Update March 30, 2022: Please visit www.banktivity.com to get the latest version of Banktivity! We will leave the rest of this article intact for archival purposes.

Today I’m pleased to announce the immediate availability of Banktivity 7!

For over the past year and a half we’ve been hard at work on bringing you the best version of Banktivity we’ve ever created. So without further ado, let’s jump in explore what is new in version 7!

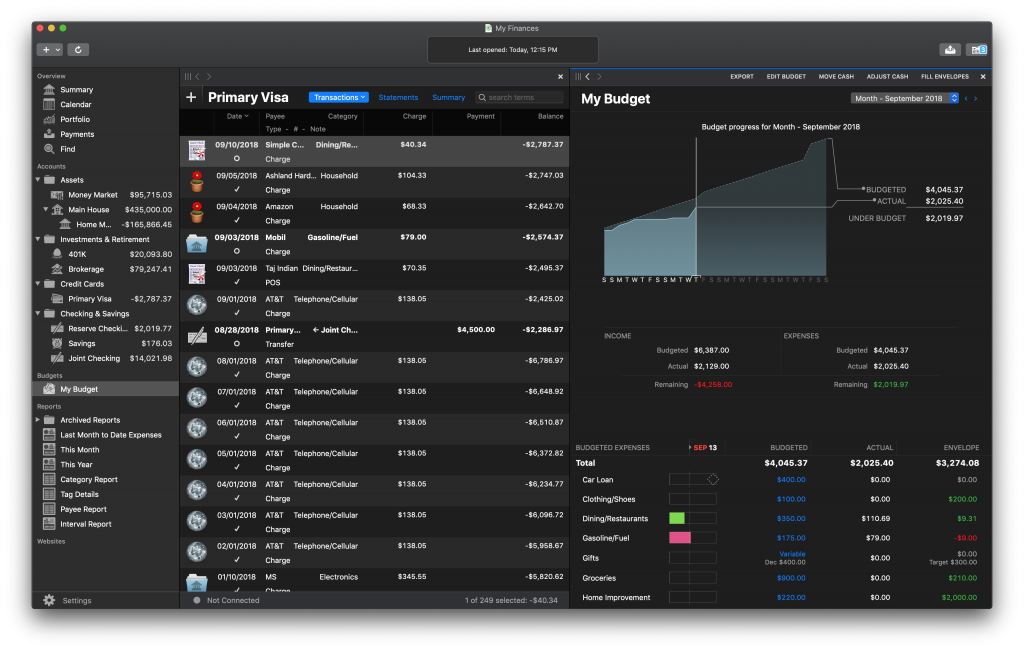

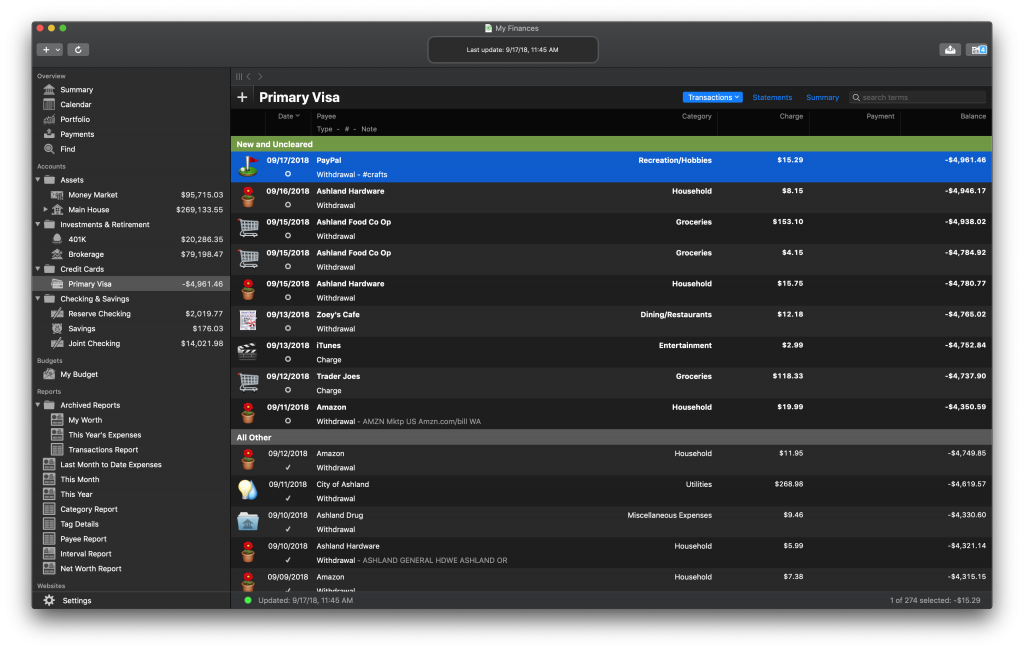

Dark Mode for Mojave

Apple has set up a pretty predictable launch schedule with its new versions of macOS and iOS. It goes like this: in June at the World Wide Developers Conference Apple gives us a preview of the new features that are coming. Then we have about three months to adopt any of the new features in the operating systems and make sure our apps don’t just break with the new versions.

