Now that we have talked about what is coming in iBank for Mac, let me loop back and talk about where we are with iBank for iPad. Though we quickly submitted a large set of fixes addressing some of the major issues that users found with version 1.0, we are still awaiting App Store approval of 1.0.1 so that you can try out… and it should be any minute now (but that’s what we said last week). I am really happy with this round of fixes, but one of the issues that 1.0.1 does not address is the time it takes to do an initial sync. For 1.1 we are working to improve the performance of sync, focusing on the the time of the initial sync and the progress feedback that sync gives. We are also looking at improving the syncing of current security prices so that investments more closely match iBank for Mac.

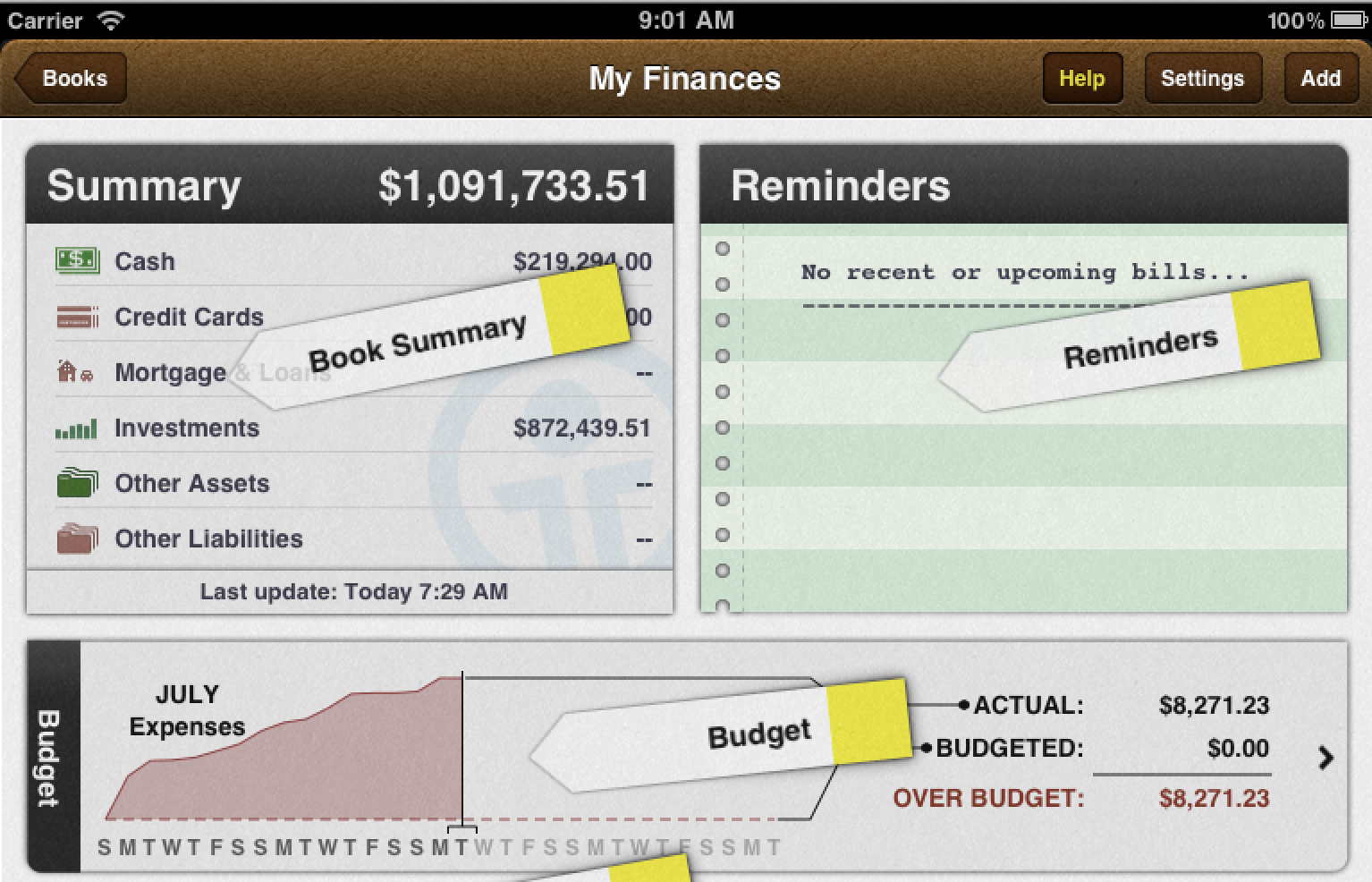

Another thing coming to iBank for iPad 1.1 is improved help. One of the biggest complaints we are getting is that the app can’t do something that users want – when actually, it can. There LOTS of cool, hidden features in the app, but we may have been a little too clever for our own good. The problem (and it is our problem) is that if you can’t figure out how the software works, then it is no different than the software not working. So we are adding in application contextual help. You can turn it on from a new help button on the tool bar, and when you do this is what you see:

Each help marker points to the part of the product that the help applies to. You can tap on any marker to get the help for that section. We hope that this greatly improves the usability of iBank for iPad.

One other common concern with the app is that budgets don’t sync between the Mac and iPad. This was done on purpose. On the Mac, there are really two ways to set up your expected income and spending: the first is the standard budget in iBank for Mac where you enter in your expected income and expenses on some periodic basis. The second way that iBank for Mac allows you to model your income and expenses is with scheduled transactions. These allow you to forecast your income and expenses, by account, into some arbitrary time in the future. On the iPad, iBank has a unified model for budgeting that allows for both of these methods. Looking ahead, we are going to develop budgeting iBank for Mac to be more like iBank for iPad. Eventually we want budgets to sync, but it will require some work on the Mac side first.

Now this does not cover all the things that we want to improve about iBank for iPad. We see this launch as the beginning and not the end. We really want to hear from you! Please tell us what you like, and what you don’t, what works, and especially what does not. The best way to do that is by chatting with our support team. One key tip: If you are experiencing crashes, please connect your iPad to iTunes. This will send the crash report to Apple, who will pass it along to us, which really helps us find and fix issues faster.

