I really don’t like going several months between blog posts. The last time I wrote from my office in Vermont, there were plenty of summer crickets chirping away. Today, as we approach Thanksgiving, the temperatures have dropped substantially — there is still thick frost in the shady areas on the ground.

I’ll reiterate what I said in my last post, and that is, when it gets this quiet around here, it is because we have our noses to the grind stone working on projects we can’t yet talk about. So instead, let me talk about some other news in IGG…

iOS Apps

On the app front, we continue to release bug fixes and add features to our existing product line up. For our iOS products, version 3.0.1 came our recently and 3.0.2 is about to be submitted for review. Version 3.0.2 has some great fixes that improve cloud sync and brings the math function keys back to the iPad when editing transaction amounts. And new for iBank for iPhone 3.0.2 you can schedule any transaction template without going through the budget editor.

iBank for Mac OS X

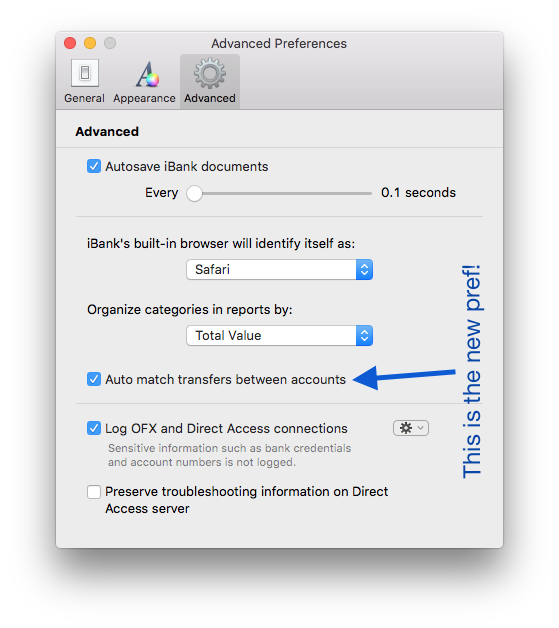

On the Mac side, iBank for Mac 5.6.3 came out a few weeks ago that fixes a bug with exchange rates and added a new preference to turn off auto-matching of account transfers if you want (see iBank > Preferences > Advanced). We added this preference after several customers really asked us to make this optional. Before the default was transfers across accounts were always automatically linked. While this works great for most people, occasionally it could match two transactions that aren’t really transfers. This wouldn’t affect your account balances, which is good, but it did indicate that a certain financial action occurred (transfer) when in fact it really didn’t. So now, you can choose if you want iBank to auto link transfers.

iBank for Mac 5.6.4 is already under development and it fixes a great threading bug with stock quote downloads. It also fixes some bugs with budgets and the overview screen and budget set up. There aren’t any new substantial features in this fix, but definitely some good fixes.

Website

If you haven’t noticed, we rolled out an entirely new website. This new website is responsive so it works well on any screen size. This is also important because apparently Google page rankings are now incorporating how mobile friendly websites are. The new website gives more emphasis to the fact we have a Free Trial for iBank 5 and it does a much better job helping people understand how iBank will help them with their finances. We no longer just highlight features; we also now highlight how iBank can help build savings, control spending and plan for your financial future.

I hope everyone has a nice holiday season as we move into this busy time of year and I look forward to writing again in the future.

-Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

It nice to hear that there is continual development on the products.

Listen to your customers IGG!

We don’t trust you with our financial data in the cloud when much larger and more resourceful companies get hacked all the time.

Bring back local sync.

Don’t be arrogant and refuse to listen to your customers!

I quit using iBank some time earlier this year because I could no longer sync my devices (IOS on iPhone, iPad and my MacBook Pro and MacBook Air). After contacting your support group, but not getting a satisfactory solution I abandoned IBank. It made me sad because I had really enjoyed using the program for quite some time. I decided to give it another try this week and discovered that now everything syncs in the cloud! Yahoo!!!!! I am thrilled! Thank you for continuing to work to get things working (syncing) correctly and easily!

