No preamble needed for this post: iBank 5 Public Beta is available now. If you like to use software that is beta because you want to help find those last few bugs, then please go get it now. Use it, break it — help us improve it! But please remember, this is beta software and may result in data loss or other bad stuff.

You can run iBank 5 side-by-side with iBank 4, so you can make a “soft” commitment if you want to try out the beta without jeopardizing your iBank 4 document(s). All beta feedback should be sent to ibank5beta at iggsoftware.com.

iBank 5 has been under development for over a year. We took our existing flagship product, looked at our users’ feature requests, our own strategy, and now we’re delivering a powerhouse of an update. Please read below for details on all of the major (and even some minor) changes we’ve made. This app is, of course, Mavericks ready (but 10.8 is also supported).

New iBank 5.

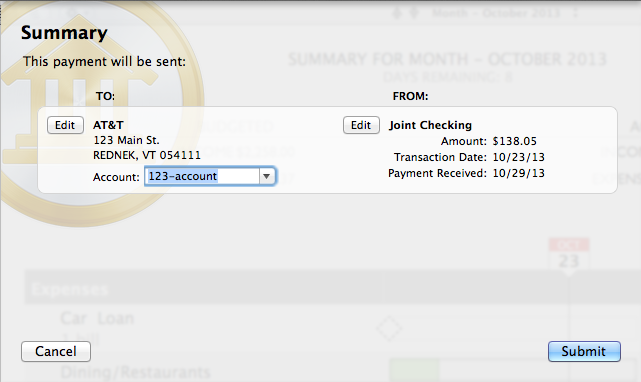

Bill Pay — This has been our number one requested feature. We’ve implemented it via the OFX protocol, so if your bank supports it, you get to use this outstanding feature. If your bank doesn’t support OFX (the standard used for direct downloads), you might want to consider switching banks.

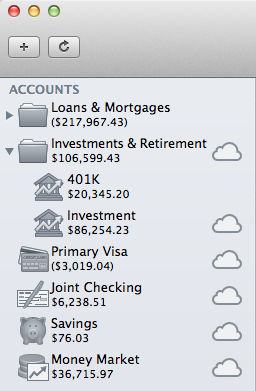

Direct Access — We’ve brought over the same great Direct Access service we introduced on iBank for iPad, allowing automatic account updates from over 10,000 financial institutions. Direct Access requires a free iBank ID plus a paid subscription to enjoy the ease and convenience of this exclusive service. However, if you already use Direct Access on the iPad, you do NOT need to pay again. You’re welcome. 🙂

Improved Syncing — When we rolled out iBank for iPad 1.0, it synced the essentials: accounts and transactions. Now with iBank 5 and iBank for iPad 2 (a free upgrade) we sync accounts, transactions, scheduled transactions and budgets. And yes, if you opt to have Direct Access (DA) set up on the Mac, you can sync that over to the iPad and get DA updating on your device.