When we saw Dark Mode in Mojave, we knew we wanted to support it. Dark Mode is great for so many different uses on your Mac and for many people here at IGG it has become their preferred work environment.

We like to support the most recent macOS versions as soon as we are able and I’m thrilled that this year we don’t just support it, but can wholeheartedly embrace it with Dark Mode. This wasn’t a small undertaking, we put a lot of resources into looking at every screen and restructuring how we bundle our visual assets in the app. The rewards for this hard work have been great. Check out how nice Banktivity 7 looks in Dark Mode on Mojave:

Banktivity Summary screen in Dark Mode

Banktivity in Dark Mode with two workspaces: regular register and budget

Banktivity in Dark Mode with two reports in workspaces

Banktivity credit card register with new and uncleared transactions separated out.

I hope those screenshots give a sense of how your finances will look in Dark Mode. Although this is strictly a visual feature it shows our commitment to the macOS platform and overall user experience. One last thing to note: if Dark Mode isn’t your thing, don’t worry, the app still looks great in the Aqua user interface.

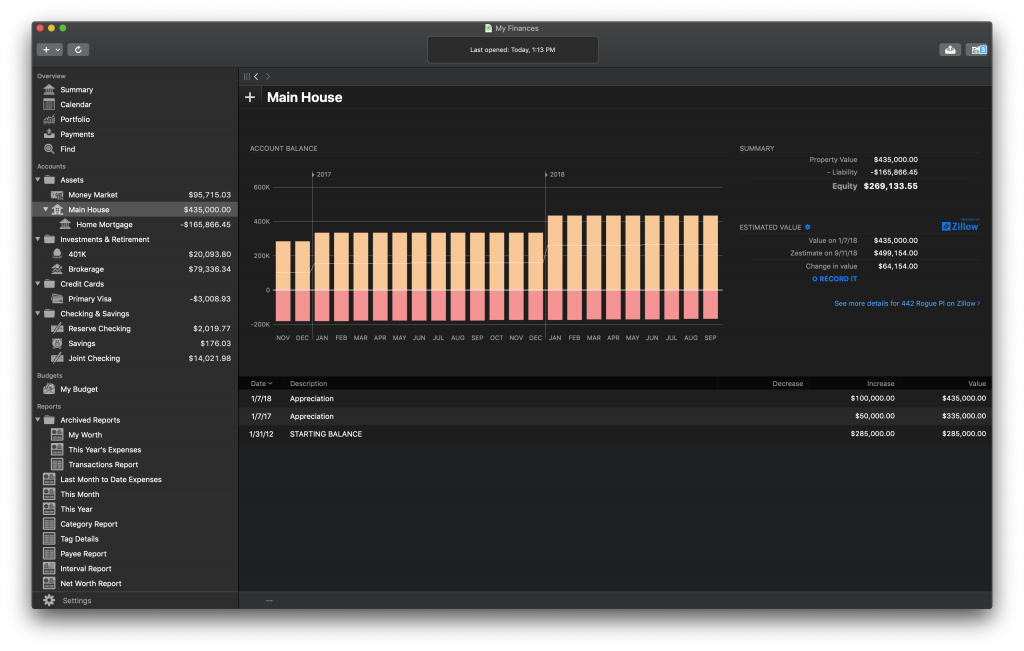

Real Estate Tracking

It is true that you’ve always been able to track the value of your home or other real estate properties in Banktivity, but it has never been a great solution. In the past, you had to add an asset account and manually adjust the value of your home asset to what you think it might be. This approach has always left a lot to be desired. Wouldn’t it be nice to have the value of your home automatically calculated? And wouldn’t it be nice if you could easily see how much equity you have in your home after you factor in any mortgages or lines of credit? Well, now you can in Banktivity 7.

For Banktivity 7 we’ve integrated Zillow’s estimating capabilities right into Banktivity. We’ve also designed an entirely new real estate view when you are looking at a home in Banktivity 7. Further, you can now link your real estate accounts with the loans associated with them and see a more complete picture of your properties all in one place.

