Today I’m going to share some of the new features and improvements we have coming for Banktivity 8.2 on Mac and iOS. First, I’m going to cover some improvements that have been implemented in Mac and iOS simultaneously, then I’ll cover some of the bigger, specific changes to each platform.

However, before I dive into all of the goodies in 8.2, I want to give a very brief update on Direct Access 2 and Open Banking support for the UK and EU. In short, everything is still on track. As planned, the new DA 2 and Open Banking support will be coming in a subsequent release. I just want to let everyone know things are moving ahead simultaneously on these fronts while we’ve been working on Banktivity 8.2.

New in Banktivity 8.2 for macOS & iOS

New Account Types

We are bringing some new account types that should be popular with our international customers. Specifically, with Banktivity 8.2 you’ll be able to choose these new account types:

- Current (common in the UK)

- RRSP (common in Canada)

- RESP (common in Canada)

The RRSP and RESP support investment transactions, while the Current account is essentially identical to a Checking.

Portfolio improvements with multiple currencies

If you track investments in multiple currencies, we now show the performance of each account in its native currency. If you choose to show your investments by type or risk and you have multiple currencies, we now group these by currency. This way we only use an exchange rate when summing up across accounts in different currencies. Ultimately, this results in a much more accurate picture of your investments in different currencies.

Banktivity 8.2 for Mac

Enhanced Drag and Drop on Mac

We’ve supported drag and drop in Banktivity for Mac for a long time. But for the last couple of years, our drag and drop support hasn’t changed much. For transactions you can do two things: rearrange them if they fall on the same date, or merge an imported transaction with a manually entered one. For accounts, drag and drop allows to you rearrange them so you can customize the sidebar to your liking.

With 8.2 we are adding a couple of nice improvements to drag and drop. First, you’ll be able to drag and drop transactions from one account to another. You can do this by dragging between two different accounts open in two workspaces or windows, or by dragging a transaction onto an account in the sidebar. This is a feature that has been requested by customers and I’m happy to be able to bring it to life. Second, with 8.2 you can drag an importable file, like a QIF or CSV file, directly onto an account in the sidebar. For those that still occasionally import a file, this is a nice enhancement.