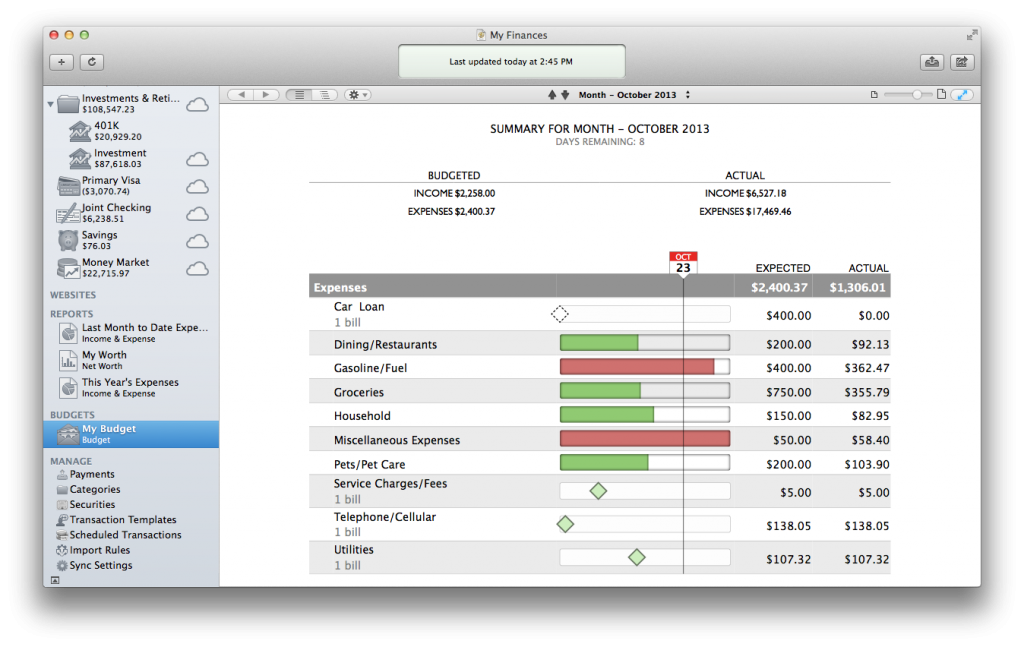

New Budgets — We completely rewrote budgets for iBank 5. We now automatically incorporate bills and track which ones have been paid. Once you tell iBank which bills you have, you can be reminded about them and check your budget to make sure you are spending what you expected.

