The funny thing about writing software is that the concept of “done” is arguably non-existent. As soon as SomeSuperApp 1.0 is released, it’s time to start fixing bugs and thinking about features to add. The release of a point version like 1.0 or 2.0 marks a milestone, but from my perspective the application isn’t “done.” So while we were finishing up testing iBank 4.0 we already had a list of features and bug fixes for 4.0.1, 4.1, and other future releases.

4.0.1 and the smaller subsequent patches where just that: “patches.” But 4.1 has been fun to develop because it brings an impressive set of features, polish and bug fixes, and that is what I mostly want to talk about in this post. Please note that iBank 4.1 is not available at the time of writing, but we hope to get it out in early December 2010.

Before I get into some of the juicier, meaty features we’ve added, I’ll start with some of the smaller enhancements:

1. Sorting for transaction templates, scheduled transactions and import rules. (Yay, finally! ) We wanted to get this in for 4.0, but it didn’t happen… sorry about that.

2. Preference for hiding the image column and iPhone syncing on launch is restored.

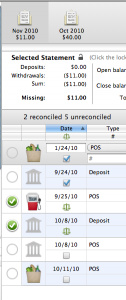

3. Reconciling. Our small little balance image wasn’t obvious enough for users when they were reconciling. Now we have the big green checkbox. It only appears when the selected statement is “unlocked.” The sort order of statements has been reversed too, no more scrolling to the end to get to the most recent statement.

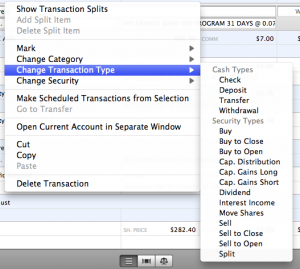

4. Contextual Menus. They’ve been added to the source list and the transaction table with a little style:

5. Reports (mini feature). You can now use “daily” as a report frequency.

6. Reports (bigger features). We’ve added a setup assistant. Many customers, after they created a report, didn’t realize they could edit them later to refine them. Now you’ll get a setup assistant to choose categories, accounts, date options, etc.

7. Scaling reports! Hooray. All reports now have a nice looking slider for zooming in, out and “size to fit.” Not only does this allow for more customized viewing, it also allowed us to improve the font size when printing.

8. Forecasting. iBank 3 had an OK forecast engine. In v4.1 it now rocks. You can forecast out any account for as long as you want and use a slider to scrub through your details. We actually aren’t done with this yet (drill-down still doesn’t work, the pop-up bubbles still lack some info, etc.), so we aren’t quite ready to show a screenshot of this, but when we are, we’ll post it on the blog.

9. Want to see more split items in a transaction? Now you can just drag and resize the split editor to whatever height you want.

10. Some users want their “hidden” accounts to be used in reports and smart accounts — you can do that now, as an option.

So building upon a strong start is one of things I’ve been doing since we released iBank 4.0 and we think you will really enjoy what we have in store for iBank 4.1. I’m sure we aren’t going to meet everyone’s “you gotta add this for 4.1” list, but we’ve done pretty darn good.

Cheers to never being “done.”

Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

At first I wasn’t quite sure with iBank v4, only because I was used to version 3 for about 2 years and liked the way it functioned. But I wanted to congratulate you guys on a job well done with version 4 and I don’t miss version 3. I love the new reporting feature most of all. I like how I have 2 reports for my investments that tell me my gains, short and long, my net worth, and I can create just about any report for any type of account. I truly can see the value of my accounts better than what version 3 could do. I like how the interface seems cleaner and easier to use. Keep up the good work!

I was us unsure about IB4 like Eric M however since completing the demo of IB4 and purchasing the upgrade, I can say that I am very pleased with the progress of the app. As Ian noted above, there is always room for improvement and such is the case with IB4. This version has taken the app a giant step forward from IB3. That is saying something since I really loved IB3. My biggest and most frequently asked for request was added to IB4. I love the fact that I no longer have to get out the calculator to figure out what I have left in a budget line item! The long awaited “Remaining” column has been added.

I would suggest adding an additional summary feature to view Cleared Totals. IB4 hides this information in the account preferences. I have to double click the account to see the “Cleared Total” for a particular account.

I would also hope that the update Ian describes above will also address the constant hanging/crashing of the app. IB4 freezes constantly when performing any task, i.e., transaction entry, budget review, accessing reports, backup to MobileMe, editing transactions, etc. I have to launch Finder to force quit the app and restart.

Looking forward to continued improvements!! Keep up the good work!

The list of improvements in 4.1 validates again a major reason I chose iBank, beginning with 3.5.5: because the developers really listen to user suggestions and are energetic about enhancing the application. I will particularly welcome the resizable window for splits and the scalable reports.

Thanks for the update and thank you for such a great app. I have seen many other great suggestions for new features and improvements on the forums and would love to see some coments from the ibank staff on which ones they are considering. Or even a list of accepted requests.

I couldn’t agree with TRB more! I left Quicken when IBK3.5 came out. I haven’t looked back since. This new update is everything I wanted. Anything more, and I will just be blown away. Thank you IGG!!!!!! I can’t wait to see how iBank Mobile evolves!

