The first part of our hidden gems series covered how to quickly sum up selected transactions, using option-click to expand/collapse nested categories and our new transaction editor. This post will pick up where the original left off and we’ll cover three more hidden gems, numbers 4-6.

For those new to us, our new version of Banktivity is a powerhouse update that brings big new features like workspaces, find, portfolio and quick reports. But, we added over 100 improvements and enhancements. And this short series of blog posts are dedicated to covering those often overlooked, but still awesome features. So without further ado, here are another three “hidden gems” in Banktivity 6.

Hidden Gem #4 – The Emerald

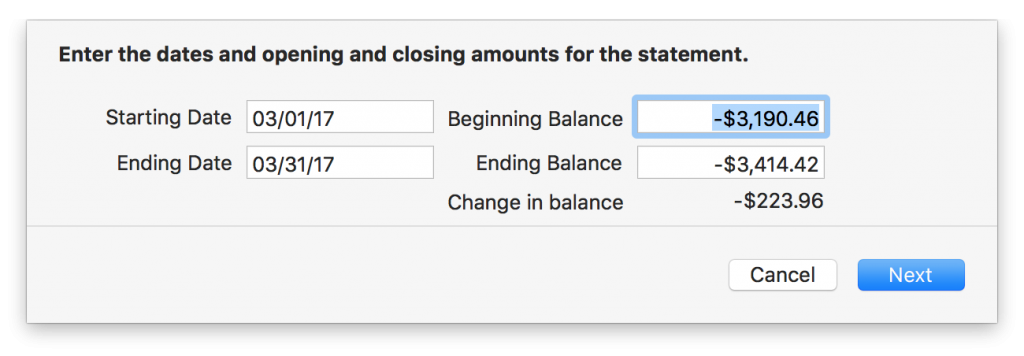

We completely redid how transactions are reconciled with statements and we changed the way statements are displayed. To get started click the “RECONCILE” button when viewing an account and then enter the start/end dates and beginning and ending balances in the sheet that comes down.