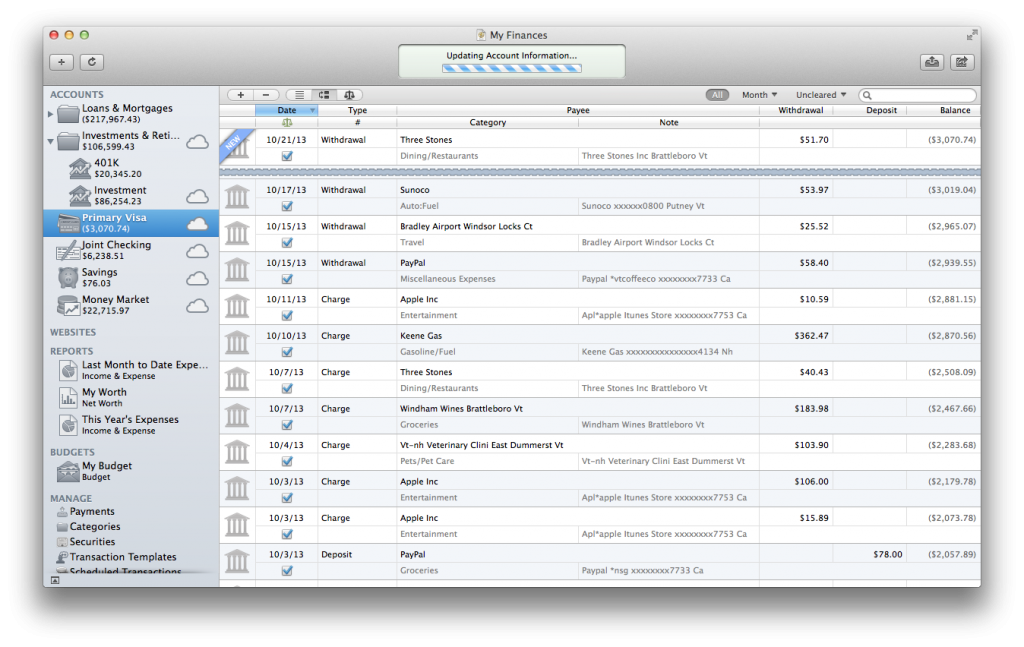

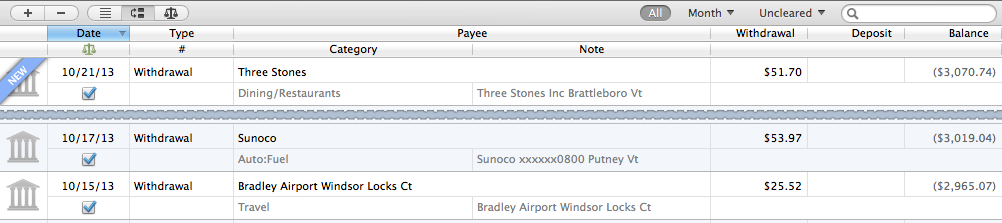

Inline Importing — In previous versions of iBank, whenever you imported transactions (whether via a direct download or a file from a bank’s website) we always showed you the Import Window. Now, imported transactions just appear inline in your register, called out as “NEW” or “MATCHED”. Our new advanced matching algorithm ensures that duplicates don’t appear.

New Import Rules — You know that transaction you downloaded into your checking account that said something like, “ATM 7/15/2013 101 MAIN ST MERCHANT?” Now, once you correct that payee to something more meaningful (say, “Sam’s Outdoor Outfitters”), the next time iBank encounters a transaction like that, it automatically applies what you entered last time — even if the next time you shop there, the date in the payee name is different. What’s more, is that we do all of this automatically. This idea was introduced in iBank 4, but we’ve dramatically improved it for iBank 5.

New Bills (Scheduled Transactions) — We don’t know of a single other program out there that can track changes made to different time periods to your bills in a budget. Why would you want to do this? Well, let’s say it’s March and you have been budgeting for an AT&T bill of $100. Then a few months go by and you add a phone line and the monthly bill goes up to $130. Then another month passes and you are curious as to how well you stuck to your budget throughout the year so far. Since we track these changes, when you look at your budget in the past, everything is still accurate; months prior to the increase are unaffected.

Update Everything — The new toolbar in iBank 5 has four buttons. One is “update everything” — which does just that: it syncs devices, updates accounts and stock quotes, and fetches Direct Access transactions if you have a subscription. (You can also have the document update automatically whenever it is opened.)

QuickLook — If you attach a document to a transaction (e.g. a PDF receipt), just press the space bar and you can “QuickLook” the attached document or file.

Improved Imports — We completely rebuilt our QIF and OFX importing engines. Switching from Quicken has never been so easy. iBank will import accounts, transactions, securities, categories and security prices. We also preserve all transfers.

Resolve View — We built this handy view so you can easily see the most important activity in an account. This view groups new, matched and uncleared transactions together so you can quickly see what has come in and what is still outstanding.

Filter Transactions — We’ve added handy buttons to filter transactions by date range or cleared status.

Bonds and Options — You can now track par value and contract size for each security. Result, much improved tracking of bonds and investments.

Categorize Investment Income — By popular demand. Enough said.

Improved Loan Support — We’ve implemented a much easier way to setup loans for accurate tracking and for incorporating them into your budget.

Modernized UI — The user interface got a refresh. The menus have changed as well, to be easier to use.

Better Direct Connect (OFX) — We completely rewrote the backend for a better, more robust service when downloading data from your financial institutions.

Add Bills to Reminders App — You can have iBank 5 automatically put your scheduled transactions (mostly, bills) into your Mac’s Reminders app.

New document architecture — More stable, plays nicer with the file system, and File > Save As… is back.

Improved multi-core support — We made some major technical changes to take advantage of multi-core processors.

There are more changes, especially under the hood, that I won’t go into here. But as I’m sure you will agree, we’ve put some excellent features and enhancements into this version. With my own personal data, I love just launching the app and having all of my accounts just update, automatically. It’s pretty awesome and works great. One of our internal beta testers has summed up iBank 5 nicely,

“I think you all have nailed it. I’ve run it for two days non stop. It updates my account info automagically, and even seems to be able to download more than I can access through a browser!

