot be moved aside to observe or try out what is learned from the help file. If you close Help to do that you have to search again for what you were looking at. Also, the little green circles showing new download entries for an account – difficult to see the count, and that becomes even more difficult once the account is selected and background color changes.

Been running V8 under Big Sur for 3-4 weeks now and I am very satisfied with how the product looks and feels. The sidebar totals has been a very useful update for me (ie i prefer Cleared Total so it matches my Bank) and this announcement about scheduled tags really is the cherry on top.

I would love to see a transaction DUPLICATE in context so we can easily duplicate transactions within the register. I find myself using cut/paste way too much. It would be more value than the new DELETE in context.

I just installed the V8 on my new M1 Mac. The look is good however the “retire” goal is not working properly. I spoke to the customer service team and I was told that it’s a known issue. I was advised to delete and reinstall the app however it still didn’t work.

Just wondering when this issue will be fixed?

New version looks good. Any updates on if/when you might support UK open banking? It was mentioned a few months back that your 3rd party appears to have started supporting it. With the new subscriptions its a bit of a rub that I am on the middle tier but not getting the benefit of automatic downloads.

It’s still on our roadmap, but we need to get a major update to Direct Access put in place first. Once that is done, we will start working on the Salt Edge integration. I don’t want to keep you all hanging, it won’t be soon, but it is our plan. I know this isn’t the best news, just trying to be transparent.

Ian I appreciate your honesty on the timing of the salt edge integration for eu customers. I just want to let you know there are lots of us eagerly waiting for this!

Salt Edge is an excellent choice – it works in many countries and with many banks.

Any update on the services roadmap, especially for UK/EU customers?

In the meantime, v8 is still way too expensive for the “services” offered in this part of the world, unfortunately.

Any news or timescales on the reintroduction of direct access for uk customers?

Agree with Direct Access in the UK, subscription is still the same price without all the functionality

Hope that 8.1 has a fix for creating statement / reconcillistion

Please can you bring live (or near live) quotes back? EOD is not good enough for my purposes so will have to look elsewhere if this is not planned. Both Euronext and LSE (the exchanges I use) have free APIs so why can’t you use them?

Frustrated also by lack of DA for EU/UK. At the moment upgrading to B8 makes no sense for me.

I haven’t seen any options for free APIs to Euronext or LSE for a commercial app like ours.

I don’t mind paying $100 per year for live (or near live) quotes from LSE and Euronext – so please look at paid APIs if that is all that is available. I’m definitely not going to subscribe to B8 in its current form with one patchy EOD quotes and no support for mutual funds.

I still don’t understand why you dropped Yahoo when all your rivals (Moneywiz, SEE Finance, Moneydance, Quicken) are still using their API. I suspect it is a different API to what you formerly used, because the data is more reliable than the data you used to get from Yahoo (the prices don’t flip between pounds and pence). Anyway I will have to reluctantly move to one of them if you can’t fix this – the data from IEX is abysmal even when it works – and it is not working for LSE at all at the moment,

Please try to work on reporting too. More customization to expense reports would be nice. Reports on iOS would be appreciated as well.

I’ve looked at tags a few times but concluded that not having tags persist in scheduled transactions made them unusable. So it’s great to learn that this feature will be in 8.1. Would be good to understand how blog contributors might plan to use tags in future? How have users got value from tags?

My most wanted feature for Banktivity is account groups available on Mac to be mirrored on iOS. For example, I have a variety of discrete investment accounts that I group on my Mac to easily and simply state my total investment.. These account groups don’t appear to be available on iOS.

I use tags to flag tax deductible items at different tiers eg TAX100 TAX 50 Tax25 being % deductibility. Also use tags to identify car costs using the number plates as tags. Have also used tags for holidays to identify how much each has cost me over time. Hope that helps.

Great work, looking forward to the updates.

Have you made any progress on users suggesting new features, voting on new features, etc.?

Best place is to use this form for now: https://www.iggsoftware.com/contact_support.php

Is it possible to have an account type set as “current account” as in the uk and most eu countries this is the main account that we all use?

You’ll want to use “Checking”. Although I understand that this type of account doesn’t really exist in the UK. That being said, it should work behind the scenes like you want it to.

Now that Apple allow in app purchases to be shared between family members, is this an option that’s enabled in Banktivity? I still believe having to be gold just to use multiple currencies is excessively expensive. That’s the ONLY feature I use from gold, other than that, I could be an even lower tier than the basic one. But being able to share it with my sister could make us go for it.

