Now that Banktivity 6 has been in the wild for a little while, I wanted to write about a few lesser known features in the app. Most folks know about the big ticket items like Workspaces, Tags, Quick Reports, Find and Portfolio. But we’ve added a ton of other new features and polish throughout the app, and they deserve some attention. So over the coming months I’ll be doing a few blog posts calling out some of these less-spotlighted features and, of course, we will write about other development/company news as appropriate. I know many are clamoring for an update on our iOS apps – sorry, you won’t find that in this blog post. But trust me, when we have something to say about them, we will write about it here!

So, without further ado, here are three lesser-known features in Banktivity 6 –or as I like to call them, hidden gems.

Hidden Gem #1 – The Sapphire

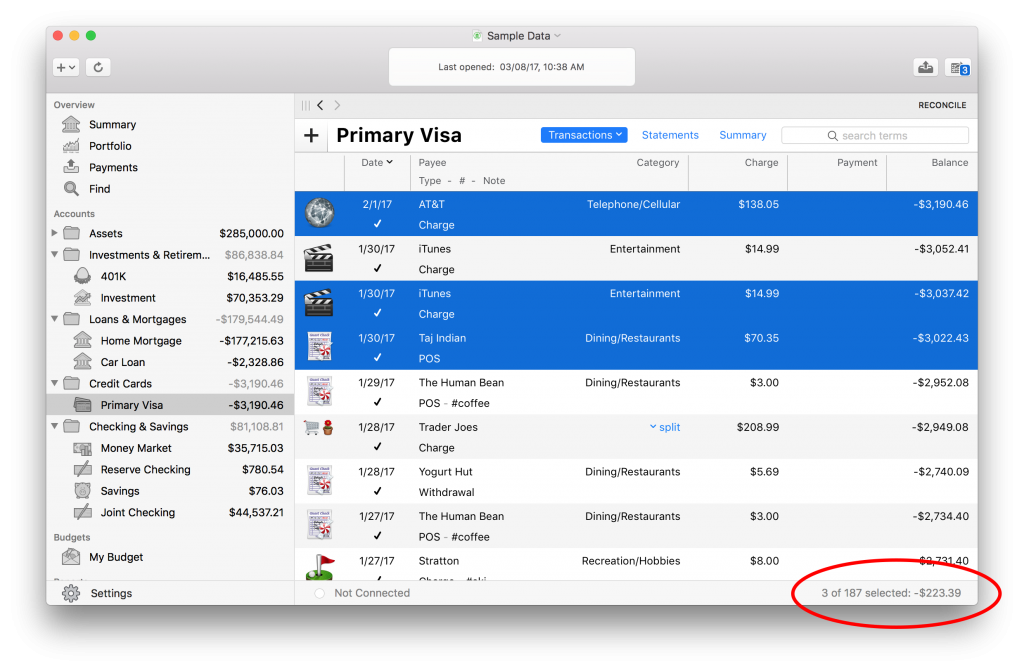

Sometimes, customers want a way to quickly sum up a couple of transactions. Now you can do that: at the bottom of the window is a little description showing the sum of all of the selected transactions (see the red ellipse in the screenshot below). Not much else to say about this. It’s simple, it’s fast, it’s useful.

Hidden Gem #2 – The Ruby

Are you a fan of nested categories? We do a much better job now of showing nested categories in reports. One thing that we needed to figure out, however, was what to do if someone wanted to expand all categories. Now, if you see nested categories and a little disclosure button, just click it with the Option key down and ALL categories will be expanded or collapsed. It’s not a huge thing, but a nice little touch. By the way, the Finder behaves the same way with folders.