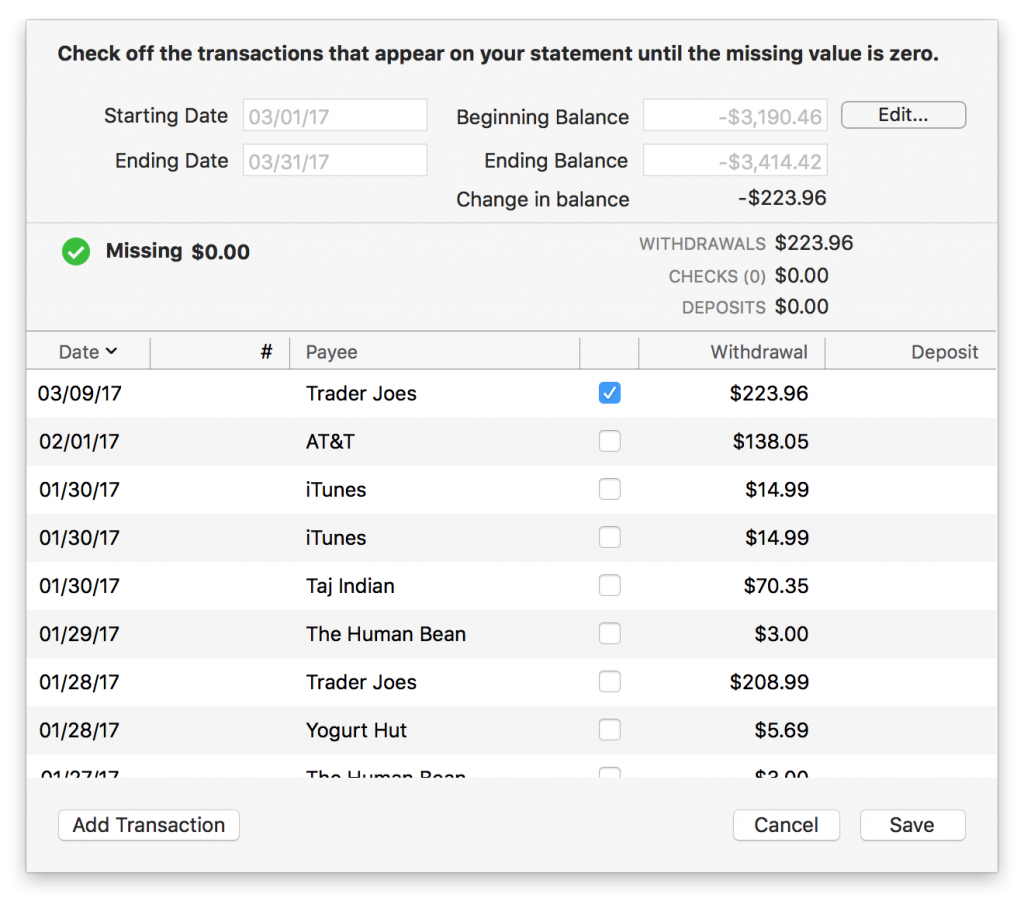

After you make any necessary adjustments , click Next to get to the screen to check-off the transactions that should be on the statement. If you need to batch change multiple transactions, select them and choose Transaction > Mark Reconciled/Unreconciled (this menu item is also accessible via the right-click contextual menu).

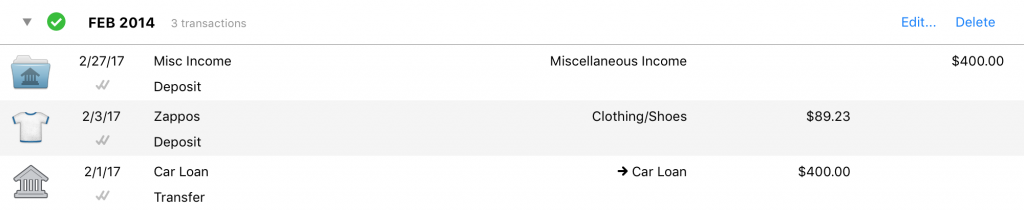

Last, but certainly not least, once your document has statements, they appear as rows with a disclosure button. If you expand the statement, you see the transactions that are in that statement.

This is showing one statement with three transactions in it.

Hidden Gem #5 – The Amethyst

We have always shipped Banktivity with a set of high quality category images. The problem was, these were never accessible to the customer aside from being the default for the standard category set. Now in Banktivity 6 you can customize your category images from a high quality set of default images. Of course, you can use your own custom image as well. To use your own image, just drag and drop or paste it into the image well in the edit category sheet. This new image picker popover is available when you go to edit a category.

To see, edit and manage all of your categories go to View > Go To > Categories (or click Settings > Categories at the bottom of the sidebar).

Hidden Gem #6 – The Topaz

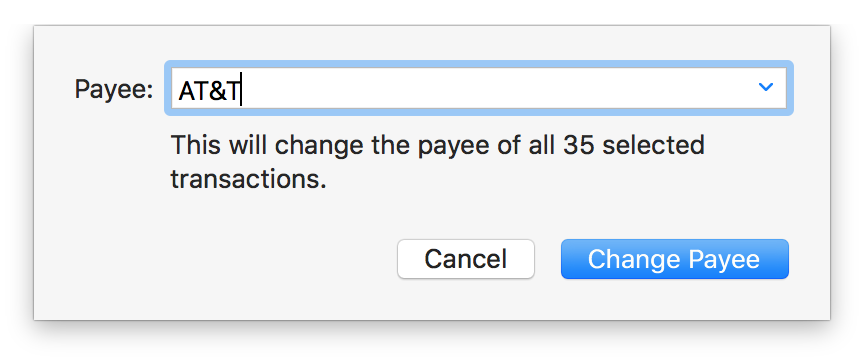

It goes something like this. You get started with Banktivity and over the course of using it for a year (or 10!) you have a payee, say “ATT.” This is the company that you pay for your iPhone. You aren’t sure why it is ATT, I mean shouldn’t it be AT&T? Anyway, you tired of looking at those three big letters without a proper ampersand. But you realize if you change it from now going forward, if you run a payee report it will report on both payees…grrrr! Even if you don’t run a payee report, there is some OCD part in you that wants the payee to be consistent. So in the past to fix this, you’d have to change each one by hand. Well not any more!

In Banktivity 6 we introduced a new command under the Transaction menu, “Change Payee…” How it works is simple, select the payees you want to change (pro-tip, use the filter box to narrow down your results to select what you want) and choose Transaction > Change Payee…

I hope you have enjoyed this hidden gems series. Have you discovered a gem we haven’t covered yet? Let us know in the comments.

Until next time,

-Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

I wish the reconciliation statement had a summary line as it did in V5, going into EDIT to see this data does not seem right.

What specifically do you want in the summary?

