I’m here today to talk about budgets. Put simply, budgets are tricky business. In theory they sound quite simple: budget how much you plan to spend and then track how much you actually spend. If this is done for all expenses, it can really help prevent you from spending too much. It should also help you answer several other related questions: Can I afford XYZ? How much do we save every month? How long until I’ve saved $1000? This sounds fine from a broad perspective but when we get to down to an individual’s needs, the devil is in the details.

For example, a monthly time interval is natural period in which to budget because the majority of people’s bills occur at monthly intervals. However, for many other expenses, and for most people, there is no typical month. Your groceries might cost approximately the same amount month to month, but how about paying for your kids’ karate class that they just started taking? Or an odd property tax schedule? Or the fuel pump on your car that needs to be replaced at some unknown point, or a biannual insurance bill, or extra cash for a weekend getaway or… You get the idea. So the big question is, how do you budget for these oddly timed expenses? Some people are big advocates of “envelope budgeting,” while others always try to stay under budget so you have saved cash for the harder-to-plan-for expenses. The other approach, which I think offers the most flexibility, is to use a system that allows you to model for oddly timed expenses through the use of bills and scheduled income. This is the approach that we took in iBank for iPad, where you tell the app about the bills you have and it automatically incorporates those into your budget.

The other nice thing about budgeting for bills, is that it reflects events in our real life (bills) so it is an easy concept for most people to grasp. Of course, not all expenses are bills, so we still need to allow users to budget for things like groceries, gas, dining, entertainment, etc. Even after you’ve budgeted and planned for all of your bills it is still a good idea to keep an active engagement in the monthly budgeting process. That is, budgets change, and should be updated to reflect those changes. Last month when I had a large unexpected car service, I changed my budgeted amount for “auto service” from $0 per month to $750. This in turn forced me to decide where we were going to come up with an additional $750 from within our budget.

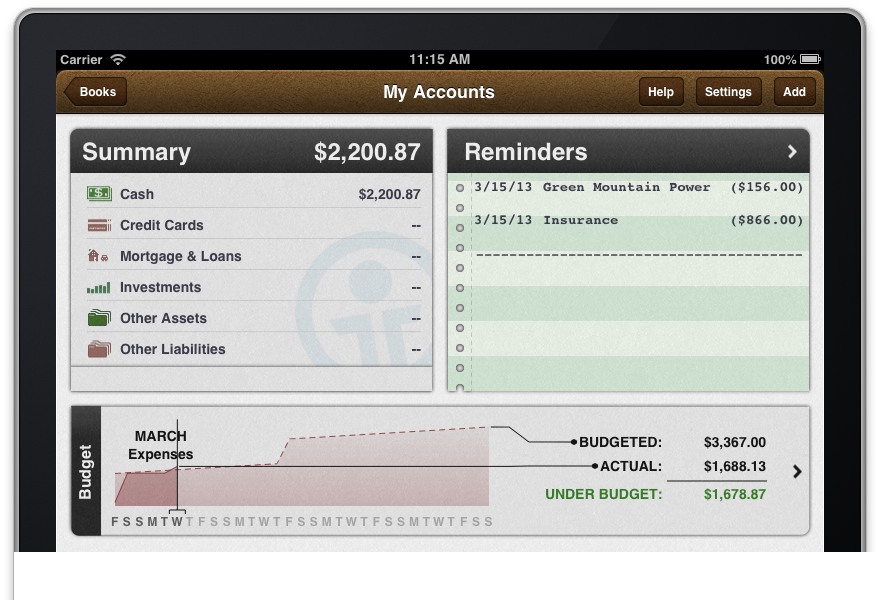

The process of budgeting for bills and “unscheduled expenses,” like groceries and gas, works quite well in iBank for iPad. I not only get an overview of what my expenses should be for the month, but I can also see exactly within the month when I need cash for bills. The following screenshot illustrates the predictive power of of the budgeting in iBank for iPad — at the start of each month I know almost exactly how much I’m going to spend and how that is distributed over the month.

The budget section in this screenshot shows that I will spend very close to $3,367 and I have significant bills due in middle of the month.

However, the current implementation of our budgeting system isn’t without some limitations. For example, some people might want to exclude their 401k account from being used in calculating your actual expenses and income because often people don’t want to include their retirement accounts in their budget.

Another limitation is that we don’t preserve your historical changes to scheduled transactions (aka bills). For example, say you set up your cell phone bill for $100/month occurring on the 10th of each month starting in January. Then, a few months later you add a line to the plan and now your bill is $150, so you make the corresponding change in our app. All seems fine, but if you then look back at January, your expected/budgeted amount will say $150. This situation is only an issue if you find value in looking back at historical budgeted vs. actual charts and since we allow the user to see these historical figures, they should be accurate. So a “fix” for this issue is coming in iBank for iPad 1.2. I use the quotes because this isn’t a bug that we were unaware of, but rather we decided this behavior wasn’t critical for v1.0. I also want to point out that introducing the correct behavior was no small feat. Handling the myriad of common cases and edge cases is huge, especially since we need to do it in a way that will support syncing of budgets in a future release. That’s right, syncing of budgets to a future version of iBank for Mac is coming, but it won’t be for a while. And although this is the Developers’ Blog and it wouldn’t feel out of place to discuss in detail why this wasn’t an easy feature to code and implement, take my word for it and see how our competitors handle this situation (hint: they don’t).