Hidden Gem #3 – The Diamond

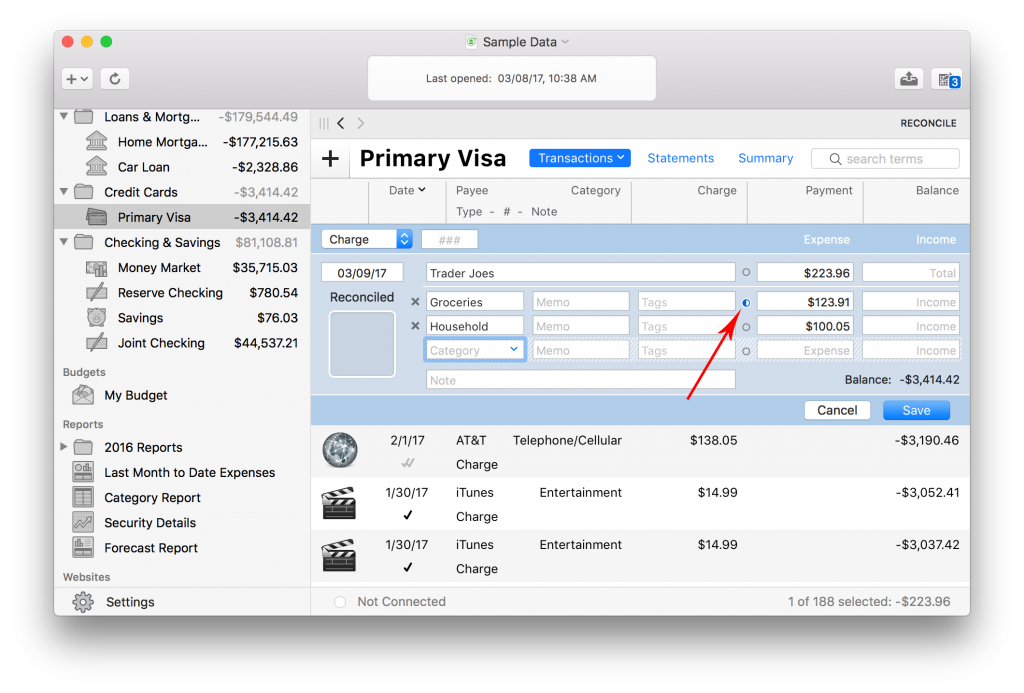

Alright, there isn’t anything hidden about this, as it is probably one part of the app you interact with most: our inline transaction editor. For Banktivity 6, it has been completely re-engineered. We tried to keep the parts of Banktivity 5 that worked well, and improved the areas we thought needed help. One of first things you will notice is that you can tab to any part of the editor, add or delete splits, and do just about anything with key strokes. Yay!

We also greatly improved how split balancing works. There are two basic use cases that we wanted to get right and we think we really nailed it. The use cases are as follows.

Split entry case 1: A transaction exists in your account that is not split, and you want to split it. When you are adding splits to this transaction, you never want the total to change, or else it will affect your account balance.

Split entry case 2: You sit down to enter a new transaction, and you just want to enter in all of the split items and let the total be the amount debited from (or deposited to) the account.

Right off the bat, we handle both of these cases without you having to do anything – we just do the right thing – but we also exposed a new control so you can be more precise in controlling exactly how split entry will work. How do you know what behavior you are going to get? Look at the little “split balancer” next to the amount (red arrow). That indicates which line item will “absorb” any extra amount to make sure the transaction remains valid. In the screenshot below I’m editing an existing transaction and I’m about to enter an additional split item. The Groceries item will absorb the value I enter so that the total will always sum to $223.96 – the total amount of the transaction.