So I’m guessing the answer is no

Please can you provide a new subscription tier more suited to us European users? I understand that currency data is expensive for you and I would pay for that. But it is not correct to leave us with the only option to pay the Gold tier price when we don’t get Direct Access nor live stock price data, nor mutual fund prices. If you were to add a “Blue” tier that included multi-currency accounts and currency updates then I suspect that you would be able to retain a lot of your European customers like me who are currently actively researching alternative software. If later you do sort out PSD2/Open-banking support and find a way to add live stock quotes and mutual fund prices for European markets then we would at least still be part of your client-base and could be tempted to upgrade to Gold tier later. But given how difficult and time consuming it is to transition to other software, once we have made the move most of us won’t come back.

I have had an open ticket for close to a month that has not gone anywhere. I have attempted to reach out to you on Twitter but have been ignored. I have been a customer for many years. The latest version of the Mac software has broken direct access from American Express. My emails re the ticket are all the same – we know nothing and we will get back to you. The is very frustrating. Can anyone look into this?

@ian any update? This is quite frustrating

Usually if a big financial institution is broken for this long it is because they are blocking the IP addresses of our backend provider. I’ll reach out to you privately and verify this is actually the case.

Thank you

Any updates?

I believe you are communicating directly with our tech support manager. That is a better channel for communicating about these types of issues.

Ian. This issue is open for 5!weeks. The tech sending me emails says someone is looking at it but nothing changes. Can someone please work this as it is very broken.

Thanks

I have savings and checking accounts. At times I make transfers between the accounts and I attach a TAG to each transaction. When I run a TAG REPORT those TAGS that are attached to a TRANSFER Transaction do not appear in the report. Am I missing something that would allow these TRANSFER TAGS to appear, or, is it a feature that is not available.

Thank you

Steve,

You are spot on in your observation, my view is that a TAG is a TAG regardless of the transaction type and should be included in these reports.

Same ‘logic’ when you report on ‘uncleared transactions’, if you pay your credit card (a transfer) your bank will clear the debit but the credit to the credit card will occur days later. This would not show in an uncleared report unless you exclude the first account (where the funds come from)

I would like to see this resolved or added as a preference.

This is an issue for me as well. For example, our son has just started college so we’ve started using his 529 account. We usually make purchases using a credit card and then reimburse the expense from the 529. The tagged purchases show up in the default reports, but not tagged transfers out of the 529. The only way to get a listing is to select a transaction and do a “Report On”. These transactions are tax exempt, but may need to be documented at some point. Our son also has a scholarship, so we’re allowed to withdrawal that amount penalty free, but there is capital gains taxation on a portion of the distribution. It would be great to easily report on these transactions! How about the ability to tag any/all transactions?

Hi Lance, it sounds like you just need to configure the report to either include or exclude the 529 account depending on which questions are you trying to answer. For example, if you want to see contributions to the 529 from a checking, you’d report on the Checking, but exclude the 529.

Ian,

Happy New Year and thanks for your response. As you suggested, if I exclude the 529 account in the “Tag Spending Report” then I see the tagged transactions. They don’t show up under “Tag Summary” on the main Summary page though. How do I fix that?

“Improvements to category autofill”

This is not an improvement, it is a major screw up. Every rule I have is being ignored and your categories are replacing mine. Even after turning off this feature (it should not have been automatically turned on, let the users decide, not after the fact) you are not applying the categories that appear in my Import Rules. Now support tells me I have to delete or edit every single rule in the hopes that doing so will fix it. This is the worst improvement I have ever encountered, makes me want to go back to B7.

Hi Mike,

That doesn’t sound right. The only changes to category auto-fill have to do with type-ahead. You can go to Preferences > Import and turn off “use bank categories when available”

I did that, after fixing over 200 entries because it was turned on as the default, bad practice. I can send you examples, but it is still doing it with the switch turned off. The example I gave the tech was a local grocery store that is being flagged as Travel. Arby’s that is being flagged as Uncategorized. I fix some as they come in, but it’s a real pain, and having to delete all of my rules and re-enter them is going to be a pain becuase many are specialized because the defaults don’t always work.

Mike I had a serious problem that sounds very similar or identical to yours, with a prolonged exchange with Support that led nowhere. No import categorisation has worked for me for several months (since Direct Access went down, but that’s another story). Having a software development background with support experience led me to the conclusion that our friends at banktivity have a significant undiagnosed bug here. I have not (yet) seen it admitted and thus (coupled with the uk Direct Access issue and others) is a strong push to drop them and go elsewhere unless fixed quickly.

I haven’t tried the manual imports, these are my daily’s from American Express.

In addition, if it helps, B8 seems to be copying what you populate in the Payee field into the Note field as well.

