In one of the earliest blog posts about our forthcoming iBank for iPad app, I talked about how ease of use was a driving force in its design. In this post, I want to go into more detail about what we mean by that. Specifically, I will cover some ways you get your financial data into the app that don’t involve entering everything manually.

When you first set up a document you’ll be presented with a choice: do you want to sync with iBank for Mac or use the app standalone? If you choose to sync with iBank for Mac, your account data will be transferred over, including all security/investment transactions – unlike in iBank Mobile. You can then edit your transactions, add new transactions, add/edit/delete accounts, etc. There isn’t anything too new with this concept, yet there are some non-trivial improvements over iBank Mobile syncing.

The more interesting discussion occurs when we talk about choosing to use the app “standalone.” We knew from Day 1 that if we developed iBank for iPad we needed to have a really good solution to aggregating your financial data. Manually entering transactions is so 1990s. The current OFX solution we have in iBank for Mac works great, if your bank supports it. The problem is, there are too many banks that don’t support it and likely never will. We also considered having users log in to their banks’ websites via Safari on the iPad, or having an embedded WebView (much like the built-in browser in iBank for Mac). But this solution is wrought with problems too – the biggest being it can get tedious fast if you have more than a couple of accounts.

I’m pleased to announce that we have a solution that allows our users to connect to thousands more financial institutions than what we currently support via OFX. While not every bank is supported, it’s easily a ten-fold increase over our existing supported financial institutions. Even the little credit union here in southern Vermont works. We’ve partnered with a company to assist us with this account aggregation and we are really excited about their services.

Having this ability to get data from so many banks, coupled with the any time, anywhere mobility of the iPad, pointed to a name for the app that seemed both obvious and inevitable. We call it iBank Access.