I’m generally very pleased with iBank for Mac 5.x but agree with other comments on this site that it needs a “facelift” and some improvements in the reporting area.

My larger concern is iBank for iPhone. It works well, is stable and reliable. That said, it’s VERY difficult to read many of the screens, even with my glasses on, and could stand a “facelift”, as well. Some expanded use of color would help greatly, as would some reporting capability.

Spot on Bernie, the software is very functional but needs a facelift, improved reporting and a review of scheduled payments, they worked better in version 4 of the product.

I’ve been using both iBank and Quicken Mac in parallel over the last 12 months (including a paid subscription to Direct Access). I’m sure there are quite a few others in the same boat. While I certainly understand the need to keep upcoming improvements/updates proprietary, I think the user base should at least have some feel for features under consideration, especially those which we have been waiting several years for. Just my 2 cents – the fork in the road is coming up and many of us will have to make a decision.

Please ! improve the reports of ibank for mac.

I’ve been using Quicken for Mac since it first came out and I’m currently using Quicken 2007, Quicken 2015 and iBank 5 concurrently and trying to determine which is best. I was a beta tester for Q2015 and I’m totally disappointed with it (and 2016) and Intuit’s apparent lack of interest. Q2007 is likely not long for this world. That leaves iBank which has been working very well for me but is lacking in the one key area that others have mentioned – reporting. I like to build customized reports and I have many of them memorized in Q2007.

So, I’ll echo what other have said. Please give us a much more robust and customizable reporting function. Thanks for your time and continued good luck!

@Karim – My guess is they’re working on a website product, similar to Mint. That would explain their steadfast refusal to address our concerns about eliminating local sync in favor of cloud sync. (And a paid Direct Access subscription would provide good recurring revenue for a website product.)

I’m still waiting for a lot of improvements to be made to the desktop version. Features that have been requested for several years! Better reporting and data entry on split transactions come to mind. Also, please reinstate WiFi sync – my data is not going into the cloud.

iBank desperately needs a single-line view for registers. The current eat-what’s-on-your-plate approach is not hacking it.

I know most of us pay almost everything electronically, but we still do some checks. Why not a “printer” icon on the menus bar we can click rather than needing always to go to tile etc etc ?

I really hope they don’t create a web-only version of iBank and abandon the standalone version. Believe it or not, some people spend considerable time away from internet access yet still need to keep their financial records up to date…

Web only would be a disaster so I hope IGG, if they’re not going that way, will make a statement to that effect so we can stop speculating.

Reports & exporting data is where iBank for the Mac needs work.

I’d like to add my vote to decent reporting, or at least a clean and simple way to get stuff into Excel. Please please please!!?

iBank is excellent for tracking, but the barely customisable reporting is a big let-down.

As for single line registers, this should really be a simple option that will please a good number of users – I’d think this should be a quick win for you guys?

Another vote for more customzation of reports as well as overview page. I’m also all for the single line transaction. I would just like to include a feature request of tags…. as of now, Categories and Payees are the only way to track, Tags would give customers some additional customization in reporting.

And for the love of god.. can you please disable the #’s only coding for the check # box. Many of us pay bills online and we will get a confirmation or transaction code that is letters and numbers. We can’t put anything in the check number box if it has a letter of special character. At least make this an option if “online” is selected from the transaction type.

You will gain a lot of customers with the current unknown future of Quicken. iBank appears to be in the drivers seat. Don’t take your foot off the accelerator.

Hello, I would like that expense reports timeline can group the subcategories of each category and to deploy them in case they are needed.Because now they are all subcategories and reporting is very extensive.

Thank you

I am a heavy user of iBank: for Mac, iPhone and iPad. It works great, but I agree with all users here: please do better reporting for us. I remember using Microsoft Money a long time ago, and how customisable, user friendly and informative reports were on that platform. For instance, I would like to hover over columns on reports and just see the value/percentage visible immediately. Instead, I have to open that columns to see any numbers.