Opening Balance + Total Credits – Total Debits = Closing Balance

“Hidden” being the operative word here when we are talking about statement reconciliation, for a number of reasons (in addition to the point Mario made above about summary figures)

:

1) the pop-over reconcile box is TINY. Why? How about using up all that screen real estate to provide some more information?

2) The list of transactions tells only part of the story as you can’t see as much info as you can in the account register. Before (version 5) it was all done in the register and you had the benefit of seeing all the details you might need to differentiate one transaction from another to ensure you’re marking off the right one. Not any more. Hidden from view for some reason I can’t fathom are: category, note, memo and transaction type. This is a retrograde step in both design and functionality from the previous version of Banktivity in my experience. As you said above: “Grrrr!”.

I agree. Especially when it comes to reconciling my checking account where there are so many entries to reconcile. When reconciliation was done as part of the register, you could search (thereby filter) specific amounts to easily find an entry. Or, search for a payee and easily find a miss-typed amount. I found reconciliation went much faster by using this method.

Also, albeit a minor cosmetic point on reconciliations.

I would prefer to see a double GREEN tick for a reconciled item rather than the dimmed double tick which is almost unnoticeable. I loved the way a reconciled item showed up in B5 (balance icon), you could not miss it.

I concur with the above comments by Steve; to date I have not had a reconciliation where I have had to mine thru similar txns to get the right one. The new system makes this more difficult.

I really want an option to use COLOR TEXT to highlight certain transactions in a long list!

Yes, the reconcile is a big step backward. Takes twice as,long now.

When reconciling my monthly bank statement I always have some odd transaction items left over from 2016, 2015, and 2014 (different accounts) that I have never been able to reconcile. Although my bank statement is reconciled every month, how do I “clean up” these straggling items without possibly messing up my current register/reconciled items or causing me a reconcile problem next month? I just reconciled yesterday with my bank and all is well. My OCD wants me to clean up the list and get rid of these “rogue” transactions which may have come from my original data import from Quicken a few years ago into iBank/Banktivity. Any help appreciated! Love my Banktivity 6!!

I feel your pain…. Agree

Agree with others about size of reconciliation panel and type of tick marks. I do like how you separated the completed statements summary from the reconciliation panel. Also, thank you for the gems you posted here. Didn’t know that about “changing payee” and marking multiple items when reconciling.

These “gems” are fine, but it would be nice to address the basics first. Like being able to budget different amounts month-to-month. The July vacation . . . The November property tax bill . . . MS Money had this capability 20-years ago! But, not IGG.

You can budget different amounts month-to-month. Look for the “Custom” option under the interval (e.g. weekly, monthly, etc.) popup.

I really miss the running balance that used to be on the reconciliation screen in v5. I could cross-check my Wells Fargo statements, which have an account balance for all transactions at the end of a day. For accounts that have a lot of transactions, it was a great way to continually check that your are in sync. Is it hard to add back?

One thing I’ve never found in banktivity is this. I sometimes post a transaction (payment or deposit) to the wrong account. i.e. I said a charge was made to my American Express Credit Card and I realize it should be moved to the Discover card.

I’ve never found a way to do this – and yet it seems a basic and needed function. Is it there and I’ve missed it? Or is this something that’s never been implemented.

Its so easy to choose the wrong account when you’re adding a transaction on mobile – and then when you go reconcile in the desktop version – you realize you put the transaction on the wrong credit card. Is it possible to move a transaction? If so – what am I missing?

Cut & paste is the only way to do this. I agree it would be much simpler to be able to right-click and move.

I agree – it seems there should be an option to “move to a different account”. Cut and paste is what you have to do.

I agree with this one. Would love the option to move transaction to another account. Would make it much easier.

Great idea !

You can’t do it on the desktop version, but in the mobile app you can edit the transaction and change the account its in…why this feature is not in the desktop is beyond me.

REF: Ticket @KIODR

Category Images is a good approach, but I still expect colored categories.

I expect this feature back soon in a future update.

regards

Serge Mercier

One more vote for Mario Recuero’s suggestion about the reconciliation statement matter, but I’d like to mention that I perceive Banktivity 6 a great improvement and the 6 hidden gems so far have been very good. Great job ! Keep on like this guys ! Regards.

Since, you cannot post scheduled transactions while reconciling, I am forever having to go in and out of the reconciliation sheet. Since there is no way to have scheduled transactions added automatically, reconciliation is often where they need to be added, and there is no way to do that while reconciling. The reconciliation sheet does not remember its size or sort order, so I have to change that each time I re-enter. And worse, if I accidentally click Cancel instead of Save, all my work reconciling is lost – any transactions I’ve added manually, anything I’ve ticked, all lost with one wrong click.