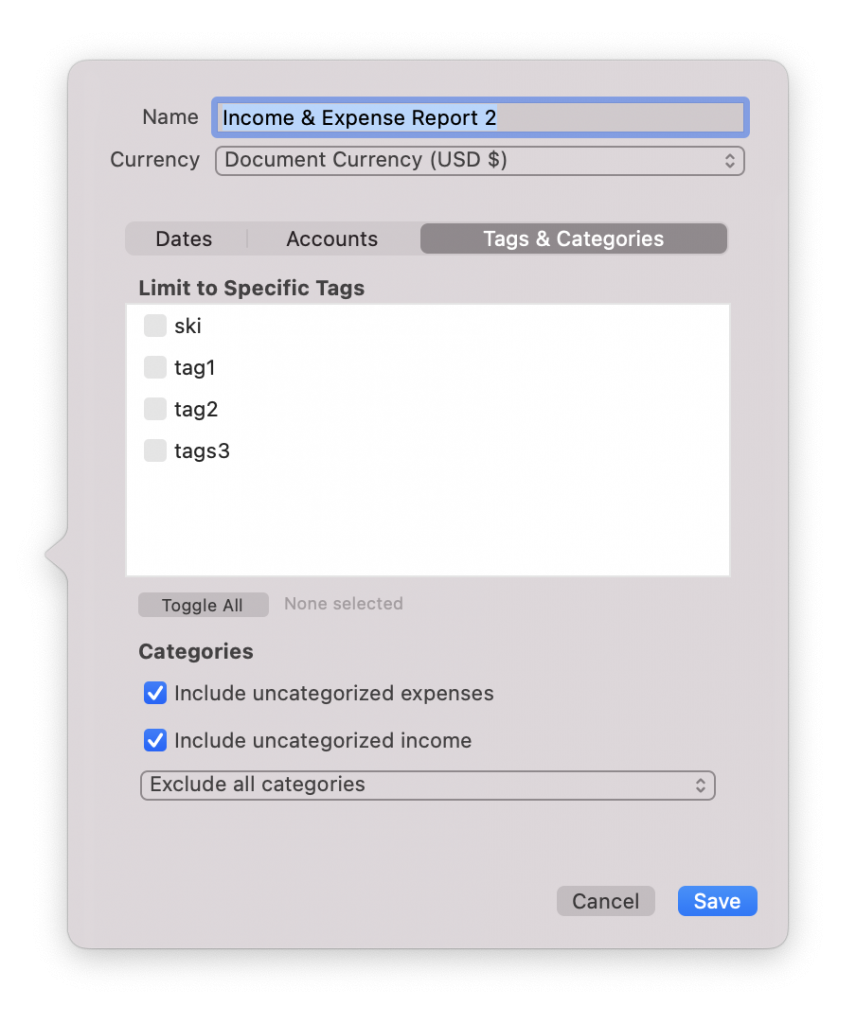

Find uncategorized transactions

For a long time, our customers have wanted a way to easily find their uncategorized transactions across all accounts. There was a way to do this, but it was pretty “hacky” and involved setting a report to include uncategorized income and expenses (that part is straightforward) but to prevent all categories from showing up, you also need to tell the report to include only one category and make sure that category isn’t actually used in the file (that is the hacky part). We never liked this, so now, you can tell a report to just exclude all categories and report on uncategorized, and voila! You see just your uncategorized transactions.

(If you want to find uncategorized transactions in a specific account, that can be achieved by clicking the down arrow button next to “Transactions” and choosing “Uncategorized”.)

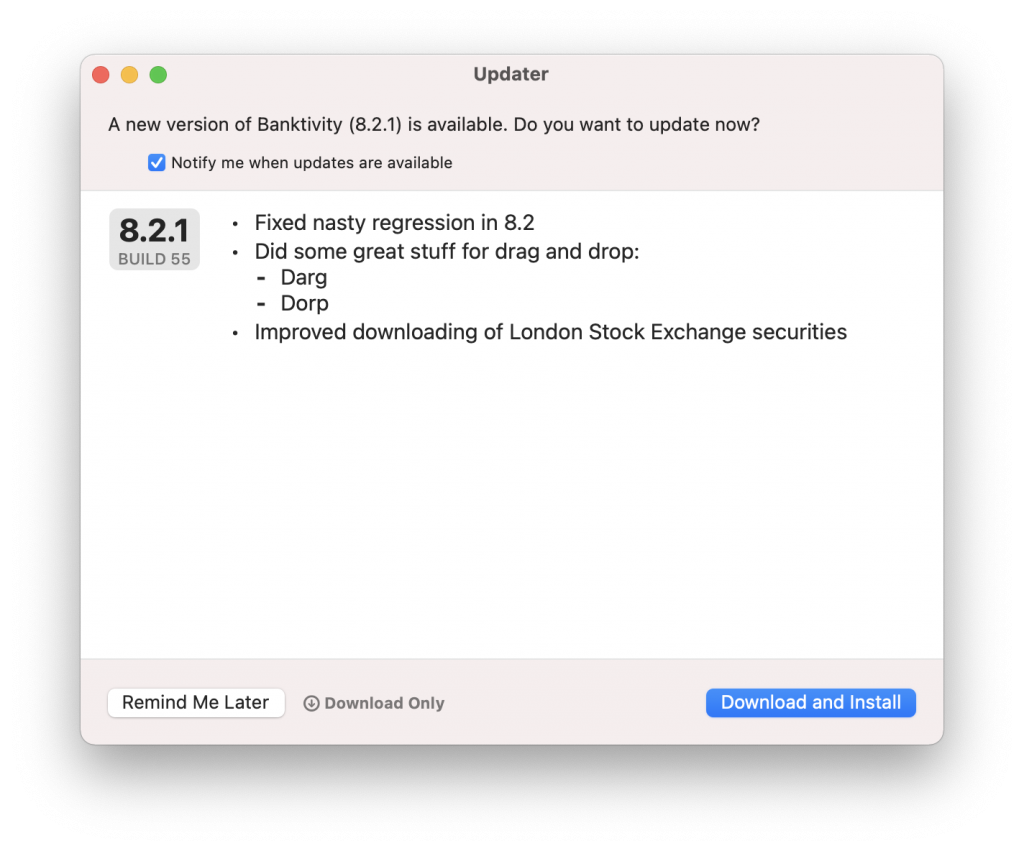

Auto installer

When we release Banktivity 8.2.1, the update process will be entirely new! You’ll get a nice presentation of the main changes in the new version and you’ll be able to download and install the new version without downloading a disk image (dmg file) via Safari or other browser. We thought about using Sparkle for this, which is an open source installer, but we decided to roll our own so that we can control the experience and make sure we can play nice with any upcoming security improvements Apple might introduce.

