We’ve invested a lot of time and resources into the frameworks we will use to build the next-generation suite of our products, and iBank for iPad is the first app to utilize them. Getting iBank for iPad 1.0 released was a major milestone because it required integrating so many different new components. Now that it has shipped, we have a little breathing room and are better able to distribute our engineers to the full range of our products. We have the obligatory iBank for iPad 1.0.1 update coming in the next week or so, and later in the summer you’ll see version 1.1, which adds built-in help and numerous other performance enhancements. But what I’m here mostly to talk about is iBank for Mac 4.6. This release adds some great improvements to budgets.

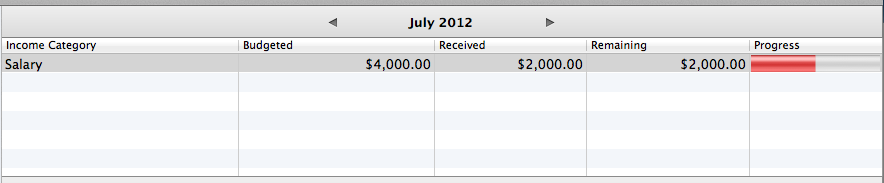

Go Forward and Backward With Budgets. New in iBank for Mac 4.6 is the ability to look at your budget for historical periods. As you can see in the screenshot below, we’ve added little arrows to look back on how well you’ve stuck to your budget over a given date range. The title, which reads “July 2012” in the screenshot, changes as needed depending on whether you are budgeting monthly, weekly, quarterly, etc.

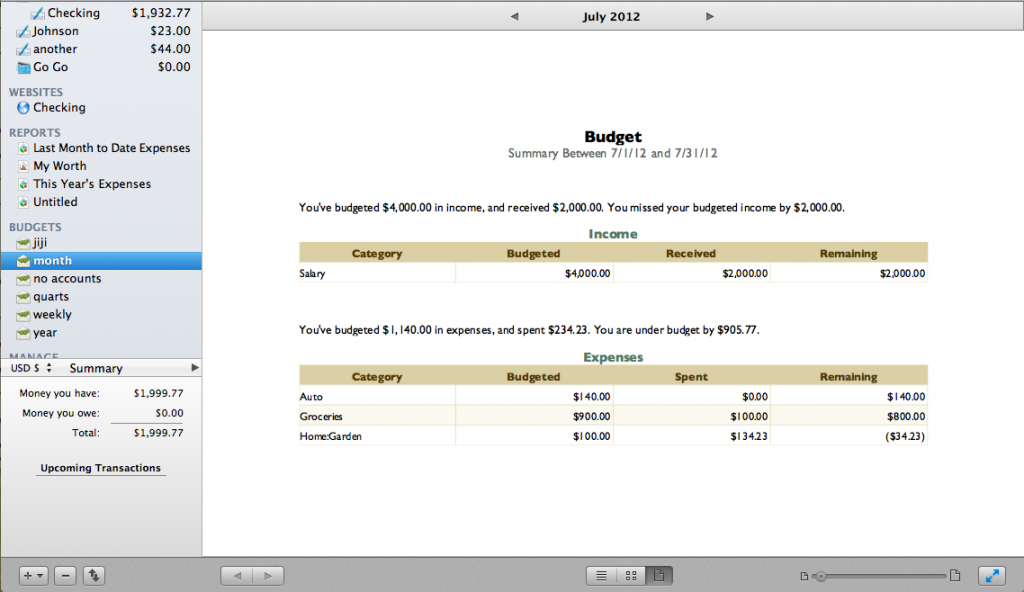

Budget Report View. One of the other big requested features for budgets has been the ability to print them. We’ve accomplished this by not just merely allowing you to print the current budget screen (which would be rife with problems of pagination and pixelation). Instead, we are introducing a “report view” that is available when viewing a budget:

A third button in the centered bottom control is where you click to see this view. When you click this button you get a full report on your budget (the exact look and feel subject to change and in fact, it probably will change) which can be multiple pages long and gives you WYSIWYG printing. Additionally, you can click on any category and drill down to see the transactions that make up the amount you spent for each category. This is a big feature for me, when I look at my budget I frequently want to see the specific transactions that are contributing to the “spent” column.