With a development team now deployed among all apps here, we are working hard to fix things that are broken, build the things that are missing and in general make our apps better. And more than ever, we value your input.

Thanks,

James

- Direct Access 2 and Open Banking Support in the UK and EU - February 17, 2021

- A chunk of sync update - June 27, 2014

- 2013 In Review - December 17, 2013

Why does ibank for iPad not transfer loan details from ibank for mac? It would be nice to see interest rate, length of loan etc on the iPad version

When is this released internationally? I am a mexican user, I need the iPad version. THank you.

First off thanks for the update, its good to know you are moving forward with he application and making much needed improvements.

To make things simple I will make a list in order of priority I would like.

1) A sync solution that is not based around the mac. Prior to ibank for the ipad the current method was adequate but now I have 2 mobile devices i need to make the choice which to use on a business trip. Both is not possible due to being away from my mac and no possibility of syncing. Currently the iPhone app always wins out.

2) Transaction templates. This has always been a key feature for iBank products and i am not sure how it dropped off the radar.

3) Scheduled transactions. I don’t personally use budgets, i just need a way of entering a recurring transaction and pressing a button to post it.

The above 3 points I see as essentials I need before I start to use the product again. Below is a list of less important features / suggestions.

4) A quick way to clear transactions. (toggle the pending button)

5) A way to split accounts on the main page, e.g. Savings and current accounts.

6) A way to move accounts between books and keep syncing working.

7) A way to minimise graphs.

8) I would much prefer a swipe on a transaction to bring up the options. This is he only iOS application I know that uses double tap. I have found no use for swiping bar getting back to the home screen an there is a button for that.

I am sure I missed some but its a start. Looking forward to future developments so I can start using the app.

Tom

Even though I knew the app wasn’t quite complete with the features I need I went ahead and bought it today and began playing around with it. I agree with much of what Tom said. The budget segment is not something I would use or need. I’m really hoping you can include envelope budgeting like what is in iBank in an update soon. The ability to import QIF files would be nice too.

I agree with Tom.