V6 no longer allows inclusion of “inactive'” accounts in computing net worth. Please bring back this feature.

Is it also possible to have a better way to identify and merge transfers between accounts? One way this can work well is as used in MoneyWell, which lets you have a view of ALL transactions across ALL accounts. After importing from banks etc you can very quickly spot the ones that are tr transfers, command-click to select the two, then use a keyboard shortcut to merge them into a single transfer transaction. Achieving the same outcome in Banktivity is considerably more difficult.

Thanks for considering it.

Would be nice to have the pie chart in Reports brighter, the colours are so pale it is hard to distinguish the sections, I prefer the pie chart in ‘5’

I strongly agree with Linda’s observation – it would be far preferable to use web-safe colors rather than pale pastels. I use Banktivity to present financials to an 800-member organization, and the pastel graphs generate complaints. How about user-selectable palettes?

Tiny little issue that I’d like a fix for is that the Reconcile panel doesn’t open to fill the window I have, and I always have to resize…it takes seconds, but is something I do every time.

Also, maybe a clear all / select all option for the current reconciliation period?

Otherwise, great upgrade to a great application – thanks!

Agree – ideally there’d be a way to save preferences – e.g. use all the landscape, and e.g. sort in reverse order (then matches my statement order)

I think that reconciliation is a big improvement – and I have been using iBank for years. Thanks for the tip about marking multiple transactions, and the ability to bulk change payee names is very welcome!

I’ve only started using Banktivity with version 6, and I like it a lot! Here are the few things I find myself wanting almost every time I open the app:

1. Tagged scheduled transactions. I use tagging a lot, and I’m finding that I forget that scheduled transactions don’t include tags, so a lot of transactions that I assume are getting tagged appropriately aren’t. I end up having to go back and track down things to adds the tags by hand. I know I’m probably missing some things, though, which is leading to messy data. Using scheduled transactions at this point kinds of feels like a punishment because they aren’t reliable sources of information for me.

2. Comparison category reports. I would really like to have high-level report that allows me to compare spending on on a particular category (or tag or payee) over time. For example, monthly spending on Food over the last year. It just needs to be a very simple line graph or bar graph; no need for transactions or anything. It takes way too much clicking around at this point to be able to produce aggregated historical data on categories.

3. Navigating in reports loses its place too easily. I have an income and expense report, and I’m often going back through the last few months to review some numbers. If I do anything in the report, like drill down into a particular category, that navigation respects the month and year that was I in, but navigating back up using the Back button loses my place in time. It makes the whole experience cumbersome, and can even be very confusing when trying to do some math and not realizing that I was looking at March and now suddenly I’m looking at August again.

4. Alphabetized tags. The `Add Tag` menu at this point is mostly useless because try to search through a couple hundred tags in a seemingly random order is silly.

I have been using ‘pseudo tags’ for a while in B5 , ie adding #fuel or whatever to the scheduled transaction(s).

You can then easily find these and globally tag them. A circumvention until support for tags is built into scheduled transactions.

I’d like to see the fields for Payee/Category, Withdrawal, Deposit, etc be able to be enlarged. A simple drag of the line between each column would be great. Thus, like in a word processing table, one could grab the vertical line and drag the column wider or narrower as needed. The current size of the withdrawal/deposit/balance columns are much too wide, causing the loss of info in the Payee column.

I might have overlooked this but, on scheduled transactions I need to change the account a transaction is paid from. Some months I pay out of a checking account but might need to change to a credit card. Don’t see if this can be down easily.

This has been how Banktivity has worked, at least since I started with iBank 4. The only workaround I’ve come up with is to post the transaction into the original account, and then cut it from that account and paste it to the desired account.

The info on editing payees is perfect, so thanks! My suggestion is off-topic but here goes anyway. I would like to edit the default transaction types when entering a transaction. In particular I would like to delete or change “charge” (and who charges anything these days anyway?). The reason is I would like to enter a new transaction, type a single letter, e.g. “c” and go to “check,” and not have to go to the extra step of choosing “check” rather than “charge.” “Debit” would be useful but raises the same problem with “Deposit.”