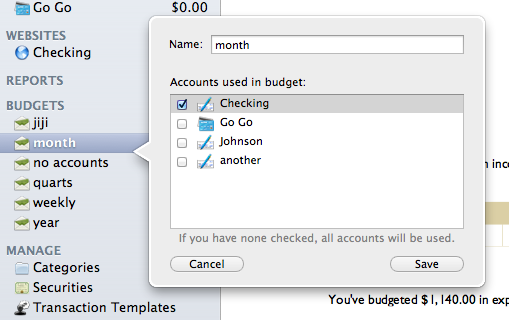

New Budget Inspector. The other big feature to budgets we’ve added is the ability to change which accounts are used via a new budget popup inspector. Prior to iBank for Mac 4.6, you could choose which accounts to use in your budget when you set it up, but you couldn’t change them ever again. This was a drag, and I apologize to those who deleted their budget just to set it up again so they could exclude or include a new account. Now, all you have to do is double-click the budget in the source list and you can pick and choose, anytime, which accounts will be used when calculating your budget.

We are fixing several bugs for iBank 4.6 as well. You can expect to see more consistent behavior with reporting on “odd date ranges” and improvements to CSV importing. We don’t have a specific release date for this new version of iBank yet, but I think around the end of this quarter is probably realistic.

Now I’m off for a much-deserved vacation. I’ll be doing some camping without any Internet access for two weeks. But don’t worry, others are still here working on squashing bugs and adding features. See you when I get back with more news and updates about what our developers are doing.

-Ian

- Continuing Investments in Direct Access - February 26, 2024

- Banktivity 9: The Little Changes - September 8, 2023

- Retiring services for older versions of Banktivity - August 11, 2023

This 4.6 update looks great. I hope you can also look into improving the handling for normal entries. The calendar pop-up e.g. is really tiny and what I’ve asked you for so time ago is that it would be great if templates could also be created and found based on the memo field. To make clear why:

If one receives funds, the payee is yourself. If you start writing your own name, iBank will find your salary or pension in the templates and nothing else. If a memo says e.g. “refund from health insurance” or “Apple dividend :-))” iBank could search for that in the templates and enter it in the transactions. This would save a lot of time and the entries would become more consistent. The templates system is great, but it practically only works for debits. Could you try to improve the handling for credits as well?

No news on Reports? IMHO this is way more important that Budgets …

@Julian B,

We have some bug fixes for reports coming. Is there something in particular you are looking for?

The key report that is missing for me is a Comparison Report, where two sets of dates can be used to compare income & expenditure etc. by Category.

I see. That won’t make it in 4.6, however, there is a workaround — make two reports with identical parameters except for the date ranges. You can right click on a report and “open in a new window” to compare them side by side.

Would be good to have the ability to hide reconciled transaction on the main screens, bac rec and import screens. After 3 years with no ability to archive it gets a bit of a pain looking through them all,

How about this long-standing bug: Select a transaction in the register (or for a real world example, modify and existing transaction). Secondary-click on a different transaction (transaction “D”). Blue focus highlight surrounds transaction “D”. Click delete in context menu. First transaction is deleted while Transaction D, the intended delete target, remains.

Is there a way to run a report from your checking account to show your checks in sequence? If not that’d be a great add to report enhancements.

@Sam, yes that is fixed in 4.6.

How bout improved check printing functionality? Marking a transaction as to be printed, and being able to batch print them? And fixing the bug where a transaction marked “withdrawal” gets a check number assigned to it.

@Ian, looks like you are squashing bugs with 4.6, great news ! Will you be fixing the smart account ‘category is not’ bug ?

See : http://qa.iggsoft.com/4181/smart-account-appears-to-be-ignoring-some-criteria

And what about the ‘uncategorized transactions not reported despite ticking “include uncategorized transactions”‘ bug ?