This screenshot shows the new real estate account view:

Banktivity 7’s new real estate view with Zillow integration

For the real estate view, there is no reconcile or search as they never really made sense for assets like a home. Instead, you get a simplified register view to show your “transactions.” On the right we show you the value of your home as recorded in Banktivity and the value of your home according to Zillow. You can click “Record It” to enter a transaction that will bring up the value of your home to match Zillow. Two things to note: 1) pulling of prices for Zillow is tied to your Direct Access subscription and 2) Zillow currently only supports homes in the United States. So if you aren’t a Direct Access subscriber and you have one or more properties in the United States, it might be time to reconsider!

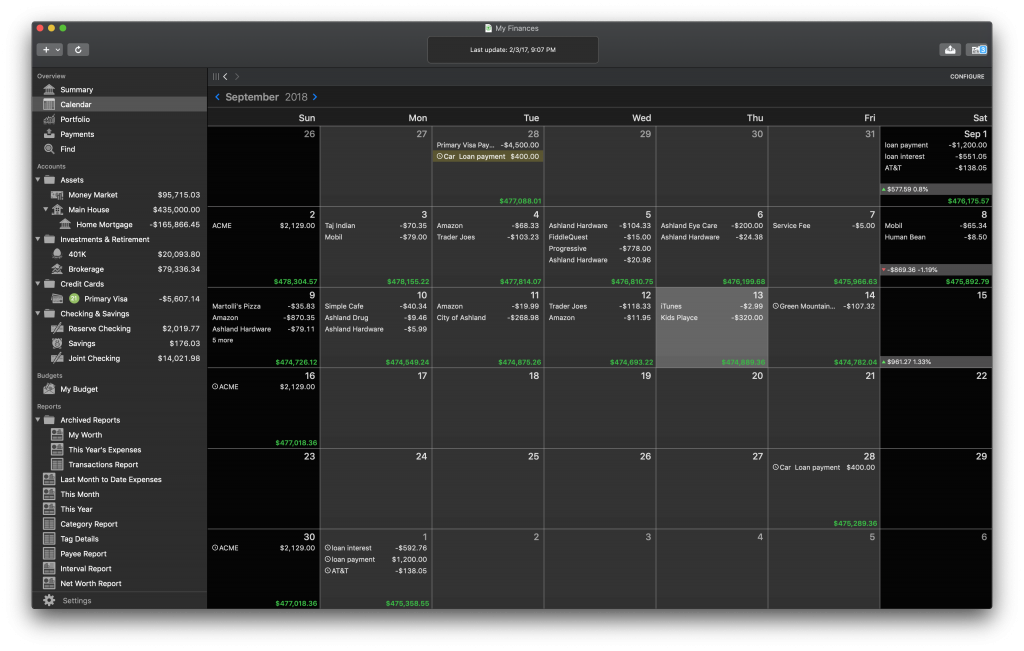

Calendar

For many years our customers have been requesting a calendar view in Banktivity. They want a place to see their past and upcoming transactions as it relates to a calendar. I’m happy to announce that Banktivity finally has a calendar view!

Our new calendar view shows your posted transactions and upcoming scheduled transactions. It also calculates a running composite balance and a summary of how your investments have performed each week. The calendar is interactive too. You can click on transactions to see them in their account. For unposted scheduled transactions, you can click them and then take action on them by either posting them, skipping them, printing a check or paying online. You can also configure the calendar to only include the accounts you are interested in.

Banktivity’s new calendar view lets you see past and upcoming transactions and important summary info.

User Requested Features

We’ve received a lot of great feature requests since the launch of Banktivity 6. We worked hard on implementing many of them, so much in fact, many deserve to be iterated here.

Stock lot selection. When you sell securities you can choose which lots to sell from, or use the FIFO default

Search Everywhere. Now you can search your payees, categories, accounts, securities and tags.

Improved Reconciling. We made some great improvements to reconciling. You can choose to have Banktivity auto-reconcile all transactions, no transactions or just the cleared transactions. We also added search to the reconcile sheet and it remembers the last size you left it at. Last but not least, we made the button to create a statement more obvious!

Customize the Summary View. You can now choose which accounts you want to be reflected in the summary view. You have options for the accounts used for your net worth, and for the income and spending calculations you can customize the accounts and categories.

Create Reports Based on Reconciled Status. This is a small “nice touch” but for many people, it will be very welcome. In the past, there was no way to find all of your uncleared or unreconciled transactions across all of your accounts. Now you can make a transaction report that does just that.

Faster Direct Access. Get your transactions into Banktivity faster.

New Account Types. We’ve added a bunch more account types and you can even change account types after an account has been created, within reason. For example, you can’t change an investment account to a checking account, but you can change an investment account to a 401k.

