Let’s face it, using Banktivity 6 on the Mac is pretty awesome 🙂 But something has been missing, namely, Banktivity for Mac’s sibling app, Banktivity for iPad and our companion app, Banktivity for iPhone. They haven’t had any major updates in quite some time. So today, I’m happy to talk about the new forthcoming versions of Banktivity for iPad and iPhone.

So, let’s jump right in. We are in the process of releasing Banktivity for iPad and iPhone version 4.0. The goal of these releases was simple, to get our customers’ most requested features implemented and get the “under the hood” components updated so we keep our codebase more consistent with Banktivity 6 for Mac.

Banktivity for iPad

Banktivity for iPad has always been our most powerful iOS app. We’ve taken that a step further with version 4.0 by adding some really great features. Let’s explore them now.

Envelope Budgeting

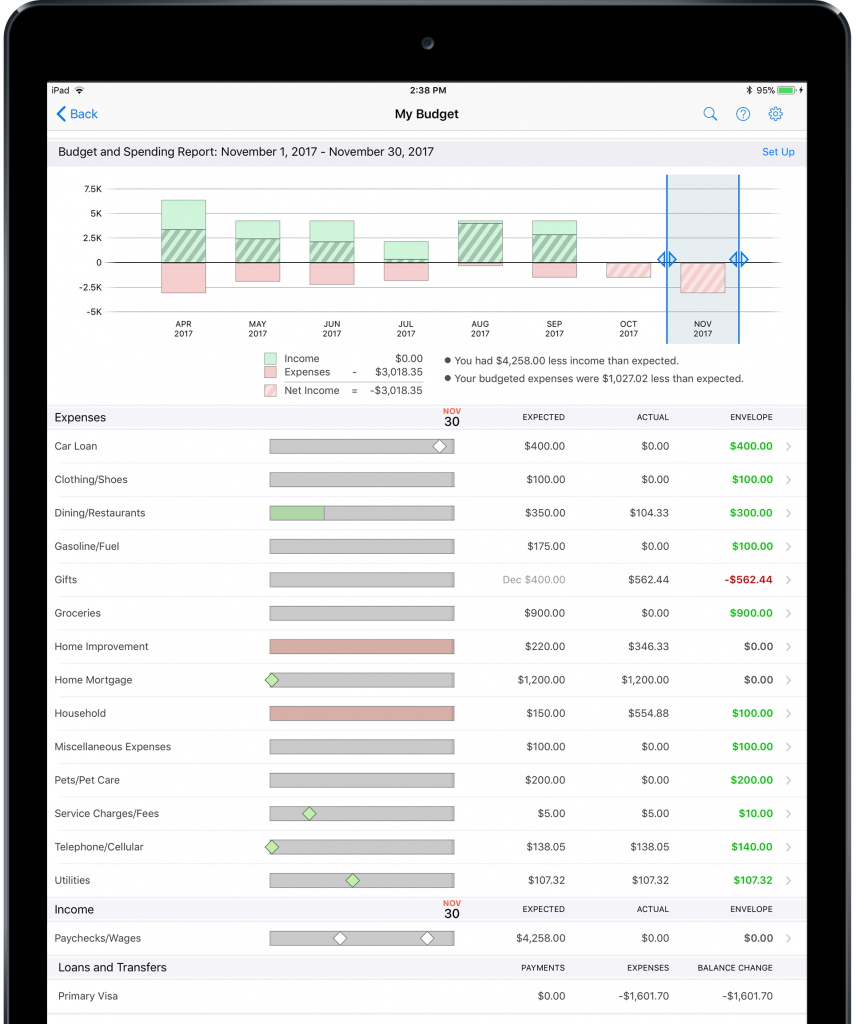

Customers have wanted to be able to see their envelopes on their iPad for a long time. So it is with great pleasure that I can say, “yes, envelope budgeting is in the new version!” With envelope budgeting you can:

- Distribute money to envelopes when you are first setting up a budget

- See how much money is in your envelopes

- Move money between envelopes

In other words, you’ll have full control of your envelope budgets on the go! Now if you don’t use envelope budgeting, I would encourage you to give it a try. You can read what it is all about here.

Envelope budgeting in Banktivity for iPad v4. Just tap the green or red amount to move money into or out of the envelope. Looks like the Gifts category needs some money!