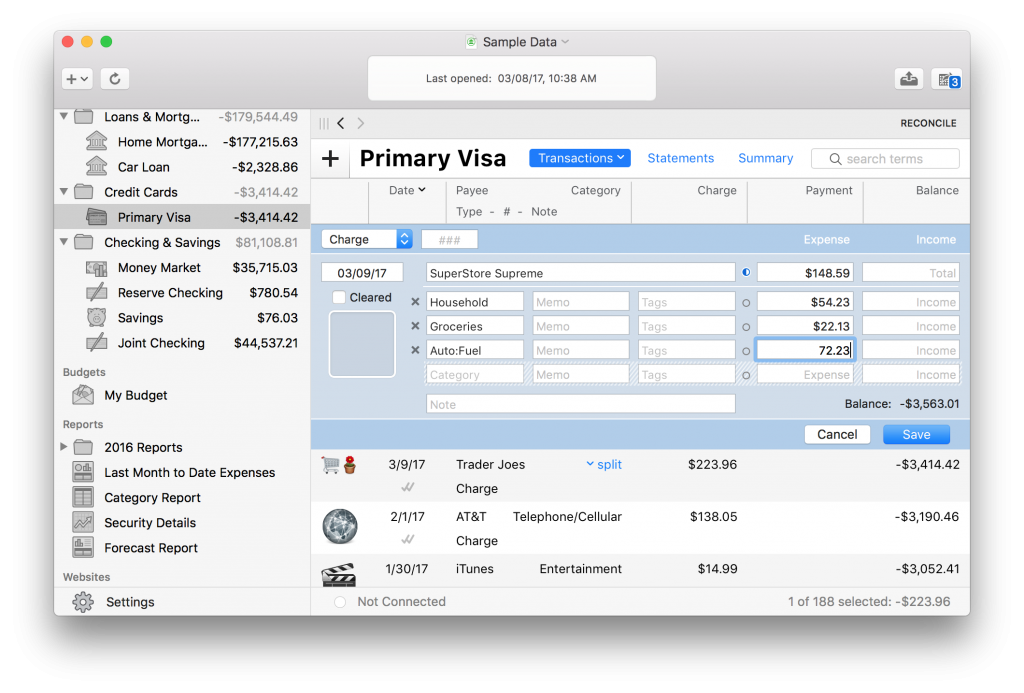

Here is an example of entering a new transaction where you want the total of the transaction to be the sum of all of the splits. Notice that the top most area, the total, has the split balancer widget. For this case, I can just enter split after split after split, and they will just keep tallying up.

The other great thing about the split balance widget is that you can move it to where you want it in case you have a situation that necessitates finer control.

If you needed another three little things to get excited about, there you go – three hidden gems. There are lots of other little nuggets of goodness in Banktivity 6. I’ll be outlining a more in the future, so check back soon, or even better, follow us on Twitter and Facebook.

Until next time.

-Ian

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

Love these “Gems…… Excellent idea Ian ….Good Job !!!

Thanks…. The Diamond is one I had not figured out , I knew there had to be a purpose to that widget.

What about a discounted upgrade option for existing users?!

There is a discounted option. Check out the website.

Cannot find the discounted option in your website. I have Banktivity 5. Is $64.99 the discounted option you are talking about?? If so, how much is the price to the general public? Thanks.

Carlos

If you download the free trial from out website you’ll have the option for upgrade pricing from within the app. It is only $29.99 USD for people upgrading from Banktivity 5 (note this is only valid if you buy from us, i.e. you can’t buy from the Mac App Store).

Thanks for your prompt reply, Ian. Just successfully registered Banktivity 6 at the reduced price. I was a bit confused when you say “(note this is only valid if you buy from us, i.e. you can’t buy from the Mac App Store)”. I thought for a while it didn´t apply to those like me who bought Banktivity 5 from the App Store.

Thanks again,

Great post. I´ll follow up for sure. Thanks.

Can you please put back the total net worth on the main page in the side bar? Also the link to Yahoo Finance quotes seems not to work anymore for all, also not to find the ticker symbols. Otherwise all looks great.

Yep, I miss this too.

All great information. Keep up the good work.

Thanks for this timely message and post. I was working up to a support ticket on the two split-entry issues, both of which I used quite often in B5. Now I can keep my mouth shut.

Ian, I just LOVE Banktivity 6 !!!!!

Now if you can only add what I gather is called accountants input where the decimal point is automatically added to transactions with a decimal part. This has been a feature in just about every other app I use including my banks iOS app when I deposit checks. It was available in Quicken for years and I think it still is. I can do a video if you need it.

It’s funny that you request that as, personally, I don’t like that feature. Perhaps it’s because I’ve been doing ten-key for so long. I automatically hit the decimal when needed and to not hit it, takes a conscious effort. Also if I”m entering $100 even, I don’t want to have to make two additional keystrokes to add the zeroes after an auto-decimal. If IGG decides to add that auto decimal, I hope they make it so hitting the decimal is optional.

Just a different point of view.

I agree!!! This is something available in Quicken as well as MoneyDance and would love to have this as a selectable option in preferences.

Please bring back the “add to calendar” feature. It’s the only reason I’m still using iBank! Can’t live without the calendar link and won’t upgrade until you do.

I have problem with personal budgeting but seit beta version but the solution is not found.