Just updated to v6.1.1 and noticed my credit card transactions are now defaulting to “charge” instead of “withdrawal”. As Greg says not sure why this was done (the version history says it was a request) because who “charges” anything these days? I’ve found the several changes to transaction type behaviour confusing and have made this field of little use anymore as they have introduced inconsistency over time:

In v5 you could suggest you own types which might have had a more relevant meaning to you; in v6 IGG removed that facility whilst leaving older transactions keep they no-longer-available type but preventing you from adding new transactions with a type to match the one you’d historically used. That wouldn’t have been so bad if there’d been a way to change the type in a bulk edit, like you now can with categories and payees, nut this isn’t an option as far as I can see. Now another change and transactions are defaulting to a different type again, so yet another opportunity for inconsistency, and no way to change the default type and still no way to change previous transactions to a common type.

Because you can’t easily have consistent transaction types across time, this begs the question what is the value of this field? It’s pretty useless!

I’d like to see consistency for transaction types between the Mac program and the iOS apps. Mainly, the very useful POS (point-of-sale) type is missing from the iOS apps.

Thank you for publishing the “hidden gems.” However, might I suggest that for future major upgrades, the “hidden gems” be compiled into, and made available as, a detailed “new features” section of the release’s complete operating manual so that they are available for users to read and familiarize themselves with prior to and during the upgrade (such as to Banktivity 7 when presumably that comes out in few years?) The hidden gems have proven very valuable but until the time some of them were published (most notably the use of the blue “splitter” selector mentioned in the last hidden gens article), I who had become familiar through years of use of Banktivity 5 was going BONKERS wondering why my split transactions were behaving so “weirdly” compared to what I was used to. Similarly, the release “pulled the rug out from under” those of us who used the previous portfolio reports (the new top-situated portfolio view does serve the purpose, but the faint small lettering is much more difficult to read in comparison to the nice bright red and green up and down percentages of the previously customizable porfolio reports).

I did figure out the ability to select and right click multiple transactions during the reconcile process, but even better would have been to keep the original option that was available in Banktivity 5 – the checkbox allowing one to “automatically select/reconcile all transactions” by default when starting a reconciliation. I can understand why we wouldn’t want to make that an unchangeable default as it would be horrific for people who don’t usually do a good job of keeping their accounts in balance as they go along – but for those of us who do, it is much easier to automatically have all transactions selected as reconciled and then if there is a discrepancy, to add or delete only the one or two oddballs transactions that for some reason didn’t make it into the cycle.

In short, big changes can have big advantages – but users need to be warned about them in advance so that they know what they are going to be in for. Banktivity 6 is a fine product once one gets to know it – but I did find it a very jarring experience when first upgrading from Banktivity 5 and suffered a lot of grief that could have been avoided had I been better informed as to what to expect.

Finally, KUDOS AND THANK YOU for finally fixing the issue with new transactions in charge accounts so that they now default to “charge” rather than “withdrawal!” Though, that too was an example of a bug that should have been quality-reviewed and squashed prior to release.

Any chance the ‘free webinars’ can be screen captured and syndicated on YouTube or similar? Your timezone isn’t great for those of us on the other side of the planet.

I like Banktivity, and recommend it to friends, but I’m not going to recommend they get out of bed at 3am to learn about it. Pity. I’m sure they’d learn a lot…

Good call ! Have the same issue !

There are free webinars?!? Yes, youtube them!

Banktivity is an indispensable app that I use daily and I’m happy to pay for. However, the comments I’ve been reading fully back my experience of dealing with IGG. It seems their “standard” customer is based out of the US so anyone dealing with foreign transactions or different time zones are second-class. I pointed out several v4 and v5 bugs, many of which were either ignored while others were just not “high priority”. In fact, I filed a bug near the end of 2016 and just got a reply asking me for more information about it last month! I provided video screen-caps but explained I’m still running v5 and asked if it had been fixed in v6. Heard nothing back.

I plan to continue supporting the developer but DirectAccess is not a useful feature to me and, as I said, I haven’t yet upgraded to v6 because I don’t want to deal with the changes to reconciliation many are complaining about and have no idea of other issues have been fixed. This just leaves me as a content (but slightly frustrated) customer using an app that I find indispensable.

I love Banktivity 6 and its new features. I am very happy to have such good financial software for our personal use and appreciate the continual improvements. Perfection is not what I am looking for only the striving for it.