Thanks and keep up the bug fixing !

Sweet … thanks for the love. Will the budget have a ytd option? … that would make me so happy. Love the improvements! So excited I don’t have to redo my budget anymore to make changes!

The biggest time saver that you could make for iBank 4.6 would be able to edit memorized transactions from within the import window as they are being downloaded. While you are downloading them is the time you want to make changes how they are imported/edited/memorized. Please make this change.

I was hoping for a variety of refinements.

What about:

Improvements to investments (enter amount and number of shares–iBank should fill in share price and push that to the price history; stock lots; ability to sell “all” shares instead of having to run a report to find out how many I have in an account; handle stock splits more automatically; handle futures)

Making search global and having a “search” button so it doesn’t go off searching half-cocked before I’ve typed in my search pattern

Speed up some things–auto fill is still too slow and should be virtually instant. iBank takes too long to start up–even if it’s already active in the dock.

The improved budget features look great – has there been an enhancement made so that a parent or master category can show the totals of the subcategories? I have a quite a few categories (for example auto) and many subcategories (parking, repairs, fuel for example). I’d like the budget to be for just Auto and not having to create a budget for each individual subcategory.

I’d still like to see the cursor go to a “new” entry (and that “new entry” were always at the bottom of the page) after you save a transaction. I never feel 100% certain that my transaction has actually been saved as it remains highlighted.

Thanks!

Why is the iPad version of iBank only available in Canada or the US and not worldwide? I can find it on google, but when I try to open it in iTunes, I get an error that it’s not available in the swiss store?

Will the new budget features allow the data to be synced to iBank for iPad, as I understand that this is not currently the case.

Two years ago I began “following” iBank due to its elegant implementation of Envelope Budgeting. Unfortunately though, I do not own a Mac. So when the iPad app was announced I was extremely hopeful it would include EB, but it didn’t. I hope you are not going away from EB and that it will be included in a future update of the iPad app. That and an iPad to iPhone syncing option that doesn’t require a Mac. 🙂

Ian, this looks nice, but for the love of god, please include “select all” AND “deselect all” for both categories AND accounts. And while you’re at it, do the same for reports. Also “save as” so many budgets/reports can be replicated quickly.

I cannot tell you have frustrating it is to have to select 9 accounts individually for 5 reports that ae virutually identical every time. YTD, MTD, last month, last year for a particular category. Toggle all and untoggle all should be so simple.

I mentioned this in 4.0… 🙁

@mark

You can select/deselect all categories. For accounts, if you don’t select any accounts, they will all be included.

Ian – I appreciate the response, thanks. I have 13 accounts, but. Leave some out of sme reports for netting purposes, like mortgage and some loans. So I still have to select 7, 8 or more accounts sometimes.

Cloning reports and making minor changes to parameters would be great too.

Everything’s wonderful. I just need iCloud sync. (I’m a simple man) 🙂

I would like to second Bart’s suggestions above. Back when we had the forums, I remember making this suggestion [having iBank add the prices so we don’t need to] which was “noted and voted”. I download transactions for my 401k, but unfortunately they do not have formal Ticker Symbols. I am having to update these prices all the time and when purchasing many different funds it gets highly annoying. It also fixes issues where a future date gets entered in mistakenly throwing everything off.

billpay, billpay, billpay!

Ian – another odd bug I see is when you transfer money from a split to another account, all the items in the split are shown in the other account too.

Example – paycheck. I have Gross salary, tax, medicare etc, plus 401(k) contribution to another account. In that account, all of the splits are shown too, only reversed leaving only the 401(k) contribution balance in there. This messes up reports if I include the 401(k) account.

Great!

Any chance for improvements on import rules? A couple of specific things that would be really handy:

i) As it stands, import rules can only be based on account, type, payee, and memo. This isn’t enough to distinguish transactions if you have many dealing with the same payee, and there are multiple matches. In this case it seems that iBank autofills the info from the most recent matching transaction, or something like that. Unfortunately, this is usually wrong.