Duplicate transactions

We’ve added a contextual menu to the account register. You can now, option-click (aka “right click”) on a transaction and choose Duplicate. And it will, not surprisingly, duplicate the selected transactions. This is a small improvement, but one that customers have requested for a while.

Other Improvements

We’ve made over 20 fixes and other small enhancements. I won’t go into all of them here, but you will be able to see them in our release notes once 8.2 goes live. Suffice to say, we’ve fixed one of the most common crashers, improved envelope budgeting descriptions when money is moved in and out of envelopes, and more.

Banktivity 8.2 for iPhoneOS and iPadOS

Our iOS apps continue to get lots of love as we dance between invisible code maintenance and improvements visible to the customer. I won’t bore you with some of the new things we are doing with UITableViews to make our code more modern. Instead, I’ll focus on the enhancements you’ll notice.

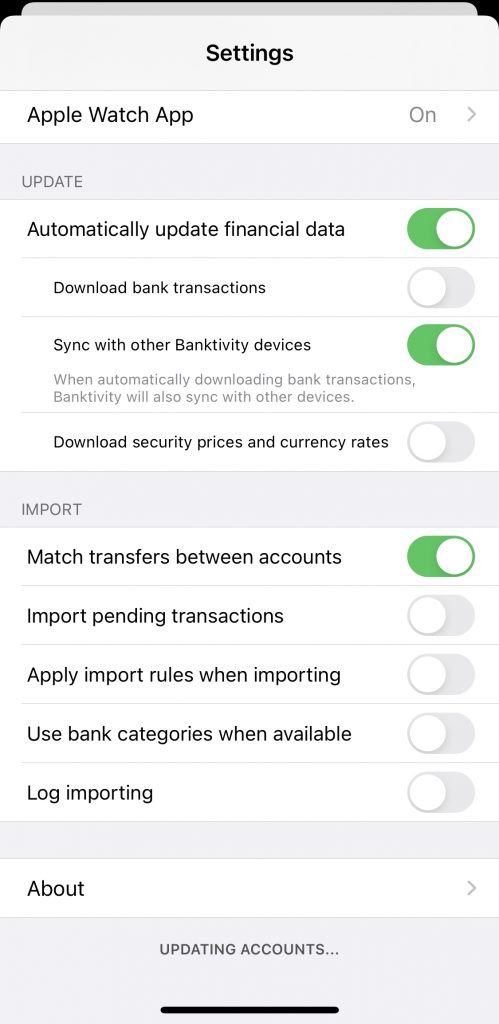

New settings to customize importing and updating

We are happy to bring additional parity to our iOS apps for importing and refreshing. Now when you tap the gear icon in the upper right you’ll get a bunch more options. Specifically, you can now set if we should automatically download transactions via Direct Access, sync with the cloud, and/or update security prices and currency exchange rates. We also added new import options. Here is a screenshot of all of the new options.

I’m particularly excited about having cloud sync set to update automatically without downloading bank transactions too.

Edit accounts when setting up from Direct Access

When adding a new account via Direct Access, you can now edit the name, type and currency like you can on Mac.

Other Improvements

Our iPhone and iPad apps have received numerous smaller, yet noticeable improvements. For example, we do a better job now of selecting the bar chart date range if you have future dated transactions, specifically, you can specify if you want to include the future date transactions or not. You can now tap to view transaction details from within a budget. Additionally, we made improvements to the statement editor and addressed many other smaller UI glitches.

So when will these be available?

I’ll try and get out in front of this question as I know it will likely get asked in the comments. The short answer is, “when it is ready.” But I know that kind of answer isn’t very helpful so let me tell you where we are in the development cycle. We are currently testing Banktivity 8.2 internally. We will likely need to rebuild it twice if not three more times to find and iron out all of the last kinks. So given that, I’m expecting we release it sometime this month (March).