Verry good app but….

Thanks Ian, I was really getting frustrated with the split process in Banktivity 6 since I use it extensively. Your “Diamond” is something I just didn’t figure out how to use yet. Thanks for breaking the code for me!

Most of us make a payment by either using billpay or printing a check. So why can’t there be a button next to the “send an online payment” button for “print check for selection..” so we can avoid going to the file tab and then scrolling down ?

I’m not sure why people left B5 to go back to Quicken. B6 is so much better.

Cool gems. But would you please re-install the ability to download a budget into a CSV file? This feature was lost between B5 and B6.

Hi, just to clarify, are you looking to export a budget into a CSV file?

hey — late to this party (by a few quarters) but found this b/c i was searching for “why can’t i export IGG Banktivity budgets anymore?” : )

i know i used to get my budgets into excel but i can’t remember how. i feel like it was just that whatever i saw on the screen i could drag over into an excel workbook. but now there is NO way to get a budget into excel (since the upgrade) and no easy way to create a report that mimics what i see in my budget (since reports CAN be exported).

it would be incredibly helpful to have that functionality back again!

I’m looking forward to hearing if you’ve added a proper capital gains/losses report for end of year tax reporting.

I second this request.

Good to know. All valuable.

You missed one of my favourite gems – selecting a bunch of fields and changing the Payee/Category/etc of all of them at once, very handy for renaming or correcting an ongoing typo. Unfortunately you don’t have a Change Note menu, so when Banktivity picks up a one-off note (eg “For Camp” on a food purchase) and inserts in to the next twenty entries before you notice, you still have to manually correct them all.

I was happy to find the group change of Account last week. I had finished balancing a credit card account – all on the wrong card. But, could move them all at once!

I agree with the “Note” persistence problem also. I think I have found all of them after a while.

Gem #2 is just what I was looking to do yesterday. Love it!

I wish there was an option to compare category totals for two years (e.g., 2016mand 2017).

I second this and for multiple years… in Banktivity 5 you could easily compare multiple years of accounts but you can only do 1 period in v6. Really miss this function.

Many reports in Banktivity 6 has a comparison period that can be shown. It is easy to compare spending in 2017 v 2016 for example, or net worth in 2016 to 2015.

I am able to figure how how to do a year to date comparison though. I would like to compare this year to date, to the same exact range last year and cannot figure out to do so.

I spent a long time on a support chat about that same issue, and it has indeed been put on the fast track to give us that flexibility. The “periods” option doesn’t necessarily line up with the dates you want to see in two years, ie. YTD. Currently one has to compare the present YTD with all of last year- not very useful. At least you can back into it by comparing data month by month. Still more flexible than with B5. But they’re working on that feature and will hopefully push it out soon.

Cheques!!! Still sadly lacking in B6 is the ability to customize cheques. I have to keep iFinance4, just so I can print my cheques every month!!

I want to print ONE cheque. I want to define where the fields go. I want to ‘scan’ a blank cheque from my chequebook and use it as the ‘base’ or template to print my cheque. This is what I CAN do with iFinance4. I can NOT do it with Bank6… also, how about ‘other countries’ besides the U.S. can use ‘Send Online Payment’?? ‘World’ software that only works in the U.S.??…

All good stuff and very welcome, but I really need the Reports to work properly.

In the ‘Income & Expense Report’ you can only expand so far. For example, you can see a total amount for the account, and you can then expand to a total for, say, ‘Dividends’, but when you click on ‘Dividends’ to expand to the individual items you don’t get the breakdown below of ‘Transactions by Account’. The heading is there, but there is nothing below it.

The reason is that it will only work when you make an entry if the ‘Type’ (left hand side of an entry) is listed as ‘Deposit’ and not ‘Dividend’, or any of the other descriptions listed, as appropriate – ‘Investment Income’, ‘Interest Income’ etc. So my choice at present is to list all the various income types as ‘Deposit’ and be able to print, or save a detailed Report, or enter it correctly and get no detailed Report.

I banged on about this when B6 first came out, but nothing has been done which I find immensely irritating. I am doing without the detailed report in the hope it will be fixed as I don’t want to spend hours having to alter every entry back when it is fixed.