Tags

Tags add another dimension to tracking your finances. I’ll take my favorite example to explain why customers love tags. Let’s say you go on vacation to Disneyland. The entire vacation consists of airplane tickets, hotel reservations, rental car, park entrance fees, food and so on. All of those expenses cover a lot of categories: travel, gasoline, entertainment, dining, etc. But what do you do if after the trip you want to get a realistic picture of how much you spent. After all, it’s never too early to be thinking about next year’s return trip! Enter the world of tags. With tags, you can easily tag all of those transactions with something like “#Disneyland2017” and then run a report to see how much spending you had across all categories with that tag. Tags are super easy, super clean and super powerful. They really do unlock a new dimension for tracking your spending.

Now in Banktivity for iPad you can create and manage your list of tags, and of course you can tag your transactions. We also added a new tag report so you can see your spending across tags for monthly date ranges.

Budgeting for Irregular Expenses

Now in Banktivity for iPad you can budget for those tricky months where you have significant expenses (or income) but only for one or two months out of the year. We introduced this feature in Banktivity 6 for Mac and I’m happy to announce you’ll be able to manage and budget for these irregular expenses in Banktivity for iPad.

Better Syncing of Transaction Types

For those that have the extended list of transaction types in their Banktivity 6 documents (e.g. Charge, ATM, POS, etc.) those will now appear in Banktivity for iPad when using Cloud Sync.

I’ve been using Banktivity for iPad 4 for the last several weeks and I’m really pleased with how these new features came out. My favorite new feature of course is enveloping budgeting. Now when my wife and I discuss if we can afford something, we just bring up the budget and look to see where we are currently prioritizing our money.

Banktivity for iPad 4 will cost $19.99 USD (for new and existing Banktivity for iPad customers).

Banktivity for iPhone

Banktivity for iPhone is also getting some great new features in version 4. Specifically, the new version has:

- Full envelope budgeting capabilities

- Tag transactions (and create/edit/delete and otherwise manage your list of tags)

- Irregular budgeting (budget for those rarer, yet still expensive months)

- Improved transaction type syncing

- iPhone X support

There is one other kind of big deal we need to get out in the open:

Banktivity for iPhone 4 is going to be free! I know, can you believe it, FREE! Everyone loves that word!

Now I’m sure you are wondering, okay, what’s the catch? What in-app purchases do I need to buy to make the app useful? And the truth is, for many customers, they won’t need to purchase anything. They can just download the app and sync it with Banktivity for Mac using our Cloud Sync. If you are a Direct Access subscriber, then you’ll get all of the great account updating magic you’ve come to expect, so no big change there.

If you don’t use our Mac product, then you can download the app for free and add as many accounts and transactions as you want. Our Direct Access service, which allows you to automatically import transactions from over 10,000 banks and financial institutions, will still be an in-app purchase. I’ll also take this opportunity to point out that purchasing Direct Access once allows you to use it from any of our apps – you don’t need to buy it separate for each app.

Requirements

You’ll need iOS 11 for these new apps. If you currently use Banktivity 5 and sync with either iOS app, you’ll want to upgrade – Banktivity for iPad 4 and Banktivity for iPhone 4 only sync with Banktivity 6 for Mac. (You can also sync iPad to iPad, iPhone to iPhone or any mix of those too.)

Release Date

UPDATE (12/28/17): The apps are now available on the App Store!

These new versions have already been submitted to Apple for review and we hope to see them live on the App Store very soon. Follow us on Twitter, if you want to know immediately when they are released!

I’m looking forward to getting these new apps in your hands!

-Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

On the iPhone app, is there a way to snap a picture a receipt to add to the transaction? I know it is possible in the MAC version, but it is very awkward to try to snap a picture using the camera of the computer.

Thanks,

Use the Grab application that is on every Mac. You will find it in “Other” applications.

Recommend Scannable in IOS , perfect for saving receipts, it saves to Evernote too. You can email yourself the receipt to put into Banktivity.

Are we able to attach receipts to transactions ? If so, how ?

I just googled and found out we can.. Banktivity rocks .

I wish you guys would give a break to existing owners of the iPad Banktivity.

I was thinking of updating my iBank 4.75 app. But then I tried to download the iOS app. I don’t have a newer iPhone and can’t upgrade to iOs 11. You didn’t leave the older version of your iOs app in the app store for people who have older phones to use. So, my choice is to upgrade my phone or keep using what I’ve already got. Wish you had made it so that people could download the older versions if they had older iOs devices.

