Every time a year comes to a close it’s good to reflect on the past. I want to take this opportunity to do just that, and provide some glimpses of what to expect in 2013.

In addition to the software updates we’ve did in 2012, which I’ll get to in a moment, 2012 for us has been the year of Live Chat. It was clear in 2011 that with our rate of growth, handling tech support via email alone was not scaling well. After researching many options (although to be honest, we never considered outsourcing technical support), we finally decided that the best way to meet our customers’ needs was to introduce an online chat system. Live chat offers a superior experience for the customer because it doesn’t require endless small email exchanges that end up lasting for weeks. Although the system isn’t available 24 hours a day, we still offer the opportunity for customers to email us if live chat is offline. After approximately 12 months of use, we’ve significantly accelerated response times and handled over 18,000 chats. I also want to point out that I believe we are the only Mac/iOS financial software developer to offer free, unlimited tech support with live chat.

When we released iBank for iPad 1.0 this past June, we rolled it out with a new technology we’ve dubbed Direct Access. To develop the backbone infrastructure of DA was no small feat. Significant resources were invested into this technology because we feel strongly it is the way of the future. We are able to offer users automatic connectivity to thousands more financial institutions than what is available with just OFX. And despite its modest cost, when you use Direct Access, you can avoid the fees some banks charge for OFX connectivity (aka Direct Connect). This makes DA both economical and efficient.

iBank for iPad is our first app to use Direct Access. The DA feature makes the app a joy to use, even without being tethered to syncing via the Mac. I personally track all of my finances now on iBank for iPad with Direct Access, though needless to say, you can expect to see DA appearing in a version of iBank for Mac in the future.

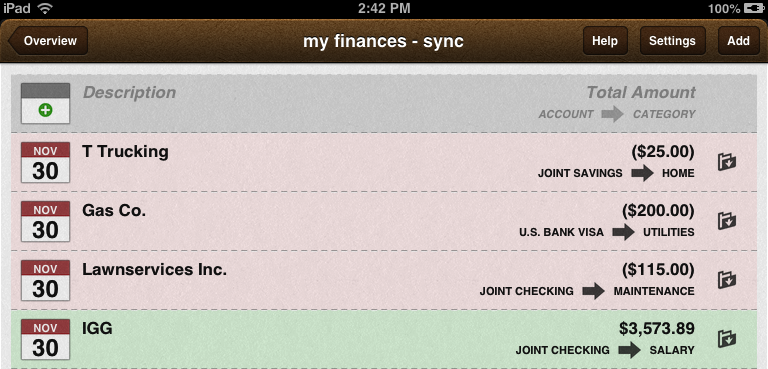

iBank for iPad has seen a total of three update releases since its debut five months ago. Combined, these versions had over 80 documented bug fixes and enhancements — including some big changes like in-line help and serious speed improvements. We are well under way with our next major iteration of iBank for iPad. You can expect to see it in early 2013, and in addition to numerous fixes and enhancements, you can expect to see the ability to view and manage Reminders (finally!):

This screenshot is still preliminary, but as you can see there is now a list of “Reminders.” The folder button allows you to take various actions. For example, you can post a transaction, skip one, etc.. The date on the left is the date the scheduled transaction is supposed to be posted and the rest of the fields are pretty self-explanatory. iBank for iPad will also look for matches to help prevent you from making erroneous entries.

iBank for Mac saw some good love in 2012 as well. We did seven releases, including two full-dot releases (4.5 and 4.6). iBank 4.6 included a long list of enhancements to budgets. But 2012 also put some external demands on our team — we had to get iBank sandboxed, signed for GateKeeper and compatible with Mac OS X Mountain Lion (10.8).

We’ve learned a lot about managing personal finances throughout the years (2013 will mark IGG Software’s 10th anniversary!). And when designing apps from the ground up, as we did with iBank for iPad, you are presented with a unique opportunity to start with a clean slate. Every feature you implement gets discussed endlessly, and it needs to withstand “the test” to actually make it into the shipping product. Additionally, every feature goes through a rigorous process of how it should work. So what is my point here? You can expect to see some of the best things about iBank for iPad to merge with iBank for Mac. The details of those features are still too top secret to discuss now, but rest assured we are hard at work.