Believe this is fixed for a forthcoming release.

Great work Ian – I was wondering what the little blob (‘split balancer’) was for!

“We tried to keep the parts of Banktivity 5 that worked well” I agree 6 is a whole lot more flexible. It’s taking some getting used to the different layouts – some aren’t as clear yet – perhaps just different?!

However there are definitely a couple of great and simple features in 5 which you’ve somehow lost or forgotten to include…

“One of first things you will notice is that you can tab to any part of the editor” (apart from the date field) – but not without double clicking or pressing Enter first which you didn’t have to do. And so we’ve also lost the the ability to click/arrow thru transactions in their ‘opened up’ state without having to click ‘Cancel’ or ‘Save’ before moving to the next one… 🙁

The ability to see and search thru all the transactions from whatever accounts are inside an account Folder. Now we only see a list of the accounts – which is pointless as we can see this list already in the Sidebar. This was a great feature – for instance if you were searching for a transaction on a credit card but didn’t know which (grouped under Credit Cards) account it was on.

Barry

Barry, your second point is pertinent and goes back to the flexibility that Smart Accounts and Grouping provided. I suspect the new register may have something to do with the dropping of Smart Accounts and Grouping. My preference would be for the Find command to have the ability to filter on fields, values, attributes and for those searches to be able to be saved. I use the Smart Accounts catch all and filter on Uncleared daily. B6 does not give me that ability.

Does Banktivity 6 offer a module for long term saving? Specifically, I want to identify purchases to make two, five, ten years away (e.g. replace major appliances, save for a European vacation, replace the roof on my house, etc), accommodate inflation, and Banktivity 6 calculates monthly savings to have a bucket of money to make the future purchases.

For those of us with failing eye sight, I would like to be able to increase the font size. Is there a way to do this now, or, will you consider this in the future? Also, be care of using color with fonts. Some light colors are most difficult to read…especially when they are small.

I second this, Have send this as a suggestion some month ago.

Yes, I agree and the layout is boring to look at too. There is no way to adjust font size and type (and colors for account types and columns) and there is a very poor choice of icons/emoji’s to select to represent each account/category. I also wish there was a guide to help create the perfect category and subcategory since it is the basis for all your work. I am experimenting with Quicken because visually it is more fun to work with but Banktivity 7 is a little slicker to use.

Thanks for the article! I wish we had a system that allowed community feedback and tips so users wouldn’t have to post in the blog post comments. Many times these comments go off topic since there are no other means to get questions or concerns answered outside of a support chat/ticket. Many times it’s not an error with the software, but simple questions of how to best use the software. I think a forum or community oriented area would be a big help. Thanks!

Yes, I would prefer a Forum also….. There are pro’s and con’s, but more pros than cons

We’ve been giving some thought to starting a Banktivity subreddit on reddit.com. I wonder if any of you would care to be moderators if we did this?

My thoughts on a Forum….. I am the administrator/Moderator/Owner of two Forums…….After nine (9) years operating, you do open up the doors for dialog, some “wanted” and some “unwanted”.

But the positive side of a Forum, I think that you would get a more consistent picture of what the Users deem to be important enough to post on a Forum……..Banktivity has a lot of talented and knowledgeable Users that can probably address 99% of all issues but the issues that cannot be addressed by the Users can be addressed by the excellent “Chat” , which has been used myself successfully in the past.

Give it some thought Ian

Count me in to be a mod. Been an Admin or Mod for various forums for many many years….

I, likewise, print lots of checks and wish there was a better way to set up the check printing. I’ve adjusted it, and adjusted it, and etc. but still end up with less than acceptable printing on my checks. I’ve wasted lots of paper and tries to make it fit, but still not there. Wish there was a way to just copy my check for it to fit.

I am liking a number of the new features although the split balancer is still a mystery. The explanation is not great. Search across all accounts is nice. What is X-match? It appeared on a transaction. Nothing in the manual on it.

Still learning it.

“X-Match: The transaction was imported within the last 24 hours and matched a

transfer that was previously recorded in another account. The transfer was completed

by linking the new transaction with the old.” Bantivity Manual 6, p. 93.