…and More. There are lots of other goodies throughout the app that I won’t go through here. I encourage you to try it out!

System Requirements

Banktivity 7 will only run on macOS High Sierra and macOS Mojave (at the time of writing macOS Mojave is the most up-to-date operating system).

Mac App Store Purchases

For the first time ever we are offering a free trial on the Mac App Store. The Mac App Store free trial is just like the one we offer from our website, it’s good for 30 days. If you have purchased Banktivity 5 or Banktivity 6 on the Mac App Store in the past you can now get upgrade pricing on the Mac App Store, yay!

Pricing

Regardless of whether you buy the app on directly from us or through the Mac App Store pricing is the same. Customers upgrading from Banktivity 5 or Banktivity 6 can get version 7 for $34.99 USD. If you are new to Banktivity, you can buy version 7 for $69.99 USD.

Wait, I just bought Banktivity 6! If you bought Banktivity 6 directly from IGG Software between June 26, 2018 and September 24, 2018 you can get Banktivity 7 for free. Just contact our support and ask for a new code and they will take care of you. Our 90-day money-back guarantee policy is only for our store on iggsoftware.com. When you buy Banktivity from another retailer like Amazon or the Mac App Store your purchase is governed by their refund policy.

Closing Thoughts

Launching a new version of a big powerful app like Banktivity is always a huge milestone to hit. (Really launching a new app, big or small, is a big milestone.) Our developers and QA have been hard at work on putting in new features, fixing bugs, all while keeping an eye at the future so we don’t accidentally box ourselves into some technological corner. If we didn’t put the feature you really wanted, I’m truly sorry. Deciding which features to implement is always a balancing between customers, technological requirements and outside forces (like Apple’s release cycle).

This is truly the best version of Banktivity we’ve ever made. I’ve been using it for my personal finances for a while now and it’s a real joy. And of course, my finances have benefited from it as I’ve been strictly envelope budgeting for over a year now. So please, go out and download Banktivity 7 and let us know what you think!

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

Let me be the first to give “Grads” to all the people involved . I look forward to the upgrade !!

Sorry for being a bit dim, but how does one access the (non MAS) upgrade (from 6.3.2) price? I can’t see it on the website.

Hi, to take advantage of the upgrade pricing you’ll want to download Banktivity 7, https://www.iggsoftware.com/banktivity/trial.php and then purchase from within the app. There will be an option to upgrade from Banktivity 5 or Banktivity 6.

Hi, is there a way to upgrade from downloaded Banktivity 6 to MAS Banktivity 7 or are you always stuck on whatever was the earlier installation path?

This appears to be true but only if you bought the previous version through the Mac App Store. What If I bought it directly from IGG? Why on earth would your upgrade from a previous verion not apply to what was purchased directly from your site??? I’ve using Banktivity and previously iBank for several years and this origin of purchase has always been an ongoing issue but half the time you have to buy it through the site and half the time through the Mac App Store. Can you figure out how to establish a consistent policy across both options???

Wow this is great Ian, I literally came to the blog wondering if you’d comment on Mojave compatibility and saw this. I literally just renewed my subscription on Sept 21st, I assume the subscription for direct downloads carries from 6.x.x to 7?

Yes, absolutely it will carry over. Your Direct Access subscription is tied to your Banktivity ID, which you can use on any device with any of our apps.

Are there any improvements planned for iOS? The last iPad update wasn’t really a major release. If nothing related to iOS is on the very near horizon, I won’t upgrade the Mac for another $35. I will then move to a better solution.

Glad to see a new version – congratulations! Can you comment on whether tags can now be saved in scheduled transactions in iBank 7? It is extremely frustrating to have to remember to assign a tag to every scheduled transaction even though it is the same tag every time. And regarding searching based on tags, is there a way to search for entries that have no tag assigned?

The ability to tag scheduled transactions within the schedule definition itself would certainly get my vote for desired functionality.

Thanks so much for raising this Kent – this is really frustrating me too in Banktivity 7.. This version is new and glossy but does not seem to tackle basic long standing workability issues that have been reported for a long time – despite demanding an upgrade fee.

1) Tags in scheduled transactions is a key one

2) Another for me is not being able to select a category by typing the first few letters of its name – I have to instead try and remember what category group it’s in and start typing the group name instead. Why??

Agreed. The categories area could use some major work. Finding and managing categories is an exercise in frustration, as there is no search, and insufficient indent to see clearly which sub-categories are nested within each parent category. One is forced to scroll endlessly up and down to find entries, and capitalized and non-capitalized entries are alphabetized differently, A reworking of this area would be, to me, of immense value.