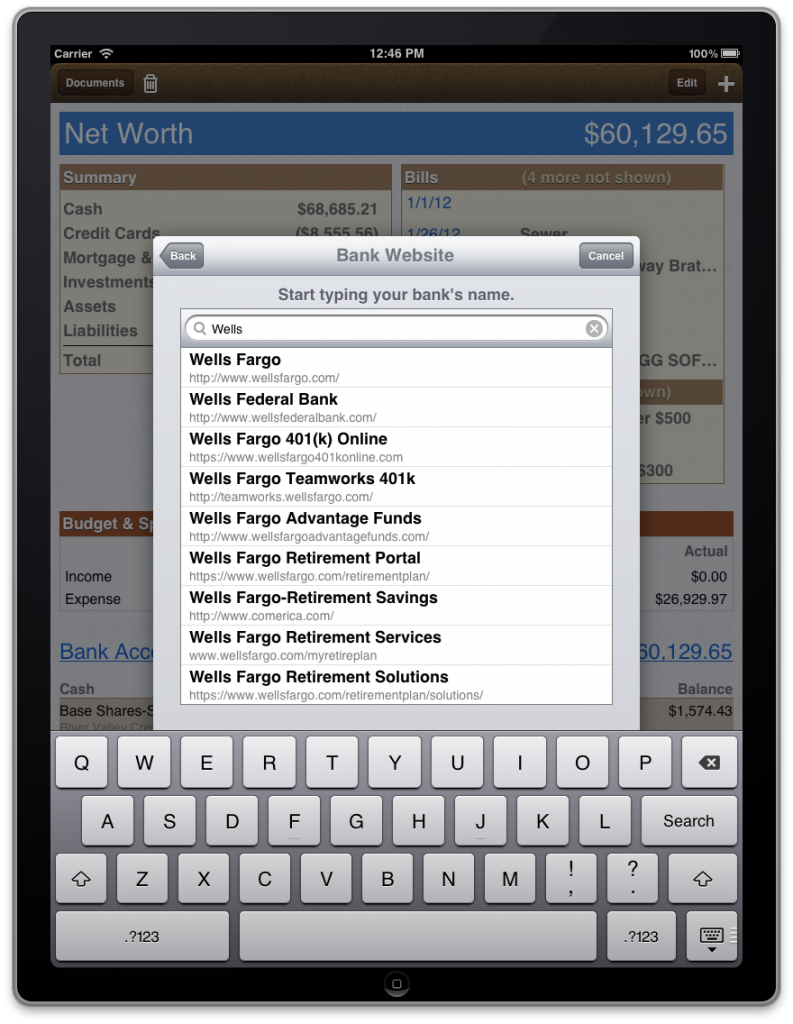

Here is how it works (and note that none of the screenshots here are final). The account set-up assistant gives you two choices when you create a new account. You can either set up a “manual account” for which no automatic downloading will take place, or choose to link the new account to a financial institution. If you choose the latter, you are asked to type in the name of the bank where the account is held. This is where our massive list of supported banks gets filtered as you type:

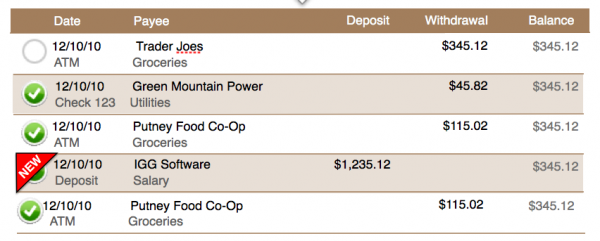

After you enter valid credentials to log in to the bank’s website, you are given a list of accounts that you have at that financial institution – with the option of choosing which accounts you actually want in iBank. For example, many folks might have a checking, savings and even credit card all at the same bank and in the last screen you would be given the option to choose which of these you might not want to import. Most users will link all of the accounts. When the accounts are created, iBank imports available historical transactions associated with each account and even does some automatic categorization. Here is where the beauty of our new aggregation system really begins to shine. Each time you launch the app, it goes out and fetches any new transactions. Unlike iBank for Mac, however, there is no separate window that appears where you have to manually verify which transactions to import. The new transactions just automatically appear conveniently marked:

Transactions that have been manually entered are matched based on date and amount, and their status is updated as appropriate.

As you can see, the process of updating accounts is really not much of a process at all. They just update. No more download or import button, no import window where you have to manually reconcile each transaction. It all just happens when a user opens their document. I’ve been using the app daily, and just having all of my personal accounts up to date, all the time, is pretty amazing.

To be transparent, there is a downside to this approach: it will cost money. Again, current users of iBank who are satisfied with the state of their accounts will simply be able to sync their desktop data to iBank Access. We know many of our current iBank users already have iPads, and while we haven’t settled on a final price for the app, the goal here is to make it an inexpensive add-on.

But in keeping the app affordable, we didn’t want to take the approach some competitors do and sell your personal financial information (while marketing the service as “free”). I don’t want ads for credit card offers or loan refinancing, so our model is simple: if the user wants to take advantage of automatic account data aggregation, there’s a small monthly subscription fee. We don’t have an exact price point yet, but I anticipate something in the range of a fancy cup of coffee. Because there are significant, ongoing costs in partnering with a third-party aggregator of bank data, a pricing structure with an optional subscription seemed the best model for all users: no ads, a reasonable app price, a nominal cost for those who want data updates automated, but no extra fees for those who sync with iBank.

There’s still lots more to tell you about iBank Access. In future posts I hope to cover in detail some of the other features we are really excited about.

-Ian

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

Fantastic update. I am a bit impatient for the final release. Just a point for me, as good as iBank Access will be, I would be happy to sync with my Desktop and IPhone versions.

Keep up the good work.

Can we get a rough idea when we can see a release? Are we talking Late Summer, or sometime early Spring like say before Easter?

I’m betting we won’t see a release until 2013, december 2013, if even then.

Are you still using MobileMe to sync? I won’t have an iPad for the foreseeable future, and I’ve been wondering when you’ll update the iPhone app to not depend on MobileMe – hopefully before June 30th!