I’m excited about 2013 — what a milestone. We’ve grown from the one-man shop to a “real company,” with health benefits, 401k and all of that stuff. I love looking back to my early days manning a booth at MacWorld, when potential customers would say, “How do I know your company will be around next year?” and I like being able to lay that question to rest. We have some exciting plans in store for 2013 and I can’t wait until I can start talking about them.

-Ian

@ianggillespie

- Continuing Investments in Direct Access - February 26, 2024

- Banktivity 9: The Little Changes - September 8, 2023

- Retiring services for older versions of Banktivity - August 11, 2023

Can we get an android app in 2013? Pretty please???? 🙂

Let me start off by saying that I have been a customer and user of your products for several years and like how they work. But Direct Access is not the way of the future. I don’t agree with a third party, whether it is deemed secure or not, having access to my bank accounts. The iBank apps all feel disconnected. There needs to be one syncing method that works and is implemented across all programs. The syncing feature should be free to use. Another reason I choose not to use Direct Access is because it costs and not implementing a true free syncing method and forcing customers to pay for a third party to access my accounts is unacceptable. I feel like gig software started off on a good foot and now it is not listening to its customers. I don’t know if it is the software engineers that came from Intuit that are influencing the decisions to use Direct Access or not. Gig software needs to look at 1Password from Agilebits and Onifocus from the Omnigroup in order to implement a free syncing capability. How am I supposed to sync data onto my iBank for Mac or iPhone if none of these devices support Direct Access? If Iggsoftware forces customers to use this feature and eliminates other syncing methods, then I will never purchase your products in the future. My bank is already updating its web page and apps to do everything that your program does and it is free of charge.

I apologize I misspelled Igg. Darn autocorrect on iPad. I wanted to add one more thing. Each iBank program seems to have a different syncing method and of which doesn’t seem to work correctly or easily. Igg needs to focus on the core components or features of a program before adding or manipulating features. The two main core features are date entry and editing of transactions and syncing of data. Budgeting and reports would be two other core features. I understand due to limitations in hardware or the software that each device is not going to be able to do have all features or accomplish them in the same manor, but the focus should be on these features. Also the data file for the apps should be secure, with more than a password, since it has vital data. It seems like Igg is not listening to customers or providing feedback and implementing features that are not desired.

Culture code, the developer of Things, did this and lost customers as a result of their cloud syncing issues.

Direct Access is a good solution for some. But for many, the granting of access, to a distant third party, to bank accounts, credit cards and stock accounts is a non starter. The monthly cost is a irritant

If you do add Direct Access to iBank for Mac, please ensure you retain all the current import and direct connect options. They work well.

Areas in need of improvement include investment reporting, correct cost basis calculations, correct annual rate of return calculations, a report that shows at a glance your aggregate stock holdings, correct foreign currency reports, a global search, correct reporting of uncategorized transactions. Many more bugs are listed in your knowledge base and some tagged as ‘feature requests’.

Totally agree, Eric. Synching between IOS devices and 1 or more computers ought to be straightforward. Current method is way too cumbersome. One reason I like 1Password is the ease of synching via my Dropbox a/c. It just happens. I don’t have to think about it.

I will also second Eric’s recommendations. The iPhone app is horribly dated and cumbersome to use and to sync with iBank for Mac. 1Password was recommended as an example for seamless syncing, but I would also like to point out that MoneyWiz has the most seamless syncing across Mac, iPhone and iPad. I also do not need or want a third party to download my banking data via Direct Connect. All of my banks support direct connect for free. While I have been using iBank for a while now, I do wish some things would change for 2013.

Namely:

1. Revamped iPhone app with easier account access and data entry

2. Ability to record currency exchange rates in iPhone app

3. Seamless background sync across ALL devices (i.e. enter transaction on iPhone, have it already on my Mac when I get home)

I agree the iPhone app upgrade should be a priority. Many people have requested budget viewing & syncing on the iPhone which I hope to see included. It makes sense… you’re out, trying to make a decision about a purchase and it would be perfect to whip out your phone for the greenlight (or red). Moneywiz seems to have this down but they’re lacking in other categories (but improving rapidly). Even a blog post with a roadmap would be helpful (and would put your feet to fire, which can help get things done)

Agree strongly with above comments. Keep WebDAV sync because I will never use direct access. I will never allow a third party to interact with my banking information.

