It’s official, iBank Investor is now in beta testing. Long past are the days of alphas and sneaky-previews; this app is getting ready for the big time.

In my last post about iBank Investor I talked about the general workflow for adding securities and syncing with iBank. In this post I would like to talk to you about some additional features and show some polished screenshots.

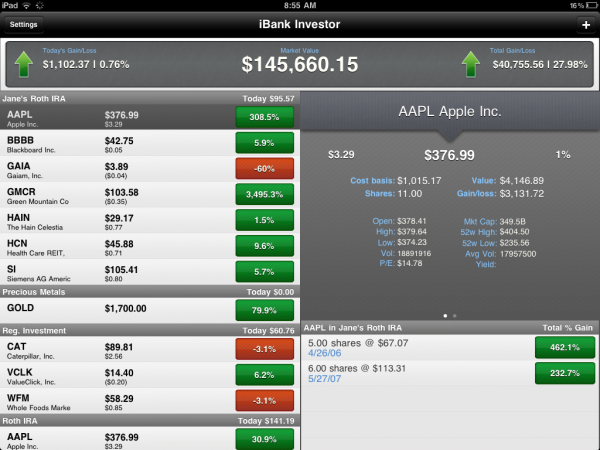

The most exciting unannounced feature is that iBank Investor is a universal app, with custom UIs specific for iPhone and iPad. This was a decision we made relatively late in the game. Since we are offering free, behind-the-scenes syncing from device to device, it makes sense to allow our users to see their data across multiple devices without having to re-enter it. For the iPad version, the entire app is navigated within one screen:

One of the unique features about iBank Investor is its ability to show you exactly where you stand on your investments down to the individual lot level. For people managing their own investments this can help them make the best decisions for each of their holdings. Additionally, for summaries at the account, security and lot level, we show four useful calculations (this is a change from what was said in the earlier blog post): today’s gain, today’s percent gain, total gain and total percent gain. Instead of cluttering the screen showing all of these calculations at the same time, you toggle between them by pressing any of the red/green button. The header above the column indicates what you are viewing.

iBank Investor on iPhone -- Tapping the green/red button toggles what calculation is shown in that column

When you are looking at an individual security you’ll notice that there is a “page view” widget. There are three possible screens you can view. The first is the security detail view which shows the price of the security, change, your cost basis, etc. The second view shows stats about the current security, like 52-week high and lows, dividend yield and open/close prices. The third screen shows a list of news headlines for the security. Tapping any of the headlines will go to that respective article in Safari. This is a nice feature for those “OMG” moments when your security takes a big move — now you can quickly see what might be the news story behind it.

I’ve also mentioned that for those who track their investments in iBank for Mac, getting your info into iBank Investor is done by using our new cloud-based sync service. We’ve added a new source list item to iBank 4 that is “Sync Settings.” This is where you will manage how iBank syncs to iBank Mobile and iBank Investor. Here is how syncing to iBank Investor works.

In iBank for Mac

1) You’ll create a free IGG Customer Account.

2) Press the sync toolbar button (or have iBank 4 sync automatically on launch and quit).

In iBank Investor

1) Log in to your IGG Customer Account.

2) There is no two.

We had some trepidation about asking users to create another online account. Let’s face it, we have accounts for banks, social networking sites, email, you name it. However, in the end we decided this was the right way to provide the best customer experience. Once your IGG Customer Account is set up, you are done and you can forget that it is even there — but don’t forget your login and password :-). And because our software company is run by reasonable human beings like you, we do NOT sell or give away your information. Period.

Along those lines, we got some feedback about the free, ad-supported version of iBank Investor, and in response to that we are going to offer an in-app purchase that will remove the ads. This is the best of both worlds. For those that hate the ads they can get rid of them, but everyone can try the app and even use it indefinitely, for free.

One last thing you’ll notice about the screenshots I’ve shown you here: we’ve added a big arrow that indicates the big picture — big green arrow pointing up is a gain, a red arrow pointing down is a loss.

Once the beta testing period wraps up we’ll be submitting iBank Investor to the App Store. We’ll send out a tweet or news blip once we reach that milestone.

-Ian

A short note about iBank for the iPad

I know a lot of our customers are itching for us to release an iPad version of iBank. It is our highest priority and we are developing it as fast as we can. Lately the development has slowed down because of the changing requirements of iOS 5 and some additional challenges we’ve encountered on the back end. There aren’t any other details to announce yet, but when we do have more to say, it will be here on the blog.

- Continuing Investments in Direct Access - February 26, 2024

- Banktivity 9: The Little Changes - September 8, 2023

- Retiring services for older versions of Banktivity - August 11, 2023

Any method to enter and track transactions?