Look, this is really remarkable – I haven’t touched my accounts in 7 months, and my major accounts reconcile to the penny. “ — David D., iBank User

For those who like testing beta software, enjoy! For those who want to get started using iBank right way, purchases of version 4 made on the IGG website during the beta testing period will include a free license for upgrading to iBank 5 at your convenience. And if you’re waiting for the official release, it will be out in just few more weeks.

-Ian

@ianggillespie

- Continuing Investments in Direct Access - February 26, 2024

- Banktivity 9: The Little Changes - September 8, 2023

- Retiring services for older versions of Banktivity - August 11, 2023

I just bought iBank 4 from the MAS. Is 5.0 a free upgrade?

Exciting news, but so sad not to see a workable “Comparison Report” (i.e. compare TY with LY). I’d been hoping it would come with v5 …

Very exciting!!

I have been a satisfied European iBank user for quite some time. What is still missing, though, apparently even for Version 5 now is language support beyond English and French.

There is a large, untapped, international market out there for you – and localizations should not be that hard to implement, or are they?

Which syncing backend will the new release use? Will it use iCloud or Dropbox?

All sounds great. What is disappointing is the lack of ability to archive. My iBank is growing and I am concerned with stability and speed as it grows. Many users have been requesting an archiving solution. When will that functionality be available?

We’ve added filter buttons to show less of your transactions (e.g. only show month or year). This can help people with many, many, many years of data (like myself :-))

Will there be improvements to the reports and graphs ? The net worth graph is alternately too tiny or far too blocky.

Also, will the IRR or RoI figures be annualized so that useful comparisons betweens funds can be made ?

Adding on to what SS says, will there be any customization options on the way reports appear on screen and print such as column sizes, fonts, elements to include, exclude, etc.? Lots of people have been asking for these for years.

Does this version have the capability to have the budgets amounts in categories that are different for different months. I really need this feature.

Thanks

@aphid

Yes.

The Direct Access syncing is magic – especially for us UK’ers who never had use of the old Direct Connect (as no support from our banks) can’t believe I previously used to regular logon through bank websites and manually download. Loving it so far 🙂

Looking forward to the new version. Will this version show share balances in the security pane? I’ve always thought that would be an easy addition, and it’s a nuisance to run a report just to see the share balances. Another feature I’m hoping for soon is the ability to drag a transaction from one account to another (as opposed to cut and paste). Less important to me than the share balance, but it would still be a cool feature.

I like the import window because for my bank, Discover and AMEX accounts, the “Online balance” in the upper import window and the “Balance after import” in the bottom right corner was used to reconcile. Now it looks like I have to log on to each of those accounts online to check my balance periodically against the iBank balance (I have never balanced to a statement, just the online balance). I liked the instant reconciliation in one window because sometimes the numbers would be off and I could quickly troubleshoot. Am I missing something? Seems like a step backward.

To run 5 concurrently with 4, does the user make a copy of the 4 data file for 5 to work with or?

@Bill When you tell v5 to open your iBank 4 file, it will ask you where to save it, this will create a v5 specific file and leave your v4 file untouched.

Wow, this is a surprise… I have put my iBank use on hold for the last 18 months because I had too many issues with the reports in iBank 4, but this looks sweet. I’ll check it out.

Sorry quick (perhaps awkward) question. How will you manage upgrades? I know the Mac App Store doesn’t deal with them too well.

Syncing – What about Transaction Templates, are they synced as well between Mac and iPad?

They are synced. You will see your scheduled transactions show up as Reminders in iBank iPad. Type-ahead isn’t available (yet).

Will iBank 5 support iCloud, Dropbox, and WebDAV syncing?

Also, I use iBank for iPhone a lot when I travel. It would be great to snap photos to attach to the transaction from my phone. Same goes for fuel purchases – the ability to track gallons/price to get a fuel economy record of that vehicle would be nice.