Update ibank for iPhone.

Make transaction entry on ibank for ipad more like ibank for iPhone. Much faster to enter data through iPhone version.

Enable reminder functionality, as you are already planning.

Continue to optimize for speed on ibank for ipad. It is finally usable, but still very sluggish on an ipad 3.

In addition to keeping WebDAV sync, add icloud sync for those not able to setup WebDAV

Add category reports to ibank for ipad like the iPhone version has.

Speed up category reports on ibank for ipad. It takes almost two minutes to see report on an iPhone 5.

Congrats Ian.

Looking forward to what’s coming up. iBank for mac is a great product and I love using it. iBank for iPad doesn’t work at all for my purposes, which is a shame because I was eagerly awaiting its release. Nevertheless, you have my money and I’m hopeful it improves over time to the point where I can use it on the go… The reason I can’t use it is that the direct access feature slowly but surely ends up with incorrect balances that only get further from the actual figure over time. I bank with the NAB in Australia.

Even with a robust direct access in place however, I would probably not end up using it as they are two products that are un-linked. I don’t want to have to do my accounting twice.

Over the air syncing through dropbox or iCloud would be great.

Best of luck for 2013.

As a long time satisfied iBank customer my fervent wish for 2013 is iCloud sync. Imagine if my MBA, iMac and iPhone were always in sync! “It just works” is what Mac’s are all about and anything you can do to ease the user experience can only benefit IGG.

Thanks for listening and all the best for 2013

Please, create better reports and budgets to iBank for Mac. It’s gonna be wonderful if you guys add a classification for categories, like MS Money have.

Beyond that, add more features to iPhone App and you will get a real killer financial app for mac. Thanks.

I agree with everything Eric said above. I kind of wish OmniGroup would buy out BareBones and IGG software. There development team seems to be much better organized and responsive to customer needs.

The iPad app is not well done. My investment account balance is not the same and accurate according to the balance on iBank or even the iBank investment app. Also I am not able to change any aspects of my loan accounts. I can’t change the loan apr, the minimum due amount, due date, or other information on the iPad app. If I attempt to change the information, then I receive a blank error with an ok button. I have a screen shot of this. One way to improve the iBank OS X app would be to have loan accounts capitalize the interest. Every week that I check on my loan the balance grows but on iBank it remains the same.

Was hoping to see a discussion about 4.7 that ca,e out. Has the blog been abandoned?

PLEASE fix reconciliation. It’s horrible. Fundamentally, stop requiring me to enter a start date.

Reconciliation is a very simple sixth grade math problem:

bank balance minus uncleared debits plus uncleared deposits should equal your balance

Period. Move along. Nothing to do with dates. Please get rid of the dates. Your insistance on mashing statements and reconciliation into the same process is a disaster. iBank can slap a date on the end if it wants so I can see the last time I did the reconciliation, but don’t factor the dates into the reconciliation process. At the very most you can have an end date, which would be the date of your bank’s balance, but even that’s irrelevant and unnecessary. There is nothing about reconciliation that needs a date.

This is not an opinion or a preference. This is the very definition of reconciliation. Walk into any bank and ask anyone sitting behind a desk.

What are you talking about Scotty? I do work in a bank, and every reconciliation has an applicable period (the date). Additionally, a reconciliation is a comparison of two things (THAT is the definition of a reconciliation), usually a statement and a ledger. Again, this is dependent upon dates, unless you insist on reconciling live-to-date transactions every time.

What you’re talking about is a trial balance, not a reconciliation, which requires two balances (a statement and ledger balance).

Any chance y’all could post a screenshot or some other juicy news of for us rabid iBank fans to drool over? Hoping iBank 5.0 includes the awesome Direct Access found in iBank for Pad. Or, the ability to sync iBank for iPad to other iOS devices without the need for desktop iBank. On that note, easier sync would be awesome as long as the same functionality is retained. Right now I track 4 different sets of accounts (iBank files), and sync 3 of those to 4 iPads and 3 iPhones. CloudSafe works, but an in-house IGG solution would be phenomenal.

Thanks for the hard work and continued dedication to your loyal Mac fans!!!