You can search categories in v7.

To me It seems I have still to remember the exact path&name of a category each time I use it. Example: I have “Groceries” under “Food” and if I type “groceries” I am offered to create a new category; I am FORCED to start typing “Food…”. Would be so much more user friendly to show all the categories matching the name I am typing while I am typing, without the need to remember which is the master category the category belongs to.

+1

Up for this!

totally agree – I have requested in the past and been told that it has been added to a list.

On those days when I want to gind an alternative app to Banktivity itbis always this nonsense with Categories that causes me frustration!

Please, please can we have this sorted?

Where is the download link For Banktivity 6? I just installed Mojave an I need to reinstall Banktivity 6. Thanks.

You can get Banktivity **6** here.

Strange !!! I do not know if old age has anything to do with the upgrade, but when I do click on the “upgrade from version 6″”, then point it to the Banktivity 6 in the application dir, I get a message that tells me that it can’t find it !!!

Yep ! It was Old Age !! I was successful in upgrading

Will Banktivity 6 and 7 interoperate in terms of cloud syncing? Or do you have to update all Macs if you’re updating one?

Reconcile, I miss the button that was at top right of an account view

now I need to click in “Statements” to get to reconcile

it was easier to stay in “Transactions” and reconcile from there,

then if needed I could go to statement to see previous reconcialtion or edit them

On Reconcile I wish Banktivity 7 would retain the calculation (WithDrawal, Checks, Deposits) somewhere on the statement as it did in B5 I think.

Yes, I agree – one advertised benefit is that the create new statement button is more obvious in v7 – but I never had to use it before, because of the now missing reconcile link.

Will there be a new manual for Banktivity 7 ?

loving the dark mode on Mac OS Mojave and will be definitely upgrading asap and the calendar addition is great but I was wondering if in future updates could I be able to share and subscribe to the bankivity calendar over CalDav (or equivalent) to my calendar apps on my Mac? Keep up the good work.

Has foreign currency updating been fixed?

They have been greatly improved. A fix for v6 is coming soon too.

Any fixes to the foreign currency updates

Great news! Any chance we can have UK house prices from zoopla?

And ……Australian Home prices via Domain.Com.Au. I do regular checks of my property portfolio and to have that built into B7 would be great.

Seconding this request – please can we have UK house prices from Zoopla. And Chinese from Anjuke if that’s not too much to ask…

ok, so it’s great that we have v7. Love this app and always happy for development. My question is should I go the App Store path or direct from your store? I purchased v5 from the App Store but had to purchase v6 direct. Now I can do either for v7

I just updated to version 7. This issue is one I’ve seen every time I’ve upgraded in the past and I can’t recall the fix. I get an error when trying to download transactions from Wells Fargo via OFX. I can’t remember but I thought there was something I had to do so they would download into a new version or YOUR software. Your product gives me an error 2000. I think I can’t connect due to the new version and some security they have on their end but it’s been a few years since the last update and I can’t recall the fix.

What did todays update do ?

great update do you have instruction on how to take advantage of the real estate and zillow intregration?

You need to change your existing property account to “real estate” type by double-clicking it in the sidebar. Or, set up a new account and on the first screen, choose the bottom radio button, then choose “real estate” as the account type.

Does the new version solve the problem of portfolio share prices for mutual funds not updating on some days (it never works on Mondays, and sometimes on other weekdays as well)? During a support chat, the person I was speaking with acknowledged that this was a “known issue” but that was all he/she could say.

What improvement, if any, has been made with foreign currency REPORTING. In the current version, reporting on a reconciled transaction that had a foreign exchange rate entered doesn’t show that way in the report… it uses the current exchange rate, instead. This is a real problem when trying to run end-of-year reports for tax purposes… and the new value of the transaction is reported instead of the date-accurate one.

A lot of improvements, but I have still to remember the exact path&name of a category each time I use it. Example: I have “Groceries” under “Food” and if I type “groceries” I am offered to create a new category; I am FORCED to start typing “Food…”. Would be so much user friendly to show all categories that contains the name I am typing in the category field while I am typing it, without the need to remember which is the master category the category belongs to.

Hear, hear! This drives me wild every time.

Why has such a basic and frustrating thing not been fixed by Version 7.?

I , too, would like to see this soon !!!

Agreed… 100%. Ridiculous you can’t type in a subcategory name without specifying the category name first.

Not a big one for me (ie time saver) but I do agree that it would be very nice and make entry faster.

Any update regarding scheduling transactions? I would love the ability to schedule a transaction for the 3rd Wednesday of each month. The Mac OS Calendar application can do it, why not Banktivity? (Repeats Every Month on the 3rd Wednesday).