Is IGG working on hiding securities with closed positions? It’s been promised.

I have billpay on Quicken. WHY can’t we have it on iBank? It is the main reason I have not tossed my old PC yet. Is this feature EVER coming to iBank, or should I just forget about it?

Thanks for the new features expected in v4.1. However, I am very disappointed that there is NO IMPROVEMENT in the budget feature and no timeline yet for budget reports. This is the main reason why many people still hanging-on to Quicken (which has far better budgeting & reporting options).

I was about to dismiss your software as another one that did not offer cashflow forecasting. So happy to see you are planning to reintroduce this more powerful tool at your next release. I guess I’m going to buy…

In response to Dayanand’s comment…the new budget feature in IB4 is a great improvement over IB3. In IB3 we had to look at the Budget Monitor and get out a calculator to see what was left in a budget category periodically throughout the month. The addition of the remaining column was a great fix! The “Income & Expense Report” is a great report to view the overall progress of the budget in a summary format. Dayanand…if you are looking at the Envelope Budget method switch to the line item view!

I too am pleased and excited about the prospect of cash-flow forecasting similar and hopefully as good as that of Quicken for PC. Quicken for Mac is the program I am currently using as I simply refuse to continue to use a PC nor will I allow microshaft to be loaded on my mac so the option of using quicken for pc is not for me.

I would appreciate two things, being notified when your update for forecasting is released and at that point I will purchase your software. The other thing I would like to know is why in the heck did I have to wait so long for this feature to become available? I certainly can understand why one needs to look at spending patterns BUT, in my opinion, one should be more concerned about FUTURE spending patterns and how tweaks to your scheduled transactions might effect future balances.

I have used the quicken calendar with the balance bar below the calendar which gives you a visual representation of your balance using any account or combination of accounts you might prefer for any month the calendar is currently showing and takes into consideration your scheduled transaction list where in you should have entered in all known debits and credits (think bills and paychecks for the future).

This was an invaluable tool that I used to plan for my retirement and one which I will not forego just to try out new accounting software.

If you have read all of this please let me request that I would like to be informed via email when the update to your software has been made available that provides for this type of forecasting as well as why you have chosen to leave it out in past versions…befuddling to my way of thinking why this great tool has been left out of so many accounting software programs.

I too am pleased and excited about the prospect of cash-flow forecasting similar and hopefully as good as that of Quicken for PC. Quicken for Mac is the program I am currently using as I simply refuse to continue to use a PC nor will I allow microshaft to be loaded on my mac so the option of using quicken for pc is not for me.

I would appreciate two things, being notified when your update for forecasting is released and at that point I will purchase your software. The other thing I would like to know is why in the heck did I have to wait so long for this feature to become available? I certainly can understand why one needs to look at spending patterns BUT, in my opinion, one should be more concerned about FUTURE spending patterns and how tweaks to your scheduled transactions might effect future balances.

I have used the quicken calendar with the balance bar below the calendar which gives you a visual representation of your balance using any account or combination of accounts you might prefer for any month the calendar is currently showing. The calendar takes into consideration your scheduled transaction list where in you should have entered in all known debits and credits (think bills and paychecks for the future).

This was an invaluable tool that I used to plan for my retirement and one which I will not forego just to try out new accounting software.

If you have read all of this please let me request that I would like to be informed via email when the update to your software has been made available that provides for this type of forecasting as well as why you have chosen to leave it out in past versions…befuddling to my way of thinking why this great tool has been left out of so many accounting software programs.

V4 a fantastic job well done. My major issues remaining are inability to create a budget for a set period ie any Custom Set Dates [none of this last quarter/half year/last year etc] & the same with Reports – Custom Date Settings for start & finish. I would also like to see the Pop Up Inspector drop down prior to creating a report, would be much easier to select Custom Date, Select A/cs, in/out Categories etc all before report production. Overall an excellent production & a good base to work from.

ibank sounds really cool! Are there any plans on making it run in windows I would drop Quickbooks in a heartbeat.

I just want to thank you for getting “it right!” What a simple and elegant application that can be as complicated as you would like to have. I too am a former user of “brand X” and have not looked back since IB3, and now with this update, it’s fabulous.

I have been doing everything in Excel, and it has been difficult, but now, this is just great. I’ve also “brought in” my previous Quicken files and converted. Great!!

Thanks again.

PW

I bought a Mac the middle of 2010. My world was turned upside down trying to use a Mac. I used Quicken for years and tried to use Quicken for Mac’s but it was not going to be easy so I changed to iBank. This also has not been easy. I know I have a learning curve but boy what a curve. I will conquer and not give in. iBank 4 is better but there are still some simple tasks that are not clear why they are set up the way they are. For example why does a reconciled statement show the start date? It should show the statement end date. You want to know the end date of the last transaction was reconciled not the date you started to reconcile. Why is it that I always have to click in a transaction to start using it. Cant the default just start in the last transaction or be able to use the arrow keys to move around the window. Why isn’t there an option choice to change some or all default settings. Thank you for creating an alternative financial software.