If this behaviour is new to version 8, this may be related to their problem with record matching on import (see my separate reply) or an attempt to fix it: in my own inconclusive exchange with sSupport a while back (v7), there was something about which field (payee or notes) was being picked up, or missed, so there may be some logic in now duplicating it by default. Only a guess, though, please note!

I’m very happy with the changes made to Banktivity and its performance under macOS Big Sur. It’s noticeably faster on the 2020 Mac Air M1 than on my 2019 Mac Pro Intel from work.

One change I’d like to see, or if it’s already possible to do, explained is how to create a separate Asset Class for precious metals. Currently, they’re under “Investments” but would like to separate them in the same manner as “Real Estate”. Is this possible or in the works?

+1 for that idea on Precious Metals Class.

I would think the best solution to this is (by far) is to simply make the classification categories/lists for each security also editable (just like expense/income categories are editable). Then Banktivity wouldn’t have to go through the enormous complexity of finding ways to categorize these things for us, and it would adapt however users would like.

Import rules for Investment transactions! When is this coming? I have been waiting since the iBank days. I have stayed a loyal customer for going on 10 years. My hands are getting tired of manually entering dividend and capital gains categories for my 20+ investment accounts. Please make this feature happen in 2021 ASAP!

The new share price feed is working well (as I don’t need intra-day updates) and I am seeing accurate pricing for London listed Venture Capital Trusts which Yahoo had great problems with. However, there is an urgent need to sort out the historic share price data. It seems that Banktivity can hold multiple prices for a single day. Due to problems with the historic Yahoo feed, I have some data points in pence (GBX) and some in pounds (GBP) on the same day. The GBX prices have been interpreted as GBP, thus multiplying the share price by 100. Sometimes you have to delete the incorrect data points four or five times before you can put in the correct price! It would be so simple to fix this by just holding one price per day. The share price editing features on the Securities page haven’t been touched for 10 years, despite many requests, and it’s almost impossible to get rid of these historic price problems.

None of my London shares or ETFs have updated since Monday 4th. I think you need to address the problems with IEX if you want non-US users like me to pay you a subscription. My B8 trial has run out now and I didn’t sign up because of poor stock downloads data. I am back to B7 now and will continue to use that until you pull the plug, then will go to SEE Finance which still has live LSE share prices.

Something doesn’t seem right with this. We’ve made several changes recently to make getting security prices from the LSE more consistent. Can you give us a symbol that isn’t working for you? Also, I assume you are on v8?

No I am not on v8, My trial expired and I didn’t subscribe because the IEX quotes were so bad, and Direct Access does not work in Europe. I have reverted to v7. I have eight ETFs that are not updating on v7 – here’s a couple IUKD.L IUSA.L. I have also tried IUKD-LN and IUSA-LN.

I would like to subscribe to v8 at Gold level – but only if the online services are improved for European users. If I am paying a subscription I expect access to stock data from a premium API for stock downloads (like Alpha Vantage) – not just day-old prices from IEX which costs IGG nothing…

Ian, you’ve gracefully acknowledged the frustration of UK users about Direct Access, and your Support representative has been brilliant on the subject by email, but I just want to add my voice to those who have already complained on this thread that we cannot use it.

Meanwhile you really must acknowledge this big limitation in your subscription model. You also MUST stop misleading your uk (eu?) market by failing to admit it the limitation on your web site – I can still not see even a low-prominence disclaimer, even if only “coming soon to the UK” or some such.

I really like banktivity and don’t want to move but I’m going to have to, I fear….

Thanks for reading/listening,

Nick

Here in UK we have to pay £98 for Gold subscription – about $130.

In return we get no Direct Access – even though we are paying for your Saltedge Subscription which includes UK Open Banking. You have had 2-3 years to set this up – but have failed to do so. Bear in mind that once Open Banking is set up, it costs NOTHING to maintain, so even if you did finally get around to fixing Open Banking we would still be paying for Saltedge even though it costs them nothing. So we would indirectly be supporting Saltedge’s expensive screen-scraping for US customers.

In return for our $130 we also get diabolical IEX quotes – which cost you nothing. IEX update 2-3 days late for stocks and ETFs, and the prices often flip flop between pounds and pence. And we get no coverage at all for mutual funds.

You mentioned in your blog that currency exchange rates are expensive. Fair enough, I have no objection at all in paying for a good service. But even your exchange rate interface does not work well – I repeatedly have to set the GBP/EUR to “Update Automatically”, then find a few days later that it has reverted to not-updating. I have other currency pairs where I have seen this too. So even your currency service is not working properly. This was on B8 while my trial lasted.