I have asked for this feature for several versions of Banktivity and iBank and it’s still not available. As already mentioned, Mac OS Calendar can do this, so it is possible.

For anyone on social security this would be a great feature.

It would be great if you could select the Real Estate valuation system of choice in the same way you select Banks for syncing. That way you could accomiadate other countries as the come onstreame.

Look forward to upgrading when I’m back in WiFi coverage ?

Totally agree, getting home valuations for the AU market via Domain website (and other countries where supported) would save me doing it manually. Home market is volatile here and it is something you need to be on top of.

BTW, if I wasn’t a Tidbits member I would never have known about the upgrade? I’m on your email list too. Is the upgrade invite still in the pipe ?

Exactly, it will be coming soon.

Just adding my voice to the choir: please add tags to the scheduled transaction list. This is a major PITA having to remember to go back and insert tags for these posted items. Also, still do not understand why the item at the top of the confirmed scheduled transaction list isn’t automatically highlighted for quick entry. Doing so would eliminate repetitive mouse clicks when selecting multiple items for posting.

I agree Tags in Scheduled Txn has to be the next big change to V7, i suspect it may be more complicated than we think but I do hope it comes soon.

Am I the only person for whom the Investment Summary Report is completely broken? ROI and IRR percentages are ridiculously incorrect. And version 7 doesn’t change it.

For example, a small Roth IRA account with no inflows/outflows has increased by 8% in 2018. But the report shows ROI of 29% and IRR of 29.4%. All my accounts are similarly broken but by varying amounts. It’s been like this year, maybe longer.

Fix for this coming in 7.0.2.

I am VERY happy to say this is finally fixed. I took data from one on my accounts for this year, plugged it into Excel, each security in a different column, with an overall summary column, then calculated ROI/IRR for each and it matches exactly. Thank you SO much for this fix.

Now if you could just add an overall IRR for the configured subset of accounts/dates/securities on the Investment Summary Report like on the Overview –> Summary –> Portfolio report (which isn’t configurable) … ?

Some of the same issues I experienced in Banktivity 6 remain in Banktivity 7.

My biggest gripe is when entering stock prices on a Monday, the Portfolio screen AlWAYS shows 0% change, because Banktivity compares prices to SUNDAY, rather than Friday.

It’s ridiculous. Can’t be that difficult to only use business days for comparison…even use a comparison to the last day ANY non-zero amount is entered.

Also, I have one security that refuses to be listed in alphabetical order, either by name or symbol. That’s ridiculous.

Obvious questions I don’t see the answers to:

Is Banktivity 6 compatible with Mojave, or must I upgrade to 7?

Does Banktivity 7 require Mojave?

Can two Macs continue to sync if one is upgraded to 7, but the other is on 6?

Cannot answer all of your questions, but I am using Banktivity 6 on Mojave with no issues.

I would prefer when adding a new transaction, the order of “Memo”, “Tags”, “Note” fields be changed to put “Note” in the front, thus saving a couple of Tab keystrokes.

I have been thinking “Memo” was meant to be “Note” and visible in the transaction summary view. I realized it much later that it’s “Note” that actually shows.

In fact, what is the purpose of “Memo”?

Thanks,

Victor

Has Canadian stock investment calculations been added yet – instead of FIFO, we use average cost. We have been asking for this feature since way before version 4. You can put all the effort into making everything dark, but can’t add a simple calculation that Quicken long offers. Come on! Its the only reason I still use Quicken for investments.

Any news on this feature?

Have you fixed the issue where when you enter a transaction and set it to a withdrawal, you can still enter a value in the Income field, rather than only being able to enter a value in the Expense field (and vice versa) as makes sense ?

Only a small issue but one I personally find very annoying.

Great update, have purchased and look forward to using it.

I also have a quick question. In Banktivity 6 I had ‘expense accounts’ which were simply set up as ‘Asset’ accounts and I was able to reconcile them to ‘statements’. However, having imported my B6 file into B7 those Asset accounts do not have a ‘statement reconciliation’ option. Before I try to make any changes is this by design, am I missing something or will it be fixed?

All in though, well done Ian and the team, a great app and I approve of how accessible you are to your customers.

Bravo

I think you will need to change those accounts to Liability if Reconciliation is a requirement. I must say that the accounts I had as Assets fitted the ‘new design’ well but not everyone has the same requirements.

What is the “special discounted pricing” for upgrading from Banktivity 6 to 7? Before I switch my files over to 7 – I’d like to know what it will cost to officially upgrade.