Interesting! The only thing I care about is more flexibility and control of report generation. I don’t even see reports on the list of what’s new. Are there any new report generation features included in v5? Thanks!

I too wanted to see better reporting, mostly the ability to show trends.

What I’d like to see the most is better support for transactions in foreign currencies. In iBank 4 I have BRL and USD as possible currencies, being BRL the main one. When I select USD as the currency for a transaction, I’d expect that iBank, since I actively did that choice, would give it priority when calculating the correspondent value based on the exchenge rate. So, let’s say you enter a value of 50 USD and a exchange rate of 2. That would give the value of 100 BRL, and save the transaction. Later, when you realize that the exchange value used by your bank was actualy 2,1, I’d change it on the transaction and hope it to leave it’s value in the foreign currency, USD in the case, as 50, and calculate the new value in the main currency, BRL in the case, as 105. Istead of doing that, iBank holds the value in the main currency as 100 and recalculates the value in the foreign currency to 47,62!!! That pisses me off! I always have to re-enter the whole transaction when my credit card bill arrives…

trying out the .. ‘if you opt to have Direct Access (DA) set up on the Mac, you can sync that over to the iPad and get DA updating on your device’ – I’ve DA already working on the iPad nicely – do I have to redo all the DA connections over on the Mac before getting them to sync ?

If Ibank 5 is a beta then where does one report bugs or problems?

Barry Pearl – It says in the blog above “All beta feedback should be sent to ibank5beta at iggsoftware.com”.

Perhaps I missed something somewhere, but I don’t see how/where to report problems with the beta. So here’s something I just ran into. Using 5.0b3, I just linked to an online account and downloaded transactions. I then attempted to edit some of those transactions (deleted some old ones), and iBank popped up with:

2 validation errors have occurred:

pSources is not valid.

pSources is not valid.

That error now pops up whenever attempting to save. So I quit without saving and so I guess my changes were lost. That’s ok, I know it’s beta, but I wanted to let everyone know to be careful about editing downloaded transactions.

I’ve been an active user of iBank for several years now and just downloaded the iBank 5 beta. There are things in it which look like solid improvements, so kudos for those–I’ve not been able to find a better alternative to the software yet and I’m sure I’ll go for the full upgrade when it’s available.

That said, I can’t say how disappointed that I am that there is still no way to combine multiple accounts or smart accounts into a single, consolidated line on the Forecast report (unless I’m missing it?). At every opportunity I’ve tried to explain why this would be a useful addition and I imagine that there are other cash flow junkies that would love this feature–and since I don’t see how combining two lists of transactions into a single register would be programmatically challenging, it seems like it would be an easy addition to the report generator. But from what I can see, there are no improvements to this piece. If I could export the register for a smart report, I could graph it in Excel, but there’s no method of exporting to CSV or SQL or anything other than the standard bank formats…so I can’t do any reporting outside of the application, either.

I’m sure a lot of people are happy to use the budgeting tools more aggressively–I’ve tried many, many times and I never seem to be able to use them because I don’t live a life on a consistent schedule. Trying to budget for gas when you drive to work Monday through Friday is probably reasonable–doing so when you drive to work twenty days one month and six days the next (because I’m flying to do business elsewhere) is nearly useless. This month, I’m $400 over, next month, I’m $200 under; either way, if I have to go to work, I’m buying gas. Cash flow forecasting works better for me, but all the development seems to be on the budgeting tools…again. And there are other pieces–I run a report based on my 401k contributions to see if I’ll hit the limit for the year, since my pay can vary throughout the year. I have a smart account that has all the transactions available for the current year, and I’ve got the expected upcoming deposits in Scheduled Transactions–it would be great to have a projection through the remainder of the year, but I can’t run that report…I have to sharpen my pencil and do it the old fashioned way, which is the whole reason I use this type of software.

So, I’ll try to give the other pieces a go and hope for better forecasting for the iPad and Mac versions going forward. But, please, please, please! Tweak the forecasts and you’ve sold me forever.