As always, it’s a pleasure to be able to add new features and fix bugs. With our move to subscription, I think we are hitting our stride with releasing solid updates on a good schedule and I’m looking forward to getting Banktivity 8.2 out to you all!

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

Duplicate !! game changer for day to day use !! Awesome.

I’m curious as to how it is better than simply selecting a transaction and typing CMD-C & CMD-V to copy & paste it – presumably the ‘duplicate’ has the current date set instead?

I like the Uncategorized report enhancement; I have used the ‘hack’ you suggested since B6 and it does the job.

Can you consider a similar enhancement for Uncleared transactions across the file. I find that more relevant for day to day for a 8 year mature file. You can achieve it with reports but requires you exclude accounts etc to capture transfers etc and I need 2 reports to cover the whole file.

This could easily be done in an ‘All Transactions’ ‘account’ with the ‘Group New & Uncleared Tranactions’ turned on? Is that what you mean?

it would be nice to be able to highlight a number of transactions and click on the cleared circle to mark them all cleared at the same time –

Looking forward to using DA2 with Salt Edge in Brazil

I have some suggestions. 1 and 2 is driving me crazy

1-Choose the currency of Grouped accounts (Folders)

2-Net Worth report based on categories

Ex. I often pay for my office expenses, and I have an Additional User on my credit card, that I like to keep eye on. I have these expenses categorized. But I cannot exclude it from my Net Worth.

3-Report on stocks buying commission.

4-Report on statements

Ex. Categories expenses from the Jan statement of X account.

I really like item 4, that would be very useful.

Item 3 has merit.

The Direct Access works half the time for me. Meaning only works on half of my accounts. I hope this update addresses the accounts which do not work as listed.

I understand the banks are changing security which is good however Banktivity is not keeping up.

Overall happy with the product. Just not happy paying for a service which does not work as promised.

I agree. My Capital One accounts ask me to verify by phone EVERY day.

If “The RRSP and RESP support investment transactions, while the Current account is essentially identical to a Checking.” then why do we need a Silver Subscription to set this type of an account as a Canadian subscriber? I currently set up 3 separate checking accounts and named them “RRSP” and manage the increases manually as the Bank only issues statements monthly.

Please can you find a way to add mutual fund prices for non-US mutual funds? I pay a fairly hefty subscription and none of my mutual funds here in Europe update. All of your competitors seem to manage this – and with a much lower subscription too.

Hi. When will a manual be available for version 8?

Thanks

I have zero interest in any new release that requires a subscription. If and when my current one-time-paid for Banktivity 7 no longer functions, I will replace it with an alternative one-time-purchase software, or maintain Numbers spreadsheets if that is the only option. I will never, but NEVER, subscribe to a software – READ MY LIPS.

One of the cool things about our subscription is, if you don’t need our connected services or tech support, you can buy it once and not renew and you’ll get future updates for free.

Banktivity has one of the best, most sensible subscription plans of any software. It’s flexible and totally up to the individual how much they need or don’t need.

Absolutely false. You just couldn’t be further from the truth.

Direct Access (the most expensive part of the subscription, as evidenced by how much it cost in Banktivity 7) is MANDATORY for every subscription level, and the majority of the world can’t use it. It’s basically US only. IGG plays Reverse Robin Hood with its customers — using the subscription fees of the poor part of the world to subsidize the world’s richest market (the US).

Multicurrency — which (surprise, surprise) is mandatory in most of the world, but not in the US — requires the Gold level subscription. So again, IGG plays Reverse Robin Hood with us.

I’ve said this from day one when it was announced, and I’ll keep saying it: sell us separate subscriptions to specific features. $20/year for cloud sync, $50/year for Direct Access, $20/year for stocks, $20/year for currencies, or something like that. Keep the bundles so those who may want it all can save a little.

I just REFUSE to subscribe to a service that plays Reverse Robin Hood with us like this. I won’t lie and say I can’t really afford it — it’s very very expensive for those of us outside the US (in my country, 1 year subscription to the gold level is over half the monthly minimum wage), but it helps us save money, so I guess it pays for itself in a way. But I just feel ripped off knowing I’m subsidizing features for one of the richest countries in the world — countries like mine are those that really need a subsidy, not the US.