Sorry can’t participate, have early 2009 Mac OS X ElCapitan 10.11.16

If only you kept the layout of the 5 version. It looks much neater than version 6. Also the use of command i which shows the inspector doesn’t include the cleared items. You have to go to the summary page for that which takes much more time. It doesn’t show the dates in UK format unless the click on the entry and when you save it reverts to US format. Scheduled entries have an infuriating habit of splitting the values when you want to increase the amount in the schedule. Has the question of scheduled dates been resolved after I submitted my email as I have not heard anything from you since I submitted it? At the moment I am using version 5 and will continue to do so until version 6 is dramatically improved

I agree that the transaction layout looked much better in B5. I prefer to have the Category listed right under the Payee. How about allowing the user to customize the layout?

This feature is so important to me that I will not upgrade to B6 unless I can keep the layout the same or very similar to the way it was in B5. I helped a friend install B6 and in assisting them with the learning process, I find the new layout very difficult. B5 and before was far cleaner and easier to read. Hoping that one day this will be an easy option for users. Kind of like it is in mail programs ie; reading pane on top, left, right, etc. So we can organize as we like it best.

Thanks for your gems. Love your program & support. The one thing I do find frustrating is if I pick up a typo on a payee in a report & correct the typo it will not then alter it for any other entries for that payee & it will always take you back to the beginning of you report & not where you left off. Is this something that can be looked at in the future. Have been meaning to ask this question for ages

I love the “diamond” of altering the split transactions. But once I pick which line I want to absorb the changes, I want it to stay there! But when I edit the transaction, whether the original or a copy, it ALWAYS goes to the first line of the split. I would like it to stay where I put it, please.

Also, why can’t we search scheduled transactions? I have a lot of them, and it would be very helpful to have a search when I need to edit them, especially ones that are linked in some way.

Ditto Rene, also I have a lot of payees (as I am sure most users do) and not having a search facility is a pain.

Essential upgrade.

Oh! And YES to searching FOLDERS. I want that feature back too!

Overall, I like the new transaction editor except for one issue: it takes so many tabs to get to the actual value to be entered. When entering transactions, Im typically looking at a receipt, memorizing the date, payee, and amount and want to get those entered as quickly as possible. I like how v5 had the category and notes after entering the main info. In v6, I have to tab across these fields (category, memo, and tag) before getting to the value.

I would like to know if the IPAD version of Banktivity could be more “independent” of MacOS when IOS 11 come.

I agree – typing this on my new iPad Pro.. it seems like the iPad version could be closer to the laptop version now.

A really necessary (and missing) option is automatic taxes. VAT, GST, PST, etc. I’ve love everything about Banktivity, but having that option means I have to use other software for my small business.

Ian, thanks for all the hard work that has gone into Banktivity. Keep the gems coming. I switched to Banktivity when Intuit decided to freeze out the Mac version from getting updates/improvements years ago. Never looked back. Thanks again.

I have not seen these requests-has there been any consideration to adding a filter for “This Year”? This would be helpful to observe cash flow for the current calendar year. Secondly, any change we may be able to edit the Summary screen to personalize the view?

I would also very much like the possibility to edit what we see on the Summary screen. On both Mac and iOS.

Is there still a problem with direct access down load with chase i have to double click my account and click check status and refresh account then it up dates.

Nested categories on the summary pages and reports is one of my favorite features. I prefer to budget in large buckets (nit picky budgeting rarely results in more control) but sometimes it’s nice to see why I a particular category spiked and be able to drill in.

I think Banktivity 6 is the best finance application I’ve used – I never thought anything would be cleaner than MS Money (which I used way back in the day) but this is. I love it!

I cannot move from Banktivity 5 to Banktivity 6 until it can connect to Chase. B5 works as it should; B6 emits dozens of “too many HTTP redirects” errors and never connects. This happens not only with a migrated B5 file but also when creating a new B6 from scratch and trying to add one Chase account.

B6 certainly looks pretty but it doesn’t work for me ..

I have my primary Checking as well as Mortgage account at Chase and use it with B6 with no download issues. What issues are you facing?

I’m having this same problem. I’ve had a support ticket open on this since June 3rd, but all I hear is that it only happens to some users, and they’re still investigating it. Not being able to connect to one of the biggest FI’s in the country seems like it should be a priority – I hope we hear more from IGG on this soon.