OK, I am amazed at how well it imported from Quicken, first time even with multi-currency. REALLY nice job on that Ian.

How do I match a downloaded transaction with one already in the register manually? Sometimes the paycheck is off by a cent or two due to rounding, and in Quicken you can force a match and have the difference just go to unknown. It saves having to delete the downloaded one which doesn’t contain the splits.

I too am a little bummed not to see that Reports are going to be improved. Sounds like there are some good feature additions, but reports are so basic to using an app like this and they are hard to use. Quicken 2007 had a “Quick Report” feature that let me check on one category quickly. For instance, ‘how much money did a spend on pizza last month?” or last year? Boom, a report with no hassle. A graph with only the info you want. Doing so in iBank is a PITA. And you have a permanent report that you have to delete later.

I’ve been “voting” for features for years with IGG and none of my features made this release. Sort of annoying. I’m happy that is sound like the underlying, back-end stuff got better (multicore, document formate, etc), but I know the wife is still going to complain that iBank is harder to use than Quicken.

Ian, you haven’t commented on any of the syncing questions or report questions. Any comments now?

Just to make sure, it sounds like any changes/downloads/etc that we do with the beta won’t be saved to a file that can be opened by iBank 4. Correct? So if we don’t want to fully upgrade to v5, we have to have parallel efforts in v4 and v5?

Thanks.

Ibank 5 Bill Pay does not work with Wells Fargo no matter how it is set up.

@Barry Pearl

Bill Pay does not work with Wells Fargo currently. We are in the process of resolving the situation with them.

Ok Will I have to have Wells Fargo Bill Pay Service?

No, unfortunately, it is more than that. Wells Fargo Bill Pay will not work with iBank 5 right now.

With Quicken, I don’t need Wells fargo’s Bill Pay, Will Ibank 5 Bill Pay work the same as Quicken?

What about categories/tagging? I’ve been waiting and waiting to switch from Quicken, but have to have this as I use the same accounts for several freelance businesses and also personal expenses.

You can categorize to your heart’s content, including sub-categories. But we don’t allow tagging.

So far, I have not seen any info regarding entering manual transactions. I am a Quicken user. In Quicken you can (+) or (-) the date field to quickly change the transaction date or using a mouse point to the desired date in a small calendar popup. Will IBank V5 include changes such as these?

Thank you,

This has been around since iBank 4:

Use the [ and ] keys to increment and decrement a date. Press the down arrow key to pop up a calendar. You might be asking, why didn’t you use the + and – keys? Because for the amount fields you can do inline calculations. For example, you can type in 10+24.50 and you’ll get the result in the field, 34.50.

I hope this helps.

Hello Ian, can we expect any response to the questions on here regarding syncing (i.e. does it use iCloud or Dropbox, or does it still rely on WebDAV)? If you are not going to address these, please could you at least state as such, so that I and any other interested party will know that it’s not necessary to check back here.

The methods for sync, wifi and WebDAV, are the same as in previous versions. However, we now sync more data to iBank for iPad.

The sync technology we use is tried and true, but showing its age. We know users want something that is easier and more flexible…stay tuned.

VERY nice set of new upgrade functionality but I too want to again voice the need for reports to be greatly improved. Quicken still has you guys beat by a mile although I understand how you put Bill Pay up front as a more critical upgrade feature. Now that it is done, please, PLEASE give the reporting engine some love. Then you’ll blow the doors off those clowns at Intuit.

List of wishes:

– Better foreign currency support (giving preference to holding the value of the SELECTED currency when calculating each other based on exchange rate);

– Better Reports as the multiple cases stated above;

– Possibility of selecting some transactions in an account list and having its SUM (addressable if this could be done with the above point, without need of a Smart account for a simple calculation, or ti fire the calculator and do by hand)

Good to see work proceeding on iBank 5. After a year of steady enhancements of iBank 4 – I’ve almost lost count of the version 4 updates released – it’s reasonable that iBank 5 will be another evolution rather than revolution. However, I have to agree with those who express disappointment about the lack of new reporting capabilities or templates so far in 5 beta. iBank is essentially a database, and a core function and power of databases, after data storage, is to retrieve and analyze stored data in different ways.