You justified your subscription pricing in your blog primarily on the grounds that online data costs money – which is absolutely fair. And I would have no problem whatsoever paying for Gold level subscription if B8 really did offer premium online services. Indeed I would pay even more than Gold if I had really decent online banking, almost-live stock prices, mutual fund support, and reliable currency information. I fully support your business model of charging a subscription because of the costs of online connectivity. But I am not going to pay a subscription for the current poor level of connectivity.

My B8 trial has now finished so I will continue on B7 for as long as you support it, and will look out for improvements to B8 connectivity. But if you switch off B7 support before B8 has decent connectivity then I will move elsewhere.

Just want to clear a few things. First, I agree there is no fee for Open Banking, but just maintaining the servers to talk with Open Banking costs money. I also want to mention we now get all LSE quotes from EOD historical data. IEX made a big change in late November and broke a lot of LSE symbols. LSE symbols are now updated everyday at 8pm London time. Also, IEX does cost money, as does EOD Historical Data.

I respect your choice to not upgrade to v8 now.

None of my symbols on LSE are updating at all (on B7). I can get an individual symbol to download up to date if I delete all history and then download again. But then it breaks again after a few days.

Even if downloads would work, I am not really satisfied at all by end of day only prices. All your competitor developers have near live prices (as you used to when I bought B7) and so it is difficult to justify now paying a premium price for an inferior service on B8. Surely there are other options to get live prices for LSE and Euronext? My brokerages all have live prices from Euronext and LSE so these are available.

I am all for paying a subscription – but only if the online services are good value. They are not at the moment for non-US users.

As a UK B7 user, I read your comments with much interest. I, too, have trouble with the updating of LSE prices – I have to download manually each day to get them. I never had this problem on earlier BX versions – real-time updates, as well. B7, hopeless.

I take it from your comments that the new subscription service (Silver) is not downloading LSE prices, either? If so, one wonders how a Silver subscription can be marketed to LSE users.

Looks like B7 for me, at least for now.

LSE prices are being updated each day at approximately 8pm London time. There are some mutual funds which aren’t supported, but overall, coverage is quite good (we are now using EOD Historical Data as a data source.

I have just been looking at EOD website and they offer intraday prices as well as end of day prices at only a very small price difference ($10 per month). If you were to implement at least intraday prices for LSE and Euronext I would stay with Banktivity. So please please do this. You would be getting $10 per month more just from me given that UK subscription is £98 or about $130.

And are you still using IEX for Euronext? Or is that now also on EOD?

This is the EOD pricing: https://eodhistoricaldata.com

If you were to subscribe to an intraday package, then Banktivity would become very useful to investors.

Also, please remove the limit of only being allowed to download one year of historic prices. I had to delete my price history for all my stocks when you messed around with your server in order to get it working again. and i have owned many of them for well over a year. There does not seem to be any good reason to limit to one year of download.

Thankyou for your response.

It’s useful to note your advice that LSE prices are downloaded daily but in that event it does not explain my experience (LSE, FTSE100 companies), which is erratic, more often than not requiring manual intervention in the form of ‘last year’ downloads. This has been a problem ever since running B7 (on OS Catalina), following years of trouble-free experience with iBank>B6.

Could you please advise:

– If I proceed with B8 subscription (Silver), can I expect reliable daily downloads for LSE/FTSE100 securities?

– Does your reference ‘now using EOD historical data’ imply you have changed LSE securities symbols (XXXX.L), or are they unchanged? (You have changed these in the past without clear notice of doing so).

– If I trial-run your B8 subscription service, will all my data be transferred across from B7?

Thanks

R Snell

Haslemere, UK

My LSE prices don’t update till after midnight, not at 8pm. No Mutual funds update at all. Which security symbols do you use for both stocks and mutual funds in UK? Thanks

From the EOD website, I see that EOD LSE symbols have a .LSE symbol suffix, but I have been unable, so far, to get any affirmation from Mr Gillespie that Banktivity users should be using these symbols (as opposed to .L as before). It would be really nice to have this information, as symbol changes have been made in the past without notice.

Meanwhile, my B7 LSE (‘.L’) security prices are not downloading daily – I have to do it manually, using “Download prices since last year”, which is very annoying.

Mr Gillespie – your advice, please.

Our server recognizes .L .LSE and -LN and “converts” to do the right thing. Since those are coming from EOD the server will convert it to .LSE before passing it along to EOD.

Each time you see the app saying, “Updating Historical Security Prices…” in the status view in the toolbar, it will be getting LSE symbols.

It seems there is no way to use a brokerage/investment account for recording transaction on different currency. Better say: with my broker I buy stocks on Us market (USD) and on European market (euros). There is no way to record transaction on same account. And this is a big issue.