So I’ll keep using Banktivity 7 until it stops working, and then I’ll move to other software. But again: if a la carte subscriptions were offered, I’d NEVER upgrade. Banktivity is the very best software of its class, hands down, no one even compares. It’s just that, if I were to buy Banktivity 8, I’d have fits of rage while using the software knowing that I was charged astronomical fees for features that are not available where I live.

I am fully with your every word! Unless the pricing model is changed, I will used Banktivity 7 until it stops working. For IGG, it means a loss of of upgrade revenue and a lost customer.

Yeah, I don’t understand all the whining – you subscribe, then unsubscribe and you get v8 (and updates) for nothing.

If you think it should be a single purchase – for life – AND connect to your banks & sync via iCloud, then you need your head read. Why should that be free for life? Some people are such cheapskates they really should just use a pencil & paper and sell their computers.

You’ve created a strawman. I think the majority of people aren’t looking for a single purchase for life. All of us paid for iBank 5, and then paid for Banktivity 6, and then for 7.

The thing is: the company has to “sell” each new release. If it’s identical to the previous one, you just don’t upgrade, so they have to work hard to get a new sell. They can’t just sit on their asses, holding your data/cloud sync hostage as they do with a subscription. Now I’m not saying IGG does this — that’s just my (and others’ as well, I guess) general perception of how subscription software works.

And I do agree that stuff like Direct Access has a cost to IGG and they have to pass it on. The issue I have with it is that those of us who don’t or can’t use it (and the comments here show that there’s a lot of us) are subsidizing those who do. And believe me, I live in a country where we make a fraction of what the equivalent US worker does (in fact, few countries are richer than the US), so all we’re asking is that IGG doesn’t play Reverse Robin Hood with us.

Oh, I do love irony! I really don’t understand your logic.

If the only service that you *can* use is cloud sync, then why bother using any of their online services at all, irrespective of whether you’re running v7 or v8? Surely both versions just as ‘useless’ to you?

What exactly is your argument? Nobody thinks the subscription is holding either the usage of the App or our data hostage at all (that’s *your* straw-man).

If you upgrade to v8 as a single purchase via the lowest ‘subscription’ tier, immediately cancel the subscription. By doing this you get v8 for what is effectively a single purchase (but still receive all V8.x updates for free, including some quite significant DA ones coming…).

If the only service that works for you on Banktivity 7 or 8 is the cloud syncing, just don’t use it and sync your documents manually (iCloud Drive, Dropbox, etc).

You said:

“I live in a country where we make a fraction of what the equivalent US worker does”

I don’t think you realise how little most US workers actually earn! If you’re able to own a computer, which you use to do your finances, I don’t think you have anything to complain about and you certainly aren’t poor! Unbelievable…

Does importing OFX files that *I* download myself from my bank etc, count as a connected service?

Thanks.

No, that does not count as a connected service. That is what we call “manual import” and it works after you buy once, but decide not to renew after a year.

Does sync across multiple devices count as a connected service? I am a longtime Banktivity user (from the earliest days of iBank) but I am hesitant to upgrade because I just don’t like subscription plans for applications (hate that MS is going to subscription based Office and stopped using Adobe apps because of their subscription model) Don’t have any issues with paying for upgrades (as apparent in moving through multiple versions and paying for mobile versions) to fund development but just hate subscription models.

So the issue that is keeping me stuck on V7 is the ability to sync between my devices. If I can pay for a year of V8 and still have sync capability after a year of subscription I would likely be willing to pay.

Yeah, our Cloud Sync is one of our connected services. It is an ongoing cost for us.

What about those of us that need connected services but can’t use them, because they’re not available in our countries?

Should the poor part of the world subsidize the world’s richest market (the US)?

I just don’t think it’s fair, and I’m voting with my dollars. I’ll keep using Banktivity 7 until the day it shuts down, unless subscription options without Direct Access are offered.

Hi Ian – did you finally add a feature to add description text and a date when funds are moved from one envelope to another? This is a critical piece of functionality I’ve been wanting for a while.

No we didn’t add this. However, in 8.2 we do show a better log of when money was moved and from/to where. The date is recorded when money is moved and it is recording on the day of the movement.