Thanks, this is certainly encouraging. Some questions, though: I’m currently trying out iBank for Mac. In order to download our account information more easily, I opted for the “direct” download method. Bank of America charges me $9.95/month to have this direct access enabled. Will iBank access then require another charge for accessing that same data? (albeit, through its third-party aggregator)

And, as always, what security guarantees are provided by this third-party company? I’m trying iBank instead of Mint, purely in an effort to keep my financial information from floating through to multiple other parties.

Thanks –

This post does not mentioned syncing between instances of the iBank apps. For example, my family has an iPad, two iPhones, and at least one Mac that we would like to keep in sync wrt iBank data. Is syncing in this sense still available? Is it still mediated by iBank on the Mac? Or, will the entire line-up receive at least a back-end refresh when iBank Access is released? Syncing between instances can become complicated if my wife and I each enter transactions on our phones and Macs and our iPads are simultaneously downloading this information from the bank without reconciling across devices.

Concerning the new automatic download functionality…

How safe and secure is this process? It seems that we will have to hand banking IDS and passwords over to a third party so that they can retrieve our data. However, they can also create new accounts, request new bank cards, change addresses, and transfer funds with this information. What measures are in place, beyond the integrity of this third/fourth party to prevent this from happening?

Will the app be usable while it downloads transactions in the background? Or, will I have to wait several seconds or more for the app to open before I can use it?

What transactions will be downloaded? My bank shows pending transactions almost immediately and posted transactions each morning; however, the pending transactions can change before they are posted (e.g. tips at restaurants are only reflected in the posted transactions). It would be great to have access to these pending transactions, but some users may find the dollar authorized by gas pumps and incomplete amounts from restaurants to be confusing and frustrating.

It seems that the new method does not rely on OFX access. Does that mean that I can drop that service (and fee) from my bank(s)? If so, I am even more interested in when iBank for Mac will have this functionality, or how it can take advantage of this functionality by syncing with iBank Access. How will this functionality work on multiple iPads, or, eventually, iPad/iPhone households?

Can each instance include and sync a unique set of accounts? For example, I’d like a portfolio for my personal accounts and another one for business, but I would only want my wife to have and sync our personal accounts. Should this be possible?

As others have mentioned, I’m really excited about this update to my existing financial work flow. Are we getting close to a public beta, perhaps? Any thoughts on the timeframe for initial release? I’m looking forward to it!

Russell

Another thought…. Is the a way to import existing iBank transactions and still use automatic downloading? The term “standalone mode” connotes a disconnect from the data that I’ve been recording for years. This would be a real turn off to me and, I imagine most potential customers, who all have similar amounts of legacy data. Is it possible to import the data from iBank first and switch to automatic mode later. (I actually really dislike the term “standalone,” because with multiple family members, business partners, and devices, few if any users will want this app to “stand alone.” Data should be connected and accessible, not stand alone.)

Russell

Are you planning to support any banks outside of USA with iBank Access?

Many banks are charging a fee now for downloading transactions. For anyone with multiple bank accounts, this is getting to be a prohibitively expensive exercise simply to save time. Adding an additional fee via iBank on top of local bank charges makes this an even more unappealing feature.

If you add a true cashflow forecast feature you will own the market. Just sayin.

http://satisfaction.mint.com/mint/topics/cash_flow_forecast_tool

Will there be a corresponding update to the existing iPhone app? (In effect, will iBank Access have Universal support or will it be completely separate?).

Thanks, keep up the amazing work!

Great! Great! But you should not forget your french users for the direct download. You should have a look on Bankin’ and Linxo which offer the feature you described for an idea of the list of financial institutions supported. They are well rated on the french App Store.

Warm regard!

Everything looks nice so far but I have a few questions:

1 – If I want to manually retrieve my transactions from my bank using Safari do I have that option?

2 – What if the downloaded transactions do not properly match to my manually entered transactions? Is there a mechanism to correct that?

3 – Can I import historical data from Quicken?

Thanks,

Jamie

Sounds good… I hate paying monthly fees but if this were to work with all my accounts it might make me bite. Will there be a trail period to see if all your accounts work? Also would really love to have everything seamlessly sync with icloud? Excited to see where things go. Thanks for the update.