This app wasn’t really designed to enter transactions like iBank Mobile. If you use iBank for Mac and sync with iBank Investor, the data is readonly. This is how most of our current customers will use it — essentially as tool to quickly see how their investments are performing.

If you are using it as a standalone app to track your investments (which is is perfectly capable of doing), you’ll enter in your lots of the securities you own with the appropriate cost basis. This is kinda like entering “transactions”, but it is to track your lots.

I wish I had invested in Green Mountain Co….

Your in-app purchase approach is the perfect solution. Thanks for offering that option. The app looks sweet!

Meanwhile, behind the scene a large chorus of mobile users chant on and on iBank…iPad…iBank…iPad…iBank…iPad

Looking good on both counts.

It looks like IGG might be spread pretty thin amongst the development demands… I hope the core iBank app is still getting some attention. I’m sure I am not the only person here who keeps Quicken chugging along in the background for those areas that iBank falls short.

Also, keep an eye on the iPad 1 performance. I have seen more and more apps released that crash on it because the specs are relatively low compared to the iPad2 😉

You’re working on this, and I still can’t see my budget in ibank mobile???

This iOS app is pretty silly, really. The developer time should really be spent fixing iBank for Mac instead of writing a limited purpose iOS application. There are already stock tracking apps on the iOS. What is REALLY needed is a Quicken 2007 replacement. Too bad IGG has lost some focus lately.

I agree with those who are concerned about the diversion of focus to mobile platforms when the basic iBank app for OS-X is buggy and has serious limits to functionality. It’s still a “tough choice” to switch from Quicken to iBank. An impossible choice for me, really. It should be an easy choice — considering that Quicken hasn’t updated their mac software since 2007!! And I say this while fully acknowledging that iBank looks better than any of the other Quicken for Mac competitors.

Considering the situation, I am still staying with Snow Leopard and Quicken 2007. Please IGG, I don’t want to be stuck in Mac OS purgatory forever! Just give us a Quicken alternative that’s workable.

I likewise agree with the statements from others that iBank is where the new individual lot identification functionality belongs.

I am still stuck using Quicken for Windows on Parallels. I will purchase iBank if and when it finally includes that capability, which is essential (not optional).

Will the three possible screens available for each security via the “page view” widget include one with a user-defined field or two, such as the Notes and Memo fields in iBank3?

I would use them to track stop loss orders and the recommendation source/basis for buying each security. I continue to be surprised this sort of capability is never mentioned in this blog or on the Forum posts I’ve seen. Does no one else see the need for these?

I, too, have found myself sticking with Snow Leopard running Quicken while waiting for iBank for Mac to resolve some of its existing issues — especially concerning its ability to accurately transfer investment data without having to manually correct a potentially significant amount of historical data. I was unaware that iBank Investor was in development and, having missed the earlier posts on it, I am not certain how it ties in with iBank. I would really like to upgrade to Lion, but I have held off due to Quicken’s inability to run on it. It is looking more and more as though I am going to have to bite the bullet and install Windows on my Mac (not something that I want to do) and begin running Quicken for Windows.

Please come up with something SOON that will enable me to port my years and years worth of Quicken financial and investment data!!!!

This blog post does indeed hit a nerve. I had never heard of iBank until today. I fired up Parallels desktop and Quicken 2007. I started getting some errors which reminded me to go look again at Quicken Essentials for Mac (I’ve been doing this about once every quarter since before the product was even released). I was disappointed with the lack of feature parity with Quicken2007 (again) and decided to punt on buying it (again). Then, in frustration, I started Googling and wound up here. Downloaded the trial, installed it, exported QIF files from Quicken and imported into iBank… the process was nice and confidence inspiring. But what I saw in the Account list when I was done was terrifying: mortgages turned into liabilities, all accounts in USD instead of the proper currency, and worst of all, incorrect balances in ANY account that had EVER had a non-USD transfer.

I’m so fed up with Quicken that I was actually contemplating reentering thousands of transactions for mortgages and non-USD accounts. I even went and did one account as a trail. But, it was painful enough that I went to the forums to see how others were handing these issues. I was disappointed to see that these issues are not new -but I figured IGG was hard at work fixing them. And then I read this blog post and find that development is being spilt across several “speculative” products like an iPad app. Wow. That’s discouraging -this app has lots of promise- as it’s not just not practical to migrate from Quicken 2007. And I’m clearly not the only one who feels that way.

Why not speculate on the desire of the Quicken user base to defect instead of mobile? I would HAPPILY pay $100 just for a high-quality import tool. You could sell it separately to keep the base price lower for those users without the baggage of Quicken. I’d even pay more than that for one-time import service. Send in Quicken Data, get back a high-fidelity IBank file…. a dream true.

You’ve clearly got a fraction of the distractions of Intuit -don’t lose your focus by chasing mobile when iBank still has so much unrealized promise.

Sincerely,

Chris