Wells Fargo OFX/Direct Download has been down for days. I use this for Bill Pay and without it am dead in the water. Reported through feedback link. Called WF and they stated ‘many’ Banktivity customers had called in regarding this so issue is not with them. Also, Direct Access is working fine (only one of our WF accounts uses OFX). Any ETA on resolution>

What is the best way to get a response? I’ve emailed, I’ve posted here. No one has gotten back to me and I consider this a pretty serious issue……

We have an internal build that fixes the issue. We are working hard on wrapping up testing to get it out to customers.

Thanks, Ian. What changed? It was working fine and then it stopped. 6.0.4 didn’t break it….something amiss on the back end?

Wells Fargo made a change to the OFX spec that they support. Banktivity already supports that spec, but they didn’t like the format of a unique ID we were sending. So we changed the format and all is well.

Ian, sorry to belabor this here, but I am not getting responses elsewhere. It’s still not working for me. When do you expect this to be resolved? I have not been able to pay bills online for over a week……

We hope to release the fix next week.

Still getting used to version 6 but IGG made two changes that seem arbitrary and that reduce functionality.

First, the calculator icon is gone from the toolbar. The calculator was always one click away. Now I have to scroll up to the Window menu, click a drop-down menu, scroll down, and click the word “Calculator.” It was much simpler to simply click on the toolbar icon. If you’re going to continue to have a toolbar, why remove such simple and useful tools from it? Makes no sense.

Secondly, in the register view of my checking and saving accounts, future transactions were previously displayed with a slightly different background color for the date field, making it obvious to see at a glance what’s coming up. In the new view, future transactions are marked by a very tiny gold star next to the date and it takes a second or two to scan the column to see where the gold stars begin. Previously, you could instantaneously see the dividing line between present and future at a glance. Now you have to look for it. Like the calculator, it’s harder to find.

What possible reason would there be for making things harder and more time-consuming to find??? These are not improvements.

I have B5 now; if I download the trial of B6 can I import B5 data for the trial of B6 or will it mess up my B5? I want to revert if I don’t like B6. Hoping someone can assist. Also, after download how do I get B5 info into B6? I only see how to do for Quicken into B6. Thanks!!

You can run B5 and B6 side-by-side if you want. They each retain their separate documents. Banktivity 6 will import a “raw” Banktivity 5 file.

Please bring back the British English spelling of “cheque” which has disappeared in v6.

Is this #3.1? When I enter a split transaction for an existing payee the total amount is split by the same percentages as the last saved transaction. For me, this is great.

I gotta add that you’ve got another hidden gem in my opinion, and that’s the variable budget. I feel we’ve been asking for that since version 2 — at least before Envelopes because that’s what we expected Envelopes to do for us. This is a terrific feature for us.

Are you going to give us more reporting options to do budget vs actual beyond what’s just in the Budget itself? It’d be nice to drag the budget and actual amounts to Numbers. It’d be even better to be able to specify our own range (I’d like to specify Year-to-last month).

Thanks a lot for adding this feature. It’s what convinced me to finally upgrade, and I’m planning to get rid of some side spreadsheets.

Chuck

Ian,

I have been trying to connect to the software support team, and no luck. No email is listed, the chat site is “at capacity” and the ticket site is crashed. Why can’t direct connect and Banktivity work with Wells Fargo? It appears that the problem is with this software, as Wells Fargo claims that all of their clients are automatically enabled to direct connect if they have working access to their online banking. Is it the version 6 with this issue? Can we download the older version in order for this to work? What is the solution to this? I know that Wells offers the manual “Web Connect” which is compatible with Banktivity, but we need solutions/answers here……

Thanks.

I have used quicken on Mac for more than a decade. I absolutely hated the latest upgrade, and I am thrilled with Banktivity. I am still learning the program, and though I like the quicken instant reports , everything about Banktivity is more intuitive, prettier, and quicker to adjust to any changes. (such as opening a report, and correcting a transaction within) I absolutely love the Direct Access! I know from other programs, change can be hard with upgrades. Since I did not spend much time with Banktivity 5, I am not experiencing anything but relief in saying goodbye to Quicken.