The main feature I use of iBank on the Mac is the cash-flow forecasting based on scheduled transactions (rather than using budgets). Until this functionality comes to the iPad version, it is no more than a larger, better looking transaction entering tool. I’ve still always got to have my Mac handy if I want to do any analysis/reporting.

I fully agree with Tom above – especially his points 1 & 3

Votes for

– Tom’s 1) sync without a Mac.

– Jamie’s import QIF/OFX ability

As a long time iBank -user I would like to check this new iPad-version. However, you “worldwide” -release does not sound so worldwide to me: I can not found it from the Finnish App Store… Why & when?

When iBank for iPad will come to the App Store worldwide?

I’m an italian user and I cannot buy it, because there’s no way to get it in the italian app store…

I too agree with Tom, especially on scheduled transactions and clearing. Reading the original post “On the iPad, iBank has a unified model for budgeting that allows for both of these methods”, I take the term “allows” to mean in the future. At the moment there seems to be now way of seeing the budget past the current month, although it is possible to post transactions for a later date. There needs to be the ability to budget/schedule one-off transactions such a making a provision for a new car (I wish!), like scheduled transactions on the Mac. There needs to be the ability to stop after a number of posts (i.e. 1 or more), whether yearly, monthly etc., and in addition it would be nice to be able to schedule a transaction for say just x months every year until the stop. Without a forward look, I will always have to take the Mac with me when travelling.

I use reports on the Mac quite heavily and would want some ability to slice and dice the data, especially looking forward.

I never used the budget feature on the Mac but have found it provides a useful insight now.

Unlike Tom I would need to continue with the Mac version to download transactions from banks that are not supported (all of mine) and to continue reconciling.

On the positive side, I have found what it does at the moment works very well once one gets used to it. Clearly a lot of thought has gone into it and it is very well executed.

When using the budget I found that it miscalculated the monthly payment in the budget summary if for example an item was scheduled every n years where n was great than 1, by multiplying rather than dividing by the n.

I would hope to see a tidier way of changing the date – something like iCal’s rolodex-like feature would be nice.

Looking forward to seeing 1.0.1 and 1.1, especially the help as I have yet to work out what the colour coding on budget is all about (haven’t tried too hard, but shouldn’t have to).

My concern is with bank transaction downloads. I strongly prefer QFX to direct access because I can control when my bank data is downloaded – which allows me to insure that I can review the transactions at the time of download. Frankly some should not be downloaded because they are duplicates that the system does not see as such. Direct Access appears to me to take away all user control.

Add to this that Direct Access appears to download before you can work with the file. Particularly with the iPad I tend to boot an app to do something quick and then go to something else. Direct Access appears to make this impossible.

Prioritized improvements for iPad…

1. Make sync at least as fast as the existing iPhone version.

2. Cloud-based sync across all platforms. Some competitors already have this.

3. Transaction Entry – Needs a good deal of UX improvement. I have a more comprehensive list if you want me to email it to someone. I took a typical transaction and entered it on Mac, iPhone and iPad, counting each user interaction required to successfully complete. Based on my quick calcs, the iPad design requires 26% more steps than the Mac version, and requires 37% more steps than the iPhone version.

4. Three-tap Editing? PLEASE let me single tap on a transaction to open its detail and edit if necessary. The current double-tap, then tap again wastes a lot of time, especially for some of the most common user interactions.

5. Budgets are helpful for my wife and i… but only if the information can be as current as possible. If you had a cloud-based sync, this could be updated within seconds across our iPads and iPhones so we always know where we stand BEFORE we make another purchase… instead of not knowing because we’re not in WIFI range to do a sync across all our devices.

If you want more info/feedback, let me know who to send an email to. Thx!

Correction:

I now see how to change currency rates on a transaction and how to edit a category name.

I noticed that the currency reported in a subcategory under the budget can be different from the currency in which the transaction was made, in my case £ instead of €.

Thanks for the update and the opportunity to provide feedback. My comments on iBank for iPad are as follows.

I wish to use my iPad in the way I have long used my laptop – as an alternative to my desktop Mac when I travel. My desktop will continue to be my main computer and hold the primary copy of my files. As such, I would like the iPad version of iBank to sync flawlessly with my iMac. Today that is not happening. Some but not all my accounts match after syncing. I remember that when I first moved from Quicken to iBank and transferred over a decade of data, the process was not painless and took a good bit of work to get all the balances correct. I attributed this to the problems of importing a files based on a standard. When I transfer data from one IGG product to another, I expect it to work better.