I much prefer the old reconciliation. I was able to enter my ending balance and Banktivity would take a stab at reconciling for me. 99% of the time Banktivity’s automatic checking off of items as reconciled worked and I’d be done with my reconciliation in less than a minute. Now it takes effort on my part to reconcile every account. I have to manually check off items to reconcile them. I realize it will automatically mark as reconciled any items I’ve previously manually checked as cleared or any downloaded transactions, but that just makes it more confusing. I end up having to mark every transaction as unreconciled and go through my statement item by item. I mainly manually enter my transactions throughout the month…that’s how I prefer to do it. So the old smart reconcilation was awesome, This new dumb reconciliation means I have to review the statement and check off each item individually. BTW, this comment is coming to you from someone with a degree in accounting.

Completely agree with Laurie’s comments about reconciling going from smart to dumb. It was much much easier before. In the quest to simplify Banktivity some of its very useful features have been removed, making the new version far from simple in some aspects.

I just downloaded Banktivity 6 and am evaluating it to decide whether or not to upgrade from version 5. It would be VERY handy to be able to schedule a transaction by day of the week in a month, i.e., social security deposits happen on the 1st, 2nd, and 3rd Wednesdays of each month. There is no option for this as far as I can tell.

Agree 100%. Both MoneyWell and MoneyWiz has this feature, it’s such a basic

I would like a way to use bank5 reports format in Bank6 which i bought. Right now I am still using Bank5 only because of printing out the reports. I do like Bank6 otherwise and would like to use it.

Reports in v6 print as well. Can you describe what it is about v6 reports that you don’t like?

Export options – it’d be great to be able to export full data in a report into Excel (csv is OK, Excel formatted would be better), which includes all the transactions, not just the summary

Great new release overall. Really like it. Some improvements or directions that I would find worth it:

– Customize the securities’ chart (X and Y axis) to be able to customize how data are displayed over time (day, week, month, YTD…etc).

– Be able to manage several currencies in one single investment account. Right now, one investment account is linked to one currency. And if you trade in different currencies within the same account, you have to create several accounts in several currencies. For all your customers who are not US based but trade in their local currency and USD for exemple (knowing US market is the biggest for trading), that would be a big plus.

– Develop charts and analysis for trading (sectors you have invested, yield analysis, screener…

– We all want to be richer or save more or optimize more our money or eliminate debts. Are there any tools (reports, stats…etc) that could be created to motivate and reach our personnal goals. Budgeting helps in this way, but are there some other valuable things that could be done (for exemple, tools to calculate how debts could be paid faster with accelerated payments…etc). Do not have the answer, just dropping the idea.

Ben

Sure is quiet here. That can mean only one thing… ?

Great app! In many aspects similar to my old loved MS Money, still running by VMware in my Mac. I’m really thinking to buy it. Not living in USA I really appreciate the multi curreny support an also the investment account support!

I would like 1) to have the possibility to automatically update my Mutual Funds quotes expressed by ISIN ie: LU0404220724 instead of manually doing it and 2) the possibility to customize background colours.

Many compliments.

Roberto

A small suggestion: it could be nice to edit any field containing numbers with the calculator like it happens with the calendar. Also nice might be the possibility to change background colours. Many compliments for the work done!

You already can type in simple equations in these fields… and when you hit ENTER it will calculate the result. No need for a pop up calculator.

How does one UNRECONCILE a Transaction??

Right-Click Chows Mrk Uncleared (⌘’), but no UNReconcile.

The RECONCILE window does not show any reconciled transactions.

Info on the transaction shows that it’s reconciled, but no way to toggle state.

If it’s possible, it’s not obvious. Any pointers would be appreciated.

I found it:

Statements> Edit… > Select transactions and right-click Mark Unreconciled (⌘’).

More “Gems” please……. This is an excellent way to showcase Banktivity !!

Best regards !

Please, show me something new! iPad new version?!?!

I agree with the above comments in regard to reconciliation. I much prefer the method in version 5.

Can you please fix some of the bugs that have been there is the start especially the date. My computer uses the UK format and the date is in the UK format when I enter a transaction but it changes to US format when saved. There is also the use of the UK word Cheque. It was used in 5 but not in 6 . In Summary the cleared amount is not always correct

Ian the Hidden Gems are an excellent post. Concerning the Topaz, once you make a change to the payee you end up with an unused payee dangler. To keep the db clean you have to manually go to the payee db and delete the unused one, in the example you gave ATT would not be an unused payee left in the payee db. In my experience with other financial applications these unused payees tend to grow. Maybe in a future release auto delete possible or a payee use counter as a column. You can then sort on count and then delete the zero count used payee.