In summary, what is the take home point in budgets? First, budgets are tricky because everyone has different ideas about what is helpful and what isn’t. There is no standard model for home finances and budgeting. Second, we believe the best way for users to think about their budget is in terms of bills, scheduled income (e.g. a regular paycheck) and unscheduled monthly expenses, like groceries, gas, entertainment and dining. Third, sweat the granularity and the details, that is, do incorporate that car insurance bill that occurs every six months, do incorporate property tax payments or other bills that might occur at irregular frequencies. Fourth, remain engaged and adjust your budget as needed, especially for the unexpected expenses that inevitably arise. If you do this, you’ll have a very accurate picture of how you’ll spend your money month-to-month and, most importantly, you’ll be able to identify places to save.

In the next blog post I hope to talk more about how we are re-implementing budgets on the Mac to allow for iPad syncing, and I even hope to show some screenshots.

-Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

You are over complicating budgeting.

Allow the user to select his budget period for each expense and income category.

Then, over a period of time, iBank can calculate income and expense vs budget.

Alternatively, look at how other finance programs do it; you are making what should be a simple function needlessly complex.

@ss the simple case you describe is also supported.

Still those needless oversized graphics filling the screen where I just want to see my list of transactions!!!

The trick with budgeting is having a consistent view between your income and expenditure. For example, if I know I am going to earn $50,000 and have a $5,000 bonus, my annualized income is $55k, but that doesn’t mean my monthly expenditure can be $4.5k – it can only be $4.1k with annual expenses making up the rest (car insurance or vacation expense etc). So I’d want a monthly view of my budget (with the option to roll forward on some categories) and an annual view of the budget which includes monthly (annualized) plus what I entered as annual or quarterly expenses and income.

Additionally, one feature that would make iBank pretty unique would be having separate gross and net budgets which don’t require setting up insanely complex reports or categories to make work (like Quicken does). I actually use Mint.com purely to track net income cashflow, and I probably use it more for tracking where I really am than any desktop solution for that reason. I don’t know why so many Finance apps (including iBank) find it so hard to provide net income reporting – you know, that number that actually got paid to my checking account. It’s no good to be to know that 28% of my income went to taxes – that’s not something I can control month to month.

>> we are re-implementing budgets on the Mac to allow for iPad syncing

Ian — This is fantastic news. I’ve been pleased with iBank for Mac in so many ways, but the budget feature wasn’t really helpful to me until it recently provided the ability to go back/forward by one month. Having said that, iBank for iPad has an even better feature that lets the user span MULTIPLE months. That helps answer the question “How am I doing in my budget so far THIS YEAR?” which is what I need to know. If you could bring that iPad month-spanning feature the Mac, as well as provide syncing, then I’d be one happy camper. Also it would be great if the multiple budgets I define on my Mac could sync to iPad. Right now I have multiple budgets on the Mac, but can only plan one budget on the iPad. I don’t want to define budgets separately on two devices.

It would be great is budgets were displayed on the iPhone… Some us don’t believe having an iPad and iPhone AND a Mac is necessarily responsible budgeting 😉 I spend my money mostly when I am not at home. So, seeing what I have left in my budget on my iPhone would be greatly helpful.

Really happy you guys are making it possible to sync budgets between mac and iPad, doesn’t make much sense to have two separate budgets that don’t work the same way.

Ian: I will say this as gently as I can – I hope this Budget update reaches deeper in the whole infrastructure as a complete update for the iPad and is an easier way of sneaking by the fact that IGG completely ignored the basic cries of its supporters over two years.

I think Budgets was one of the biggest flops of this app. It would be nice that is matches the tech of the OS product and syncs with that budget. Every time there is an update or hick-up with the app, the next sync with the OS version leaves a “Clean Budget” that is time consuming to rebuild and even come close to matching what is on the OS.

I am not touching Budgets unless it Wows me. Personally, it would have to have a total rebuild for me to use the app daily. If there is no wow, I will stay stuck with the OS version and try to work with the weak iPhone app. Maybe Apple might see the void in this category, and just buy Intuit.

I tried using the I Bank 4 budget feature on a MAC and have gone to a spreadsheet. Too much work but I can accommodate “bills” which as a retiree is a major part of my spending. It also allows me to plan my income needs from my investments as I do not have a pension that automatically covers what i spend each month.

Giddy Up!!!!

What on earth is going o at IGG? You released a 1.2 update for iPad, and all there is on your website is a press release that doesn’t detail ANY of the improvements, just lists a load of marketing. Even on the app store itself, there is no mention of what 1.2 brings, it just says “with your help we’re constantly improving our apps”.

After 8 years of using iBank I’m done. A sniff of commercial success has made you forget why the Mac original was ay good to start with.

I find the budgeting process is less complicated if you budget annually. This way most irregular bills are absorbed into the one period.

It would be very helpful if iBank for Mac allowed you to set the starting date of your budget period. This would allow users to start using a budget at any time of year. It would also allow users to align an annual budget with the financial year (i.e. tax year) of their state / country.

Mark, detailed version changes for all of our apps are available online; you can see that the list for iBank for iPad 1.2 is extensive: http://www.iggsoftware.com/ibankforipad/version_changes.html

This practical information, helpful to existing users and potential customers, is often accessible right from IGG’s homepage (hyperlinked via tweets about new releases – you can also follow @IGGsoftware on Twitter). The press release summarizes these changes, but you are correct: our PR is a function of marketing, directed toward the media.

The budget feature is a frustrating waste of time. Allow me to choose what I want to budget. For example I can’t hide uncategorized income or expenses and I don’t want to budget that stuff. Sadly the feature won’t let me do that. It does however add it to the uncategorized income or expenses to the summary just below the timeline. This adds really confusing numbers to the screen and makes it nearly impossible to wrap my head around exactly where everything is going. Just allow me to budget what I want to nothing more nothing less.