Given my use, I am less demanding of the feature set on the iPad but I would like to be able to do some analysis and reporting. Those features may be there but I have not explored them since the data has not transferred to my iPad correctly.

I don’t demand that the two versions be exact matches in features, but I need to understand the differences. iBank Mobile on my iPhone is not feature identical but I understand its limitations and how to use the two together. I don’t have that understanding on the iPad version. Features have names such as Budget and Scheduled Transaction on both versions, but they apparently mean different things and I have no access to documentation to understand the differences.

I use scheduled transactions extensively, not only to remind me of upcoming bills and simplify their entry but also to improve my use of the forecasting report. For the forecast to be accurate, my entire budget must be reflected in scheduled transactions. There are some where this is a bit clumsy. An example is the category Groceries. This is not a monthly bill but a collection of smaller transactions that occur at irregular intervals during the month. I set up one scheduled transaction for my monthly budgeted amount. Once a month I must post that transaction and then immediately delete it. I would like the option when posting scheduled transactions not to post while maintaining the schedule in the future.

Thanks again and I look forward to future updates.

Ian –

Thanks for the update. I’ve been attempting to switch myself off of the Mac version and on the iPad version of iBank. And while it’s clearly still a 1.0 release, I think iBank for iPad is the future of personal finance software. Direct Access is huge. The new budgeting/forecasting tool is promising.

Still, the lack of documentation (which you write about) has hampered my adoption. I am left wondering, for example, how to budget recurring split transactions or loans with fixed payments, but changing proportions of principal and interest.

More than just the pop-ups you outline above, I would like to suggest that you create a set of sample data to illustrate how you expect users to handle typical accounts and transactions–A John Doe’s Book if you will with a checking (with a paycheck being deposited), savings, a credit card, a loan, an investment account, and a basic budget.

You could either include this basic book in the app (for users to look at and delete if they don’t like it), or just have a pretty detailed presentation of it on your website.

It would also be helpful if there were a quick and easy way to notify you of banks that purport to work with Direct Access but that aren’t handled properly. (For me, this includes ING Direct, the Standard 401(k), Nationwide 401(k), UHEAA, etc.) Is there some sort of plan for how to address these shortcomings?

Thanks very much. You really have a stellar product on your hands here. With some work, it could come to define the next era of personal finance.

Ciaran

(As an aside, I note that a lot of the belly aching in the knowledge base and elsewhere comes from long-time users. I’ve been an iBank user since version 1.0. But despite my familiarity and reliance upon older versions, I say to move forward, you need to focus on the future, even if that means sacrificing some of these older users. To this end, I observe that:

–iCloud is the wave of the future is the obvious way that these apps should all sync. Yes, offering iBank only through the App store will cost a chunk of your revenue, and yes, long-time owners might be forced to pay for the app all over, but ultimately this is worth it. Consider this move for iBank 5.

–Direct Access is also clearly the wave of the future. So spend the time to make sure it works right. Don’t spend as much time figuring out why User X’s old data doesn’t sync properly.

–Ultimately, the desktop version should match the iBank version and vice-versa. Consider the iBank version the basic model. Add in proper scheduled transactions, reports, and iron out the bugs, and you’ve got a great product that can define the category in the next decade.)

I have to agree with many points that were already mentioned above. I use the iPad version a lot for entering expenses right away, so that needs to be simplified. Like the rolodex for the date (very annoying) or that I get autocomplete for the Payee. Most importantly, since Direct Access is not working for me in Switzerland, I need to be able to clear transactions more efficiently. The double tap and tap again just to change that flag is massively annoying.

Syncing through either iCloud or Dropbox would be nice, but isn’t such a killer feature. I’d rather see a performance boost in the app overall. Entering a single new transaction takes long, just because there are many taps, but just confirming the transaction and waiting for it to appear takes about 3 seconds or so, which I find super slow, considering that I’m on the iPad3.