Clearly IGG is responding to wishes of some of the iBank customer base (probably mostly newcomers to financial record-keeping who don’t actually like any of the work involved in accurate recordkeeping) in enhancing features like bill pay and financial institution downloads. But to me (a user of Macs since 1985, and traditional accounting practises longer than that) those features are mere “nice to haves” that are not high priority. Getting the iBank application to interface with financial institutions’ websites is surely inherently tricky and potentially problematic. Also, my manual entry methods give me a mechanism both for being ahead of and of checking financial institutions: relying on downloaded transactions seems far inferior. So I don’t envisage myself using those features: the only download function I use (and like) in iBank is equity prices and foreign exchange rate downloads.

A higher priority surely should be enhancing reporting and multiple criteria search functions of iBank that, frankly, look far more neglected in the product as core functions expected of databases. On this front, the only enhancement I can see in 5 beta so far is enabling categorization of investment income, which ensures at last that dividends etc can be consolidated with other income in the iBank standard report, Income & Expenses, as well as the separate Investment Summary report.

iBank sorely needs a global search and replace. One of the perennial problems of databases is the accumulation of user entry errors or inconsistencies, such as inconsistencies in payee descriptions. For this reason, global search and replace should be a basic feature in all databases. But, despite growing sophistication, polish and features, iBank still lacks this basic feature.

Naturally, iBank cannot plagiarize Quicken, Microsoft Money, or any other software. All of these wishes reflect reasonable generic expectations of personal finance accounting software and databases. iBank has reached its present high standard of reliability and features without plagiarization, and can likewise enhance reporting and search functions without infringing the intellectual property of other companies.

Like the new I Bank 5 beta. Work fine. Just wish that in the securities side that the you could choose Annuity.

Last night I downloaded Ibank 5.0 now that it has bill pay. I just read today that Ibank 5.0 bill pay does not work with Wells Fargo. Any timing on when this will be resolved?

There appears to be some syncing changes, but is there anyway to sync between computers yet? I’ve never found a great way to do that that yet, and I think IGG discourages Dropbox. Thanks.

Can we use v4 and v5 on the same iBank data file?

Glad to see iBank 5.0 has been released, but disappointed that there doesn’t appear to be a new syncing option. I see Ian says above to stay tuned in regards to sync. I’m all ears and ready to upgrade as soon as there is a modern syncing approach.

Great improvements, but where are Tags??? I have 130 business clients; I can list them as sub-categories, but I have no way of running reports to see total revenue by client, etc.

I too think everything looks great EXCEPT for one mandatory thing for me: TAGS. I am just too dependent on them as that is how I sort my expense reports. After seeing that iBank doesn’t support them, I deleted the trial version.

Stunned after all the past requests for TAGS that they have not been included in v5 – very disappointed

Just did a quick look at v5 and I would like to throw in requests for:

1) An option to turn off “Update All” at start-up. Startup is already problematic, it now takes up to 2 minutes to get a working instance of the application. A long time if I just want to enter a couple of checks. I don’t need to update my quotes and accounts every time I start up, rather I want control of that. I would also like to download quotes independently of the transaction download, but that might just be me.

2) What Sean says: Bring back the Import Window (if only as an preference). I dislike things happening behind the scenes and currently there is no way for me to see what transactions you imported without looking at each account independently. Think about the Target breach. I used to see newly imported transitions in one place and could verify them easily with a quick glance and a single button click, and if no transactions where there, all is well. Now I have to look at each account after each update to see if a new transaction “appeared”.