That is correct. If you have an account in currency A, you can only buy securities in that same currency.

OK, but you have no solution, neither intencion to solve the problem? You only want to please US customer? this is not nice.

The way I dealt with this is to open separate broker accounts for each currency. I use Degiro for Euro, Saxo for USD, and Hargreaves Lansdown for GBP.

New Zealand user checking in here….still patiently/hopefully waiting for stock quote availability to return (there seemed to be a positive sign in December but it was only for a day?). I’m hoping this resolves and I won’t need to explore other options – regularly updated quotes (EOD is fine for me) is a key functionality for my needs.

Ian – with the new subscription model my expectation is continuous, regular improvement of the Banktivity applications.

I don’t personally have a requirement for stock updates but I think we, outside the US, would like to understand what we can firmly expect in the next round of application updates and a more general view of what’s coming in the next 6-12 months.

On my personal wishlist for application improvements.

Number one is including all elements of the budget – included estimated categories, not just scheduled transactions – in the account forecast reports. Microsoft Money was doing this years ago; during budget creation, MM had you allocate estimated category budgets by account so these account allocations could then be used to provide more realistic account forecasts. For example, for my ‘petrol’ category I always pay with either my Amex or MasterCard so I allocate this category spend 90% to the former and 10% to the latter.

My second priority for Banktivity is account groups available on Mac to be mirrored on iOS. For example, I have a variety of discrete investment accounts that I group on my Mac to easily and simply state my total investment.. These account groups don’t appear to be available on iOS.

EOD quotes are only a little better than IEX, but still not really good enough for a premium subscription app. They quotes are still only EOD for LSE and Euronext, and no support at all for mutual funds. At least with EOD the historic data is more accurate than the old Yahoo histories for LSE.

The perfect solution would be Yahoo for live intra-day stock quotes, and mutual fund eod prices, but EOD quotes for stock history. That sort of data would be really worth a hefty subscription.

At the moment I am having to monitor my portfolio through an online portfolio aggregator – would much prefer to be paying their subscription to IGG..

I appreciate the feedback Richard and I understand getting end of day prices for LSE is not meeting your requirements. I do believe we have options for improving this, but we have some other things on our plate right now (like new Direct Access and restoring DA to the UK) that are higher priority.

Attn I Gillespie

Thankyou for your message in which you confirm LSE securities symbols which are recognised by Banktivity: .L .LSE and -LN. That’s good to know but unfortunately it does not explain why I am not getting automatic downloads for my LSE securities (XXXX.L running on B7 OS Catalina). Downloads do not happen at login, nor upon sight of the ‘Updating Historical Security Prices’ app message (updating of currencies does work, though). The only way I can get a securities prices update is by manually effecting “Download prices since last year’ – that works.

Whilst I am prepared to take your new subscription service (Silver), I will not do so unless you can deliver an automatic download service for my (LSE) securities. You will understand my reluctance to take a paid service which delivers less than that received over several years of successful usage of iBank>B6.

I understand that EOD does have a lot of the UK mutual funds under the exchange “.EUFUND” – is this element of EOD supported under B8?

And if not, could you consider adding this element to your arrangement with EOD? A lot of UK uses have mutual funds and being able to get updated prices automatically would be amazing.

Many thanks

We are working on supporting .EUFUND suffixes.

Please can you give us a heads up on what symbols we need to use for non US exchanges?

I paid for Gold subscription but as yet I still do not have any updates for my UK and French mutual funds. Do I just use the ISIN? Or do I need to add a suffix? If so what?

I know you are not supporting near live non-US stocks but I believe that you are supporting non-US mutual funds, but for the moment none of mine are updating.

It would be useful if you could set out clearly exactly which price updates/exchanges are included in Gold subscription for non-US users, and exactly which symbols and suffices we need to use.

I was a Banktivity user back when it was iBank5. It’s grown up a lot since then! Congrats! Unfortunately, the one issue that drove me away years ago is still there. I think it’s a simple fix. I’d like a global setting to disable automatic updates to templates.

For example, I have a template for the local hardware store. Most of the time transactions there should be categorized as “Household” but every once in a while it should be categorized as “Gift”. Changing the category that one time should NOT change the template. Once a template is created, it should be a deliberate action to change it — or at least a global option to make it a deliberate action.

I think all it takes is a boolean preference: Automatically update templates? Toggled one way, do the current behaviour. Toggled the other way, skip the automatic template updating logic.

Thanks for the feedback, we will certainly consider adding this!

I have very strong reasons to not update my MacOs beyond Mojave. So . . . I’m screwed as far as Banktivity upgrades go?