Aside from the technical complaints, it would be awesome, if you could mention stuff like the international release in this blog. I’ve kept checking the App Store all the time, whether it was finally available. Would have been nice to be notified through this blog that it’s available.

And to not only complain, so far, I really like the app. It’s good looking and having my financial data on my Ipad with me makes everything a lot easier. I hope that you perceive all these complaints here in the comments as feedback from people that are eager to use your product and not just people bitching and complaining, because they think your product is crap.

I would like to use the iPad version without a mac version.

I would like to import files (QFX, but also CSV since that is the only option for one of my banks)

direct access is good if it stays optional. I also prefer downloading the files from my bank websites from specific dates.

one syncing/importing solution could be the use of DropBox.I have another good ipad app with mac version that allows wifi syncing between ipad and a mac on the same network, and also import of files (pdf) directly in the iPad using dropbox. For syncing between macs (and also their windows version of the app), they recommend changing the default directory for the files stored in the app to dropbox. Then on any machine, everything is updated. and if you don’t use a mac, that’s ok too.

I’d put in a vote for enhanced reporting / slicing and dicing for expenditures. When looking at Transactions, it would be helpful to do summary reports by Description. For example, how much money was spent at a certain store. How much money was taken out for ATM withdrawals. How much money was earned from a certain source, etc.

Far away from MS Money 🙂

First things first, I will ask for a way to delete a category/subcategory…

My current number one request is being able to sync from my phone straight to my iPad. I am going on a two-month trip soon and only want to bring my iPad and my phone, and keeping track of transactions on my phone throughout the day is much more convenient than my iPad. This one feature alone is making me hesitate on making the purchase because I currently only need my iPhone and iBank on my computer. When traveling, though, my iPad becomes my main computer.

I’m very, very concerned about the possibility that there will be a move away from scheduled transactions as a method of cash flow forecasting in the Mac version, since it does not appear that the iPad version is capable of doing the type of cash flow forecasting that I do on iBank for Mac (and that still falls short in many ways). I’m sure many people use the budgeting feature extensively and that works well for them, but the sole reason why I moved to iBank was because of the cash flow forecasting which was implemented, and my reluctance to buy iBank for iPad (and, as a result, the iPad itself) is based on this feature’s apparent absence.

Please–please!–don’t move away from the scheduled transaction model. There’s nothing wrong with having the budgeting feature available–I’m sure many people use it an love it, but it never works well for what I’m trying to do, which is know whether, for instance, I’ll have enough in cash when I have to pay for my wedding next year or in order to pay my property taxes, which budgets don’t do. It’s great that I’m $50 under budget on groceries for July, but how will I know if my credit card bill from buying a new lawn mower will require that I move money from savings to cover my personal property tax bill?

Super frustrated by the budget feature (since this is the primary reason why I spent $15 on this app). If I’m trying to manage my budget, I don’t want credit card payments going against my budget. It’s stupid. I see my expenses go up throughout the month and then immediately drop back to zero when my credit card payment goes through and now “Budget” unhelpfully and incorreclty tells me how “ahead” I am for the month. Also, including every single payment against my budget is erroneous as well. Users should have the ability to state which categories should be included in the budget. I don’t want to track things I’m reimbursed for, or have investments, etc. count against me.

I’m frustrated to be out $15 and still having to use Mint’s app to manage my finances.

@Ethan If you manage your payments to your credit cards as transfers, they won’t show up in the budget.

I use scheduled transactions extensively & agree with other users’ posts about maintaining this functionality on both iBank for Mac & iPad!

I recently made the transition from Quicken to iBank, and so far I love it. I have two suggestions for your development team:

1. Is there any way to put this data in iCloud, thus eliminating the sync issues? Or does apple keep close hold on file types stored on their servers?

2. In iBank for Mac, suggest you program the Calender interface to appear automatically after clicking on a date text box.

Great program! I look forward to further updates,

I moved from iphone to ipad version. the initial sync just jams up (over wifi) and never completes (even overnight). i probably have 500 entries in the imac so it should not be a huge load.

i would encourage you to think of an icloud solution for this. right now, the ipad app is unusable.

Is there a way for me to future forecasting on the iPad budget in bank? If so please tell me. Thanks