Spade and Paul – I’m hopeful the IGG team is watching the frenzy that is happening over at YNAB from their recent transition to web-only and subscription model and seriously questioning that development path if they are on it. In less than two weeks YNAB has had 42k views on a site hosted forum detailing reasons to abandon the platform and not upgrade. (A quick survey puts this in the top-five most viewed posts, only behind multi-year threads) In the 4 days following their Dec 30th launch they had 14k direct emails from unhappy customers and that’s not including the passionate Facebook, Twitter and Reddit responses.

I found my way here after searching for an alternative to the development choices that YNAB has made. (Not just web-only and subscription, but their doubling down on the get-out-of-debt service at the expense of a good day-to-day tracker once you’ve accomplished that and a web-platform that takes away key desktop functions.)

I am encouraged by my trialing of iBank and anticipate that I’m going to make the financial and time investment to migrate. I would be extremely unhappy to soon find that iBank’s hush hush project was to follow YNAB into web-based SAAS territory away from their strong existing programming.

We have no plans to move to a subscription model!

Please add a true export to spreadsheet and not just a cut/paste. Give us similar options for filtering, etc. as the reports use. Sometimes, the built-in reports are just not enough for what I need, such as analyzing expenses by the Payee.

Does the latest version of iBank support variable month budgeting yet? I’ve got documents back in 2009, trading notes with the iBank developers back when you had a forum on your website about this topic. That was before you introduced envelope budgeting but only on the annual level. Have you given up on this request? It’s hard to do any personal financial forecast when you show my insurance payments spread out over 12 months or assume that my gas bill will be the same in the summer as in the winter.

(I’m cynical — I figure you took it down because potential clients were able to see all of discussions about the missing features.)

@Chuck Yes, you can now vary how much is expected for each month.

I’m going to play with the sample a little more, but my first impression is that this is very nice.

I may be misunderstanding something, though. I put in a budget for 2015 so I can see how it works with real data, but all I’ve figured out is to see how the 2015 budget compares with 2016 actuals. Did I miss the way to match the budget period with the actual period?

Ian,

I’ve gotten a lot dumber as I get older, and I don’t see the variable monthly budgeting in Banktivity 5.6.5. I’ve read the online help and the manual and just aren’t seeing it. Are you sure it does what I’m trying to do:

I have income for one of my categories that I’m budgeting $120 in months 1, 2, 4, 5, 6, 8, 9, and 11. I have $500 extra income in months 3, 7, and 10. And $0 in month 12.

Is this possible?

This blog states that you don’t like going too long between blog posts. What constitutes “too long”? It’s almost the end of January 2016 and this blog post is from Nov 2015. What’s going on with improvements that have been promised? I’m still waiting on better reporting options and easier data entry for split transactions. I’ve given up on investment tracking and still using quicken 2007 for that.

@Donna If we could comment about future products, we would. Sorry I can’t say anything else at the moment.

I am upset that I am being forced to sign up to share my personal financial info on the cloud. The main reason I went with iBank for mac and iPhone was that I could synch the data between the 2 over my wifi. Please bring this back, as I am not comfortable sharing my finances over the cloud, especially with the proven failures of current security systems. Or refund me my iPhone app purchase.

@Laura I’m sorry you don’t like our cloud sync solution. Before you decide to not use it, I would encourage you to read this article: https://www.iggsoftware.com/support/articles/ibank-5/is-cloud-sync-secure/ If you still want a refund, please contact Apple as they are the ones that can reverse the credit card charge since it was purchased through their App Store.

Are you guys still around? You should not lead with, “I really don’t like going several months between blog posts.” in November and then go several months with out blog posts. I for one would like to see better reporting.

Thanks!

@Jason Yes, we are still here 🙂 All of the work we are doing right now we can’t talk about yet, so the blog is quiet.

Please please add in the Transaction type of ‘Charge’ to your iBank for iPhone app!!!

I just spent literally an extra 15 minutes in the iBank for Mac changing the ones I entered on my phone from ‘Withdrawl’ to ‘Charge’. A waste of unnecessary extra time. I was away from home most of the weekend and was catching up on my receipts which is why I was using my phone.

Request noted. Please remember you can batch change transaction types on Mac with contextual menu.