Upgrade pricing is at the bottom of this page, https://www.iggsoftware.com/banktivity/whats-new.php

You can download Banktivity 7 and take advantage of the upgrade pricing directly from within the app.

Is there improved / auto category matching? I had this in another product where it would suggest the category based on previous category to payee assignment after import. This is a huge time saver than to sort and then manually update each transaction with the right category especially for purchases from the same payee

Banktivity will learn ‘import rules’ as you edit and clean up your transactions. So if you change a payee to “Home Depot” and set the category to “Home Improvement”. Then the next time Banktivity encounters a similar transaction it will automatically change it to “Home Depot” and set the category to “Home Improvement”.

I am trying out Banktivity version 7 and I’m glad autofill is a feature now and I love Dark Mode. There are features that still seem to lag behind Quicken 2017 for Mac like Reconciliation and sorting of transactions in the account register. For example, sorting by One Month in Banktivity sorts the previous transactions exactly 30 days behind. For example, 10-4-18 to 9-4-18. In Quicken, This Month would be 10-4-18 to 10-1-18 which is correct. The way Banktivity sorts is showing the previous month in One Month view. Quicken has This & Last Month etc. Direct Access pricing at $44.99 per year is ridiculous. In Quicken, I can connect to my accounts for free.

Last I checked Quicken was not free…they just price their software differently. In fact, they are subscription ONLY now.

Attempting to do the 6 to 7 upgrade..getting server errors; not

taking my Banktivity id & pwd..are your servers having issues?

7:30 am PST

I don’t see where the Manual for Banktivity 7 is available.

How has Direct Access improved from the previous version? I really like the ability to automatically sync with my various accounts but half the time the don’t work. Sometimes I have to reenter the information or sometimes it just won’t connect with the bank. Do you think this is a bank or banktivity issue and does the new version solve these types of problems?

Wondering why 7 is always updating securities? Can I stop it from updating these every 5 min or so? Each time it does, the program pauses and I get the spinning rainbow wheel briefly….

I agree! I liked being able to control when the securities updated. Now, it starts updating as soon as I open the file, and keeps doing it periodically. I’ve also noticed a bug where it only gets prices for half the securities in my portfolio — some are correct, and some are a couple days off. It’s not like they’re obscure assets either, I’m talking about AAPL and AMZN.

Like it so far, with one exception: PLEASE bring back the “reconcile” button. Great time saver since I can stay in the transactions window.

Ian,

The calandar view is a great addition – this will be my default start screen. I’d like to see some additional functionality though. In addition to showing scheduled and historical transactions, i’d like to be able to enter new transactions. Similar to the “+” buttion on the iOS version, clicking on an empty space in a day shoud bring up a drop down of accounts and then lead to that register – that would be awesome. Thanks and keep up the good work!

I like that + idea but I think its purpose should be to pop you into the Schedule a Transaction template.

Second that motion !!!

Yes, and clicking on an item in the calendar should bring up an ‘in-place’ popup register to enter it – and make any modifications – without leaving the calendar.

If you click on a scheduled transaction in the calendar and hover over the transaction window it opens it has what you want (I think….). You can post, skip, bill pay and print (ie. 4 action icons will pop up)

What if there’s a day with no scheduled transactions and you want to add one from the calendar? This was one of the best features from Quicken ’07. Double clicking on an empty space of a calendar day should take you to the register of your default account (if so configured) or a drop-down menu of account registers – very intuitive…

I like the calendar view too. It’s good to see some detail about what’s gone on the last few weeks and looking ahead to the next.

The real bummer for me is the loss of the multi-line line graphs in cash flow reports. It makes no sense to roll up the accounts (especially when some are cash accounts and some are debt accounts). Why would both the calendar and the cash flow report roll those up?

If a user is trying to run scenarios to pay off debt accounts, they need to monitor that the cash accounts (lets say checking), does not go below zero. Seeing a mini net worth line of all accounts is worthless when that report is all about CASH FLOW (meaning I need to play to stay above zero – both for paying off debt and knowing how much I can invest/save). I can’t be the only use wanting to run projections like this — and it was a clear differentiator between IGG and other options.

This might be a deal breaker for me. PLEASE BRING BACK THE CASH FLOW MULTIPLE LINE REPORT. (This may have been why I didn’t move to 6 and likely why once again I’ll stick with 5.)

I just got the email announcing Banktivity 7. I am a long term Banktivity/iBank User. I am on your mailing list. Yet I was shocked by this announcement and to learn of Banktivity 6. Despite getting emails regularly about how to manage my money – I never heard of Banktivity 6 – before today. I am truly confused.