Okay thanks for the quick reply! I would love a future enhancement to allow descriptions for every movement of funds from one envelope to another. And if I make multiple moves, Banktivity currently just shows me the grand total amount of multiple moves made on the same day, but it would be very useful to show each move as it’s own line item with it’s own description instead of lumping everything together. In essence, I’m asking for inter-envelope transfers to get exactly the same treatment as inter-account moves get…

How about eBills? That’s pretty much the only thing quicken does better than Banktivity.

Thanks for the update, but as a long time user, I was still hoping that you would add an account type for tracking employer issues stock options. I have developed a work-around, but that throws off other reporting.

Great work Ian! Appreciate your, and your team’s, efforts to constantly improve an already great product. A job well done – Thank you

THANK YOU!

When reconciling accounts I’d like the option to use arrow keys to move up and down the transaction list, and simply use the space bar to toggle a transaction between reconciled and not reconciled.

Eliminates the mouse completely for this task.

For some time now I’ve wanted the option to add a graphic / logo to a Payee, rather than to a category.

A fuel brand; supermarket logo; bank logo; utility logo, for example.

Is this being implemented?

Thanks

This isn’t something we are working on, sorry!

Hi, I have Banktivity 7. I don’t need the connectivity service. Do I need to pay for 8 if I am upgrading from 7 and not taking up the subscription?

You will still need to buy it for at least one year, but after that, you wouldn’t need to stay subscribed. Please note that technical support falls under one of the services you get with an active subscription. I hope this helps!

LOVE that I can drag and drop between accounts. Still hoping for a robust Undo functionality. Thank you!

I could not find anywhere else so I have to comment about the Help I received just now in online chat in this blog. If not appropriate, my apologies.

Kristen B, was AMAZING, I wanted to transfer files from my old iMac using Yosemite 10.10 & Banktivity 5, to my new Big Sur iMac and upgrade to Banktivity 8.2. She gave me instructions and it took me literally 2 minutes. Truly, Truly excellent help. Thanks So Much

Does the latest app for iPad include direct access for UK Bank accounts yet?

Congratulations on the updater! That’s been a small but constant source of annoyance for a long time.

Is there a way to search for transactions that do NOT contain a tag (ie NOT “tag”) or other boolean expressions? I have some accounts where I have transactions for multiple lines of business and I separate them by tags.

Please can you add some sort of cash flow forecast? Perhaps by adding budgeted expenses to the existing Forecast report?

The envelope budgeting feature is hopeless for me as I have variable income through the year and income streams in different currencies. I need to looks 3-6 months ahead to see where my cash situation is going to be – the envelope budget just does not allow me to do this.

Thanks for these updates! I am very happy to hear I can now drag and drop between accounts! Banktivity just keeps getting better and better. I really love the budgeting feature of Banktivity – I think that is my favorite feature of the software. Great job!!!

Have you yet added average cost calculations for capital gains for Canadians? Until you do that, all the investment portfolio wonders you do make no sense for us.

I would agree, average cost would be most helpful to ensure capital gains are meaningful for Canadians. Having a new column in Portfolio View for % Holdings would be a great feature to have. Thanks for adding account types RRSP and RESP.

I use grouped accounts for different purposes of savings. Envelopes and target savings don’t really meet my needs because these accounts don’t really have targets and I want the balances to be visible at a glance (not dig though the budget module) and every dollar in that group should have a purpose. It is much easier to just deposit the money in each account with my pay check. Historically, I have been able to reconcile transactions because I could see the transactions from the group level (recently upgrade from v5), but this is no longer available.

It would also be great if there was an appropriate place to submit feature requests.

Will banktivity be able to add receipts to the app version on IOS and sync to our laptop/desktop version. I know quickbooks can do this add I would love to see this feature.

This isn’t something we are working on right now.

Will Banktivity 8 have a way to save a year and start a new year. I have version 7.2.3 and ever since version 3 there’s been no way to keep each year separate. Without renaming one year. Hard to do but I’ve done it. Please tell me you’re going to have year end , and a new year easy.

is there a way to customize the check register?

1. I don’t need the 2nd line of information – would like to make it cleaner and take that out

2. I’d prefer to change which columns go where