As long as you are going to a subscription based third party approach here, wouldn’t this also be a way to finally add bill pay to your product line? We have been waiting a long time for this feature.

I’ve been using iBank for a while and it will be my Quicken replacement. I like the option of using auto download or not. On price…I hope it won’t be another $60 dollars. I don’t mind paying you for your efforts and will gladly pay in the $10 range.

I look forward to the IBank Access app for IPad but also have a couple of questions.

1) While the subscription component downloads transactions automatically and it appears OFX support is going away, are we going to be able to use our iBank for Mac software to download the transactions from our investment accounts with OFX support and then sync it with our iPad Access app? Right now, I much prefer manually entering in transactions from my bank accounts and only downloading transactions from my investment accounts (one being Vanguard which I have to manually download anyway.) I can’t see having to spend $5 or more per month to download transactions from a couple of investment accounts.

2) Are we going to have all of the reports available to us that we currently have in iBank for Mac? Are we going to be able to modify and print out these reports from iBank Access? Can we get a comparison report available? (Should be a simple report to get ready as it would just combine a couple of already available reports into one.)

Thank you

If I had to guess I would say the company they are using is Yodlee. Only two companies really do what he is describing. Mint and Yodlee. Since Mint is now owned by Intuit which make Quicken, I doubt Intuit would allow them to work with IGG.

I like the progress so far! However, I would echo some of the previous posts, i.e., any release date set?

Secondly, I prefer to enter all of my banking transactions manually. It keeps me in touch with the budget and my day-to-day spending. My idea of iBank Access is seamless syncing via Dropbox between my iPad and the two Macs that share my iBank data via Dropbox. I would not ever turn over my banking ID’s to a third party! I only download (for free) my Savings Account and Credit Card transactions once a month. I tried the download from my bank a long time ago, but found myself editing each transaction because the bank uses abbreviations and codes for identifying each transaction. I have developed a habit of collecting and entering transactions on a daily basis and reconciling every morning. This my seem tedious, but I have found it to be very efficient. Until downloads from financial institutions mirror the way I enter transactions, I will continue to enter them manually.

Thirdly, if the app is to truly sync with the desktop version via iCloud or Dropbox, then the app will need an interface with those services in the setup. For instance, the set-up process should ask “Where is your iBank data file?” We could then enter our credentials then browse to the file.

Lastly, if the app is a true mobile app with all the functionality of the desktop version, I would not mind paying as much as the current desktop version.

Looking forward to release and having iBank with me on the road!

I really like Lindsay’s post and pretty much mirror her thinking.

Manually entering transactions is how I prefer to do things. Until transactions fully clear, they can vary (e.g. restaurant bills as well as gas stations which will often take out $1 that doesn’t adjust to the correct amount for several days.) My bank also can take a while to clear transactions and I like to be spot on from the moment the transaction occurs. (I purchased iBank Mobile so I can update my accounts at the POS.) Due to this, I think it can be understood that I do not see myself paying the monthly amount for the automatic download. I hope the manual download is still an option.

During a previous Developer’s Blog Post, I seem to recall that the app is designed such that it can be taken to a Financial Advisor. This makes me hopeful that it will be as functional as iBank for Mac. If this is the case and iBank Access is not a stripped down version, I could definitely see spending as much for it as I did for the iBank for Mac version.

Sounds interesting, but one of the weakest aspects of iBank is the auto-download process that rejects anything of the same amount within a 5 day period, even if the payee and/or memo is completely different. You need to do something about this, otherwise the iPad version will have significant issues – and perhaps you could fix this issue in the Mac version as well, as it was raised a little over 3 years ago ;).

I would like to echo other’s comments on this one point: WHEN will iBank for iPad be available?!

Again, as asked many times earlier, WHEN will ibank for IPAD be available?!??!??

I JUST purchased iBank Mobile. Does this mean I just purchased an app that has reached “end of life.” ? I was hoping to see budgeting in it.