I will have a look at these updates but if they are anything like Banktivity 6 for my desktop then I’ll give then a miss.

I don’t need or use budgeting or any related features….I just use Banktivity for my bank/credit card/investment accounts in three currencies and it is excellent for that.

I’ll give you SIX STARS for that

BUT v6 account pages look a mess……confusing layout, poor visual separation between entries (that is between one entry and the next….just look at scheduled transactions lists), irrational repositioning of entry sections…….absolutely nowhere near as clear as previous versions. A great example of what should have been ‘if it aint broke don’t fix it’. And lets not even go into why you have changed the date format to y/m/d….another completely confusing change.

I have spoken to Joe G (who is great) of your outstanding chat help and all he can offer is “I’ll pass your message on”.

Instead of leaving me in limbo could you offer some explanation for these superfluous changes…..and if you disagree with me (probably) perhaps you could say why you do, and whether any update will soon deal with any of these points please.

Otherwise I have used Banktivity for some years and I love it to bits…well, maybe not so much now as you have made so many frustrating and needless changes.

I’ve waded through the critical reviews in the App Store. I cannot understand why anyone is having serious problems with this product. I have had issues, and they were always resolved on the phone right away. Crashes? Never! From my experience, there is no better app for finances than Banktivity. I started with iBank and kept with each update/upgrade and have never lost a transaction. This app just keeps getting better.

+1

I feel the same way !!!

Please consider the following perspective for Banktivity for iOS (iPhone).

Sometimes you need a tool to enter transactions on the fly….take a photo of the receipt and be on your way. Many do ‘not’ want their entire financial lives carried around on their mobile phones day-in-and-day-out. However, the full-sync process for the iPhone app forces ALL transactions onto the iPhone. Retirement, salary… everything.

Please consider the option for ONE-WAY-SYNC, so we can capture transactions real-time, and sync merge them to the main file.. not a full 100% 2-way sync.

I will try this so I can ditch my old Quicken. I read you can synch between the Mac and/or iPad/iPhone via cloud. I don’t trust the cloud, can you synch using Bluetooth and/or internal home network? Thanks.

Synching happens via a private cloud with encrypted data, earlier versions supported wifi but this has been discontinued for almost 2 years. The cloud synch process is tight but we all have our views on that.

The Reports generated by Banktivity are really good…… The only thing that I really miss, is an “Average”….

I use the “Category Interval Report” to create a report that I call “Categories This Quarter”. An “Average” would be quite useful for me..

Sorry, I meant to write “Groceries This Quarter”

What da heck is going on? No update since 1938! 🙂 🙂

I came here to say the same thing… laurels, resting, etc.

I keep on waiting for updates, but I really do not know what is so urgent what I am waiting for?

Banktivity is rock solid for me. Perhaps not knowing what to expect is exciting.

The only thing that is missing for me (but not a game changer) is when using scheduled transactions, the “Left Hand” menu always shows the projected balance, not the present balance.

Ron

Scanning through the comments, it looks like a couple of people have the same issue that I posted in Dec, which had no response – so try again…….

Chris

December 29, 2017 at 11:38 am

Have downloaded both the iPhone And iPad versions and generally happy with both.

However, I still have issues with investments that I was hoping would be fixed in the iPad version….. Most of my investments are mutual funds, which do not have a Yahoo symbol, but have a Bloomberg ticker (I asked many years ago whether IBank could be made to automatically download from Bloomberg….). I generally get around this by manually updating the stock price in Banktivity on the Mac, which is not brilliant but not too much of a hassle (I only do a couple of times a month). The big issue I have is that when I update on the Mac version, this does NOT sync to the iOS version – it looks like the ipad can only update via the yahoo symbol ??

So – is it possible in future updates to either have (a) auto updates using Bloomberg or (b) the ability to sync manually updated security prices across Mac/ iOS ?

+1

I’ve found that if you use Settings, Update Securities on Banktivity for Mac, it appears to sync ok to the iPad version, but I want to be able to update security prices on my iPad, which would make the iPad version much more usable for me.

One screaming omission has been lack of a balance forecast on the iOS app – to me this is the most important piece of info I need and I always check it first when I open the desktop version. The other issue is that the transaction types available on the app do not reflect those on desktop version – e.g. ATM, POS, ONLINE…

I would like to request more transaction types for the mobile devices. It seems strange that POS isn’t an option when most times you use it is to put in a POS transaction