It is true that you’ve always been able to track the value of your home or other real estate properties in Banktivity,

You have always been able to include your home as an asset but valuations (+ or -) had to be done manually via ADJUSTMENT’s. Now (V7) you can integrate that with a Zillow valuation and post an ADJUSTMENT to that account (ie saves you from doing it manually viewing the Zillow site etc). I am hoping they extend this feature outside the US. Love the idea because I do this manually at least twice a year.

I make a lot of credit card transactions in foreign currencies and still find it cumbersome to enter them. I want to be able to put the foreign currency amount in and then the exchange rate be used to calculate the approximate value in my local currency. Is this ever going to be fixed as every time I talk to support they say it has been requested before!

As far as I can tell the update leaves some things to be desired that were better in previous versions.

The registers will not remember the user’s preferred date order. The menu when right clicking in a register still has copy and paste missing. The Reconcile button is nowhere to be found. The customizations in Preferences are minimal. Somewhere along the way my loan accounts got broken and no longer calculate interest.

I agree with a poster above that it needs to “show all categories that contains the name I am typing in the category field while I am typing it, without the need to remember which is the master category the category belongs to.”

All the currency, budgeting, reporting and dark theme upgrades are great, I am sure, but basic functionality need to be focused on as it is not very good in this version – at least for me.

If you upgrade to the latest (7.0.2 at time of writing) then the bug where the preferred date order wasn’t remember should be fixed. Improved category autofill is a great feature request.

I am very disciplined with my category names but I can see that a search algorithm like the Alfred app uses would be a great feature when categorising transactions. Seen this requested many times and I am now a fan.

I’m currently using a trail version of Banktivity. I have a question regarding matched

transactions:

What the process/sequence to match open transactions when two (or more) transactions have the same payee and amount, but are for different dates?

My questions steam from several transactions I have with the same payee and same amount, but are 2-days part in the register (e.g., 10/1 and 10/3). While the payee and amounts are the same; the category, memo and tag is different in each of the transactions.

When I downloaded my transactions on October 5, the app “Match” the wrong that actually

cleared my account. It matched the 10/3 transaction and left the first transaction from 10/1 open.

This happens on another transactions where the payee and amount were the same. In all cases, the app matched the later transaction and left the earlier (first transaction) open.

It appears the app starts at the bottom of my registry and works its way up the transactions list and finds the first transaction that matches payee and amount. It looks like the app would start at the top of my registry and work its way now my registry and match the earliest (oldest) transaction.

The problem this causes, I have to edit the in-corrected matched transaction and adjust the date, category, memo, and tag so that the correct transaction is actually cleared.

Then, I have to make the same adjustments to the other transaction (e.g., date, category, etc.). In essence, I end up swapping the two transactions.

Also, I agree completely with the many user comments regarding category selection when adding a transaction. I have a lot of nested sub-categories. Trying to remember the patch for each is almost impossible. I should be able enter the first few letter sub-category (e.g., groceries) and be presented with Food:Groceries without having to first find the parent category Food first.

I’m currently using a trail version of Banktivity. I have a question regarding matched transactions:

What the process/sequence to match open transactions when two (or more) transactions have the same payee and amount, but are for different dates?

My questions steam from several transactions I have with the same payee and same amount, but are 2-days part in the register (e.g., 10/1 and 10/3). While the payee and amounts are the same; the category, memo and tag is different in each of the transactions.

When I downloaded my transactions on October 5, the app “Match” the wrong that actually

cleared my account. It matched the 10/3 transaction and left the first transaction from 10/1 open.

This happens on another transactions where the payee and amount were the same. In all cases, the app matched the later transaction and left the earlier (first transaction) open.

It appears the app starts at the bottom of my registry and works its way up the transactions list and finds the first transaction that matches payee and amount. It looks like the app would start at the top of my registry and work its way now my registry and match the earliest (oldest) transaction.

The problem this causes, I have to edit the in-corrected matched transaction and adjust the date, category, memo, and tag so that the correct transaction is actually cleared.

Then, I have to make the same adjustments to the other transaction (e.g., date, category, etc.). In essence, I end up swapping the two transactions.

I like the look of the new version, but I note that now, if I purchase an asset (say a camera with my credit card), it’s included in the budget as an uncategorized item. This wasn’t the case in version 6, and actually I don’t want these included in the budget. Is there a way to stop this?

I’ve done a lot of work to create a very detailed Overall Income and Expense budget comprising both scheduled and unscheduled payments. How do I take a large subset of this existing budget and narrow it so I can look at just ‘essential’ expenditure versus income. The only option appears to be to create and populate an entirely new budget – wasting time and likely errors. Can the Overall budget I’ve created not be duplicated and then items excluded?