So it would be nice to have other criteria, for instance the amount of the transaction. Alternatively, if there are many matches, a warning that there are multiple matches to the rule could be shown, and the user could be offered a pop-up chooser.

ii) I’d like to have a way to toggle off the effect of import rules, so the user can recover quickly when iBank autofill guesses wrong.

About reports: it would be nice to have a way to search memo fields when preparing reports, e.g., report on all transactions when the memo fields includes certain terms.

Thanks!

Looks like you solved som e of the major itmes. I need to be able to see. (columns)[Category, Budgeted, Spent, Forecasted, Remaining]. The SPENT column should only report CLEARED transactions. The FORECASTED column (missing from your report) should report cleared transactions + scheduled transactions. Your budget report currently includes uncleared scheduled items that are in the register as already spent. That’s not right. Do you see what I mean? The same with the iBank iphone app. I need the budget to report from the 1st to the month to the 31st. I don\’t care what I spent the previous month. I want the mobile app to mirror the desktop budget report using the tweaks I suggested above. When I’m at the movies, I want to be able to pull out my iphone, launch ibank budget dashboard, look at my ‘Entertainment’ category and look at the bar to see how much I’ve spent versus how much left I have in the budget, Not including uncleared scheduled items.Keep up the good work.

iBank is coming along extremely well in my opinion. I’m very fortunate to have found it by chance while shopping around for something to replace my old Quicken app.

The improvement that I would be happiest to see would be the ability to move the divider between CATEGORY and TOTAL in the INCOME and EXPENSES by CATEGORY window shown in REPORTS. Some of us, including myself, have had to give long names to certain categories. In my case, when I submit the report to my accountant, I have to fill by hand a number of category names that have been cut off by the divider. This is a needless waste of time in my estimation. At the same time, the space in the same window allotted to totals is much larger than 99.99999% of iBank users would ever need.

I know that other users have put in the same request for the same reason. Is there any great difficulty in adding a bit more flexibility to this feature?

Best Wishes!

A very small, unimportant but I’m sure very simple addition… Pretty please… Would be folders in reports. much the same as with accounts. I have a ton of reports and have them all labelled with long explanatory labels that go on and on. I use them for performance of properties, tax reports, etc etc etc and a simple folder to tuck them all into as makes sense to me would be great!

Another thing while you’ve got the guys and girls building in new folders… Might as well include them with the budgets section as well. If there’s to be historical support for budgets then I may end up using them, and probably a whole bunch. Whether I break them down into the time frame of the budget, or the property or personal budgets or whatever… Folders would be nice!

Thanks for the great product. Looking forward to any and all improvements.

Still no news about tags feature implementation… Is there any chance to have this fundamental way to have a “parallel” categorization implemented in iBank? This would affect greatly also the reporting feature. Up to now the workaround I use (smart groups that search for keywords in transaction description) cannot be used for reports (you cannot select a smart group in the report, neither make the report searching for a keyword).

I can tell that I’m really going to enjoy the 4.6 update! I’m a recent convert from Quicken Essentials for Mac; the new functionality coming in 4.6 will help to close up a couple key voids in functionality that I noticed in converting over from Quicken. This sounds like some good stuff. Thanks and keep up the great work!

Good Day. I find iBank very convenient to use especially the iPad/Mac integration. A feature I’d like to see is the facility to import electronic bills (pdf format) and setup reminders to pay them. I am noticing an increase in the utility companies that are moving to electronic billing, so a way to store the documents, setup payment reminders and have the ability to tag the e-bills with a link to the iBank payment entry would be brilliant. Thanks much.

Thank you so much for finally bringing back historical budget views. I’ve been waiting for that since they disappeared in 4.0.

It would be great to be able to put a one time payment or one time income in budget. For example, if I want to spend 200 this month on clothes, but 400 next month, there’s no way to change the budgeted amount without changing every amount forever, past and present, unless I’m missing something…

Thanks!